All the business verticals will do better in coming years… If you invest now before the board clearance, probably you can get 100% gain in mid 2022.

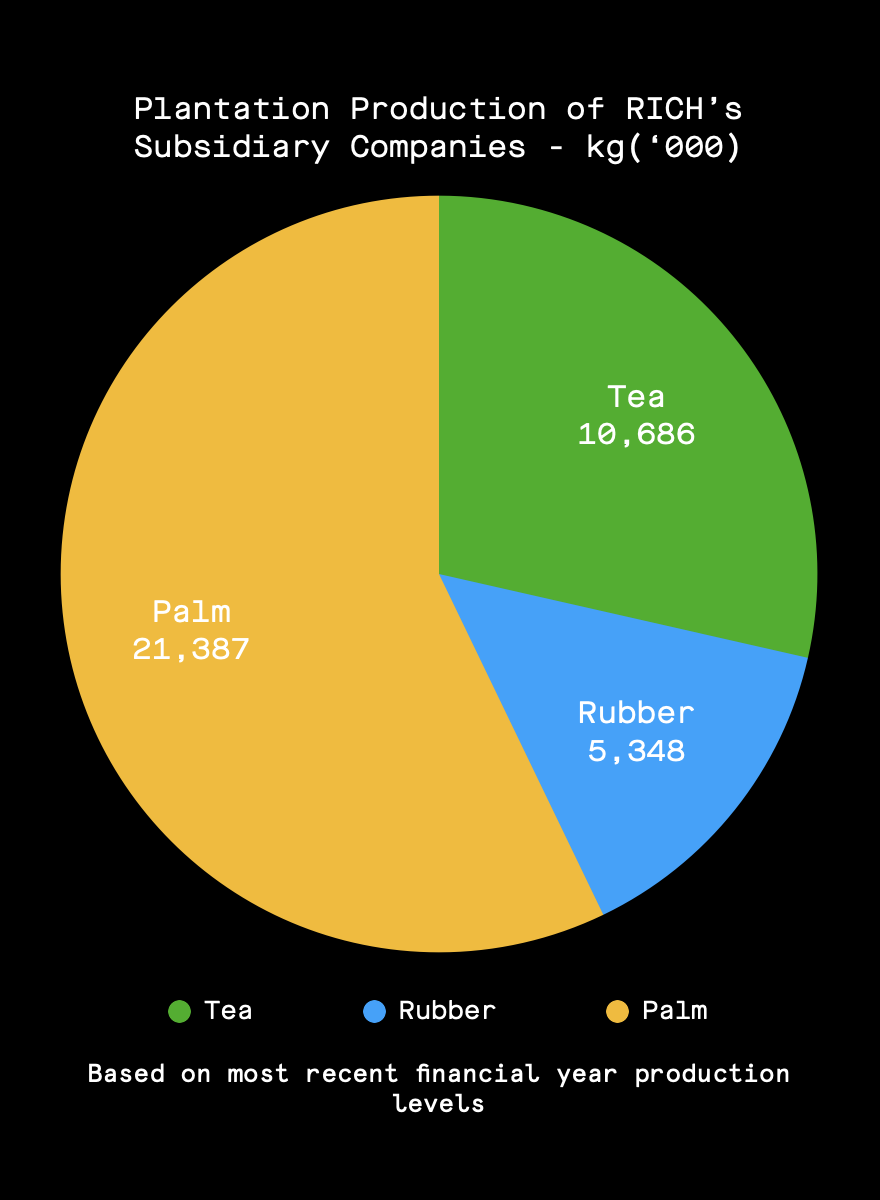

It is having a bunch of gems like Retail, PVC, Tyre, Exports(REXP), Plantation(KGAL, NAMU, MASK), Insurance(AINS). RICH is the ultimate parent of above listed companies, it is well-positioned to be a beneficiary of rubber products and palm oil export drive.

I would say it is the best conglomerate listed in the bourse, and it should trade PER with JKH, CARG, MELS, HHL, SUN trading PER.

Also, the news about Rubber-related product exports reached $1 billion for the first time. Much awaited benchmark for the industry and providing chemical fertilizers to tea planters by SL Government at concessional price will immediately affect the RICH!

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

ALERT

ALERT