RAM Ratings Lanka has reaffirmed Janashakthi Insurance PLC’s long- and short-term claims-paying-ability ratings at A- and P2, respectively; the outlook on the long-term rating remains stable. Janashakthi’s ratings are supported by its good competitive position, financial performance in the life segment and capitalisation levels. On the other hand, the ratings are tempered by its moderate underwriting performance in the highly competitive general segment.

"Janashakthi is Sri Lanka’s third-largest general insurer, accounting for 11.98% of the industry’s gross written premiums (GWPs) in FYE 31 December 2010 (FY Dec 2010). The Company, which started with life operations in 1994, was able to achieve strong growth through its focus on the general segment, which it ventured into in 1995. Its strong competitive position is underpinned by its extensive geographical reach, with a branch network that is only surpassed by the 2 largest industry players. In terms of life insurance, Janashakthi is the fifth largest, with 5.84% of that segment’s GWPs," the ratings agency said in a statement yesterday.

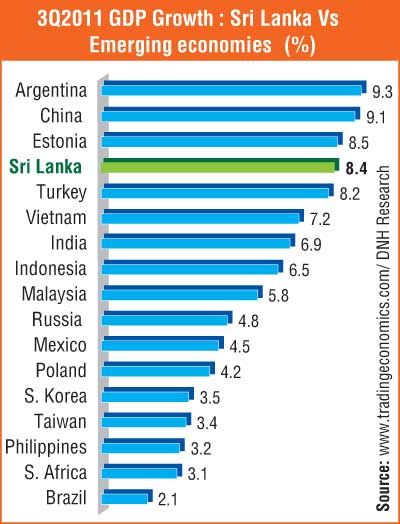

"The general segment recorded sluggish GWP growth in FY Dec 2010 amid keen competition and the shedding of loss-making contracts in a bid to focus on profitability. However, GWP increased 18.41% year-on-year (y-o-y) in the first 9 months of fiscal 2011 (9M FY Dec 2011), aided by more motor vehicle registrations and better macroeconomic conditions. Meanwhile, the introduction of new products together with consumers’ higher disposable incomes amid the more favourable economic landscape had led to a 17.73% y-o-y rise in its life GWPs to LKR 1.69 billion in FY Dec 2010; the trend continued in 9M FY Dec 2011.

"Janashakthi’s general underwriting performance is deemed moderate. Despite stringent cost control, an influx of claims subsequent to floods had worsened its underwriting losses in FY Dec 2010. Its claims ratio worsened to 69.53% that year (FY Dec 2009: 64.39%), albeit still better than most of its peers’. The Company managed to reduce its net underwriting losses in 9M FY Dec 2011, thanks to stringent cost control and measures to curb increasing claims as well as the weeding out of unprofitable businesses; its claims ratio improved to 64.25% for the period (9M FY Dec 2010: 69.35%). Going forward, the Company’s claims ratio is expected to worsen slightly as medical insurance claims tend to spike up towards the later part of the year. Nonetheless, the ratio is envisaged to remain relatively stable through the medium term.

"Meanwhile, Janashakthi’s life underwriting performance is deemed good. While claims have started trickling in with the maturing of its portfolio, its life-claims ratio is relatively in line with those of its peers. In 9M FY Dec 2011, the Company’s net underwriting margin broadened to 27.4% (9M FY Dec 2010:21.84%), supported by lower claims incidence. At the same time, the Company’s overall performance also improved, with a higher pre-tax profit of LKR 810.93 million (FY Dec 2009: LKR 749.75 million) that was fuelled by stronger investment income.

"Janashakthi’s capitalisation is deemed adequate. Its ratios on shareholders’ funds to insurance funds and shareholder funds to total assets advanced to 36.96% and 22.77%, respectively, as at end-FY Dec 2010; the latter is better compared to most of its peers’. Concurrently, the Company’s solvency margin in the general business eased to 1.56 times as at end-September 2011 (end-FY Dec 2010: 2.21 times) as it had reduced its investments in treasury bonds and repo agreements.

"The life segment’s solvency margin widened from 3.16 times to 3.70 times over the same span, in line with more robust investments in equities and corporate debt.

"Elsewhere, Janashakthi’s investment portfolio comprised investments such as repos and fixed deposits. The proportion of treasury bonds increased to 46.83% as at end-FY Dec 2010, from 44.05% a year earlier. In tandem with the local stock exchange’s boom, the Company’s exposure to equities had climbed up to 14.07% by end-September 2011. That said, about 60% of the portfolio remained in fixed deposits and government securities, reflecting its conservative investment strategy," RAM Ratings said.

http://island.lk/index.php?page_cat=article-details&page=article-details&code_title=42015

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home