The bank had a total number of 64 branches in operation as at 31st December 2015 predominantly within Western Province. The group recorded a total interest income of Rs5bn for the year ended 31st December 15 with a YoY growth of 12%. Total PAT attributable to equity holders of the parent amounted to Rs223mn compared to Rs31mn in FY 2014.

The infusion of capital by global investment giant TPG into the bank has added the much needed financial resources for its future expansion. Accordingly the bank is seen embarking into a rapid expansion. The expansion program has driving the group's gross income in a remarkably higher rate. However the rapid expansion would result in a rapid increase in fixed cost base as well such as personal costs, overheads and depreciation. This will prevent from the bank achieving a higher margin for profitability until such time the fixed cost base is stabilize. From this point onwards the bank can plan for improving the revenue from a branch on average basis where margins will start climbing.

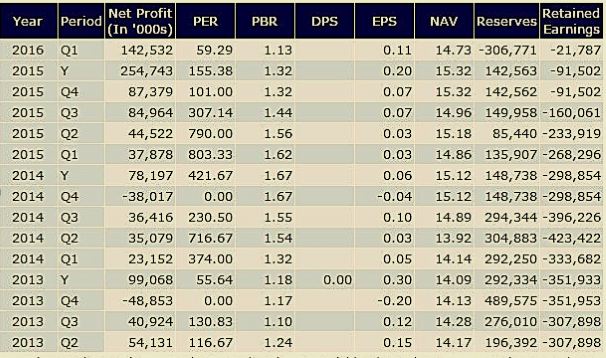

The below is the estimates for the bank for the next three years.

| 2015 | 2016 (F) | 2017 (F) | 2018 (F) | |

| Branch network | 64 | 128 | 164 | 200 |

| Total gross income (Rs mn) | 6,056 | 9,581 | 14,102 | 17,625 |

| PAT (Rs mn) | 254 | 366 | 593 | 858 |

| PAT attributable to equity holders (Rs mn) | 223 | 300 | 487 | 703 |

| EPS (Rs) | 0.20 | 0.28 | 0.45 | 0.64 |

| Equity Rs mn) | 16,386 | 16,255 | 16,742 | 17,445 |

| ROE | 1.8% | 2.9% | 4.1% |

Although the current PE level @ CMP seems to be more expensive the stock has immense future value if you are choosing UBC as a long term investment in which case your future returns will going to be huge.

Note: Q1 16 PAT is heavily boosted by trading profit. Due to unpredictability of this gain I assume net trading gains of Rs300mn, Rs330mn and Rs363mn respectively for FY 2016, 2017 and 2018. However depending on actual gain/or loss the NPAT figure can vary considerably since PAT from core business areas are still marginal.

Thanks

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home