Sri Lanka’s recent labour data shows impressive progress but inequality, youth unemployment and better jobs are still areas of much concern, a new report released by the International Labour Organisation (ILO) showed.

The economy recorded an impressive 8.3 percent growth rate in 2011. Per capita GDP increased to 2,804 last year from US$ 2,370 in 2010. The rate of unemployment has dropped 4.2 percent in 2011, the lowest level in post independence Sri Lanka.

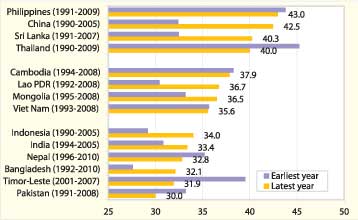

However, according to the ILO, income inequality in Sri Lanka has grown significantly and is only behind China.

"Income disparities have risen in many developing Asian countries, despite remarkable economic growth and poverty reduction in recent past decades. This trend can undermine economic sustainability and threaten social cohesion. Among countries with higher income inequality (measured by a Gini coefficient of 40 or higher), the ratio in China and Sri Lanka increased significantly by 10.0 points and 7.8 points respectively. In the Philippines the picture remains stark with only slight improvement.

In Thailand while a range of health and social policies have contributed to lower disparity levels, these still remain high," the ILO said in its April 2012 edition of the Asia Pacific Labour Market Update.

"In the Philippines and Indonesia, two countries with significant unemployment challenges, unemployment fell to 7.2 per cent in January and 6.6 per cent in August respectively. When looked at in terms of gender gaps, unemployment rates were higher for women than men in Indonesia (1.7 percentage points) and in Sri Lanka (4.3 percentage points). Moreover, in the Philippines, Sri Lanka and Thailand, assessing the desirable fall in unemployment should be balanced against limited progress in improving the quality of jobs," the ILO said.

It also showed that one in five Sri Lankan youth are unemployed, with the number of female youth out of work 11.7 percent higher than males.

Own-account and contributing family workers accounted for 42 percent of the labour force.

"On the surface, we have seen Sri Lanka achieve good employment growth and economic growth. But this is only on the surface and if we look carefully there are some concerns and a lot of work needs to be done," said ILO Labour Economist Phu Huynh as quoted in these pages last December.

"Despite the strong economic growth, we are concerned that formal sector employment is showing very little growth while Sri Lanka’s informal sector continues to be large. We have seen employment increase faster across the informal sector such as in the daily wage category and those working in households. So the country’s employment growth is not really coming from the formal sector and this is a concern because it leads to a question as to whether the economic growth was creating enough quality jobs," Huynh said.

http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=50911

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home