The Colombo bourse regained momentum in late August, with the All Share Price Index (ASPI) climbing 235 points or 4.8 per cent. The gains continued in September, as the ASPI surged a further 412 points (8%) to reach 5,592 points, erasing most of the year-to-date losses. In fact, the blue-chip Milanka Price Index (MPI) rose 10.2 per cent (455 points) during August, outperforming the ASPI. The MPI continued to outperform the ASPI in early September, as the index rose a further 437 points or nine per cent. This indicates that fundamentally sound blue-chip counters are among the hot picks, a clear shift in the trend where speculative small counters without strong backing drove the market to unprecedented levels.

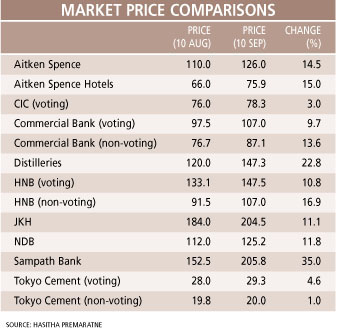

DRIVEN BY BLUE CHIPS From 10 August to 10 September, the ASPI appreciated 15 per cent, while the MPI rose 20 per cent, affirming that the blue-chip Milanka stocks outperformed the ASPI by almost five per cent. A comparison is made of the price movements of fundamentally sound stock portfolios highlighted in this column last month. Most of these stocks offered attractive returns over a period of one month and are likely to improve further in price.

Tokyo Cement and CIC are the only stocks that have not risen by double-digit percentage points. While both companies have short-term pressure on their earnings growth, they remain sound in the long term.

Meanwhile, the more defensive stock portfolio has not shown major improvements amidst the sudden upsurge in the market. These stocks, which offered attractive dividends and healthy capital gains over the 12-month period ended in July, remained modest during the hyper activity in the market. However, this portfolio of stocks will continue to offer modest dividends and adequate capital gains over a long period.

SHIFT IN PORTFOLIO MIX Coming out of difficult market conditions to a more robust trading environment, investors should consider shifting their portfolio mix towards equity, to take advantage of sporadic trading opportunities.

Typically, a 30 per cent equity exposure in a difficult market could be increased to 45 per cent when market conditions turn positive, with cash in short-term bills converted into equity. However, it’s important to stick to fundamentally sound counters, and keep a close watch on market sentiment and volatile trading conditions, to book profits in trading portfolios.

Last month’s market movements were not backed by any major shifts in the broader environment of the economy. We are still exposed to global economic concerns, a widening budget deficit in 2012 and a relatively high interest-rate environment. The changes made to the leadership of the Securities and Exchange Commission appear to be the market-moving news that resulted in positive sentiment vis-à-vis the bourse. Nevertheless, it’s impossible to justify that such a reason could drive the value of an equity market. What it may have done is to provide a boost to local investors waiting for market-moving news.

While the blue chips led the way, backed by foreign participation, it’s evident that the penny stocks which have no fundamental value at current price levels were also responsible for the mini bull run. It appears that the same investors who burnt their fingers a few months back by trading in these counters are entering the trading platform again – and exposing themselves to more risks.

While these stocks are being artificially pushed up by interested parties, it’s advisable to stay out of such penny stocks and stick to fundamentally sound entities, as trading conditions remain volatile due to sporadic pockets of profit taking that will not last long. Yet, defensive and value stocks are likely to hold ground, but investors should not hesitate to take profits when prices reach higher levels and reduce their exposure to equities to 30 per cent.

http://lmd.lk/2012/10/01/bourse-11/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home