Sri Lanka's upscale business community has put a damper on any buoyancy in economic growth this year with a new poll expressing concern over the deteriorating local and international business climate in 2012.

According to a Business Outlook Survey 2012 issued by the Ceylon Chamber of Commerce (CCC) in January, the situation regarding two critical areas - decision to invest this year and the economic environment - worsened in December 2011 against July 2011 when the previous study was done.

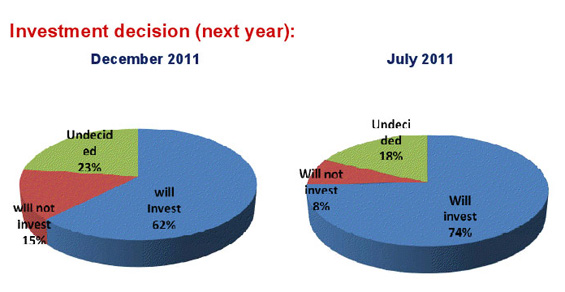

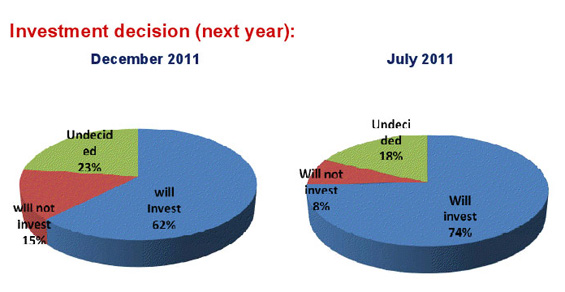

Respondents were asked whether they will invest, will not invest or are undecided. In December, 62 % said they will invest, down from 74% in July; 15% said they will not invest up from 8% while 23% were undecided against 18% (July). Asked about the economic environment in Sri Lanka for the next 12 months, 63% of the respondents said there was no change against 43% in July while only 21% said there had been an improvement against 57% earlier.

The internal survey, a copy of which the Business Times received unofficially, was aimed at obtaining an independent assessment of the business environment and the challenges encountered by Sri Lankan corporates. It covered key business sectors in Sri Lanka from Agriculture, Industry and Services such as Agriculture, Agro Processing, Banking & Finance, Food & Beverages, IT & BPO, FMCG, Plantation, Retail, Travel & Tourism, etc and was addressed to the business leaders covering SMEs to MNCs.

The mood worsened after notorious expropriation laws were introduced. Respondents asked for their perception of these laws, voted "Not Favourable (73%), Favourable (4%) and No Impact (23%)". Then asked about reconsideration of the business/investment decision based on these laws, 33% said they will reconsider, 40% said NO while 27% were undecided. Another revealing statistic was the ranking given to most positive (factors) and most negative factors. While there was hardly any change (from July to December) in the most positive factors (on a 1-5 scorecard) and comprising peaceful environment, improved infrastructure, cost of finance, improved access to finance and more transparent and consistent, the most negative ranking saw 'Abrupt/adhoc changes to laws and regulations' move one notch up to 1st place from 2nd place in July.

On average consumer prices, 69% of the respondents said it will increase (33% in July) while 31% said there was no change against 67%, six months ago. On interest rates, 51% said no change (95% earlier) while 47% said it would increase (3% earlier). The survey quoted 58% of the respondents saying salaries and wages in industry will rise (56% earlier), while industry profits would decline (27% respondents vs 55% earlier). On global economic conditions for the next 12 months, 2% of the respondents said it would improve, down from 14%; 29% said it would decline (47%earlier) while 57% said no change (51% earlier).

Commenting on the results of this survey, top economist, Prof. Sirimal Abeyratne from the University of Colombo said, the results were interesting but not surprising. He said there was a gloomy global economic outlook with the Euro crisis no more a crisis in the Euro Zone, but in the global economy.

He said the business environment of Sri Lanka needs to be strengthened through a reform process, but in practice it appears to have got damaged.

"Although the government's main policy document - Mahinda Chintana - presents a beautiful economic vision and conceptualization about the medium-term achievements of the Sri Lankan economy, there has been a huge vacuum in the mission and action plan. In certain instances, in fact, we could observe policy reversals as well as ad hoc policy changes, sending negative signals to the business community.

The business community wishes to see the policy direction of the country and, consistency and predictability of the policy environment," he said. A few bankers and industrialists polled by the Business Times had this to say:

- In addition to the macro economic issues, policy reversal is also a problem.

- Sri Lanka should have depreciated its currency two years ago and now the situation has worsened as the government failed to keep to its promises in the IMF SBA deal (flexible exchange rate policy/break-even in CEB and CPC)

- The market understands the situation much better (than the government) and is aware that the interest rates and foreign exchange rates are artificial.

- Policy reversals: the pensions pull back, the crates issue reversal, private university bill withdrawal and the expropriation law issues have sent negative signals and conflicting signals. The country can't attract investment under this environment.

http://sundaytimes.lk/120212/BusinessTimes/bt01.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home