Alternative calculation

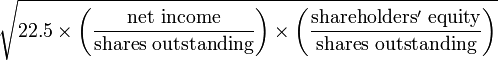

Earnings per share is calculated by dividing net income by shares outstanding. Book value is another way of saying shareholders' equity. Therefore, book value per share is calculated by dividing equity by shares outstanding. Consequently, the formula for the Graham number can also be written as follows:

This is one of the ways to estimate the intrinsic value of business based on their book value and their earnings power.

Unlike valuation methods such as DCF or Discounted Earnings, the Graham number does not take growth into the valuation. Unlike the valuation methods based on book value alone, it takes into account the earnings power. Therefore, the Graham Number is a combination of asset valuation and earnings power valuation.

In general, the Graham number is a very conservative way of valuing a stock. It cannot be applied to companies with negative book values.

Graham value is applicable only to the companies that have positive earnings and positive tangible book value.

The final number is, theoretically, the maximum price that a defensive investor should pay for the given stock.Put another way, a stock priced below the Graham Number would be considered a good value, if it also meet a number of other criteria.

The complete Graham selection procedure is much more elaborate. No decision should be made based on this number alone.

When applying any of those valuation methods, you need to be aware of their limitations. Please keep these in mind:

1. Graham Number does not take growth into account. Therefore it underestimates the values of the companies that have good earnings growth. We feel that if the earnings per share grows more than 10% a year, Graham Number underestimates the value.

2. Graham Number punishes the companies that have temporarily low earnings. Therefore, an average of earnings makes more sense in the calculation of Graham Number.

3. Graham Numbers underestimates companies that are light with book.

Source: Edited articles from Wikipedia and http://www.forbes.com

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home