[quote="ONTHEMONEY"]Hi Guys,

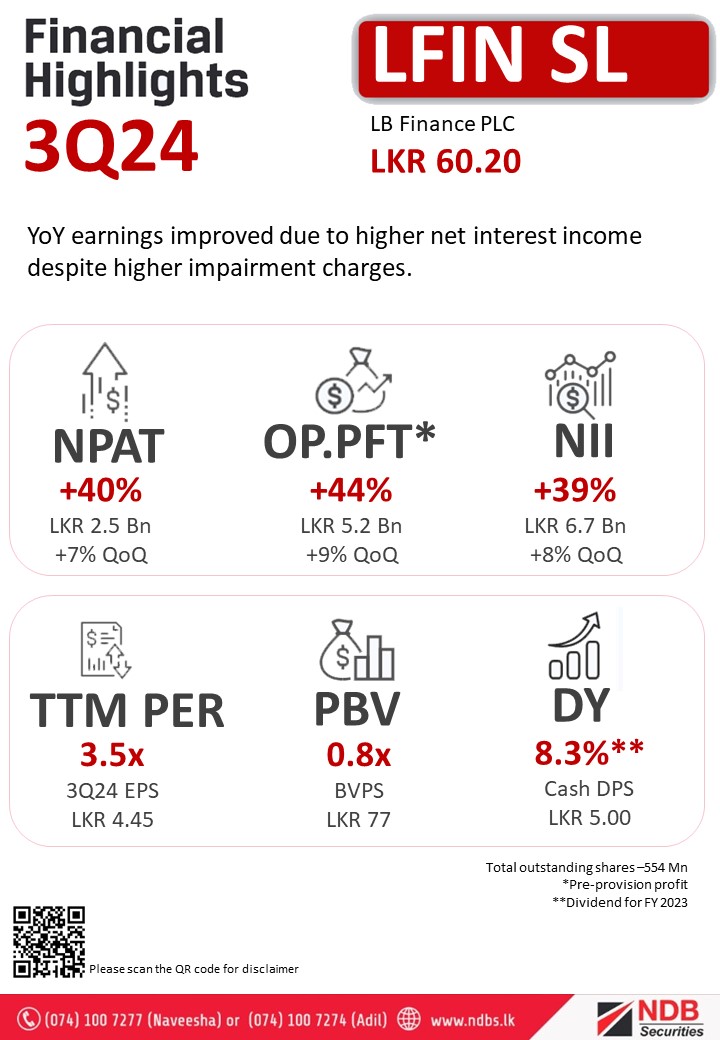

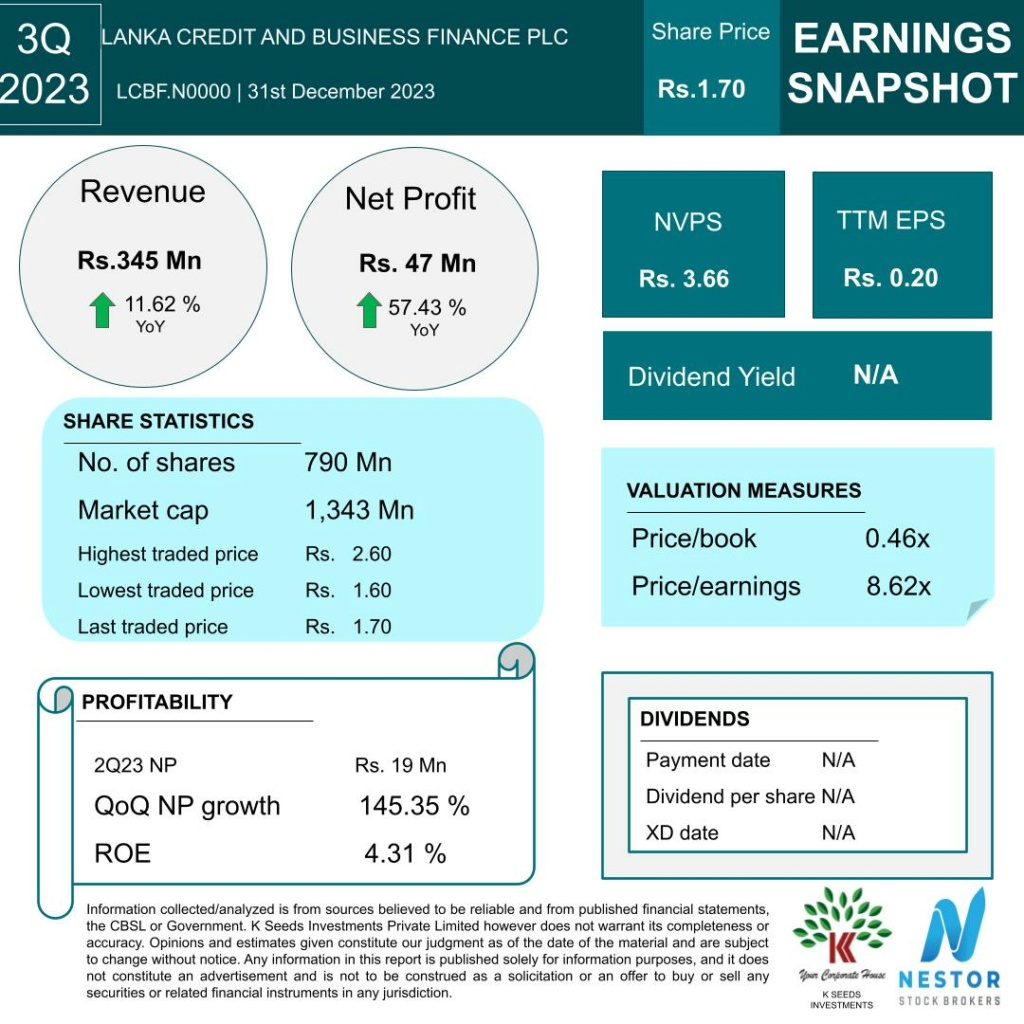

Impressive results from Banking and Finance sector.

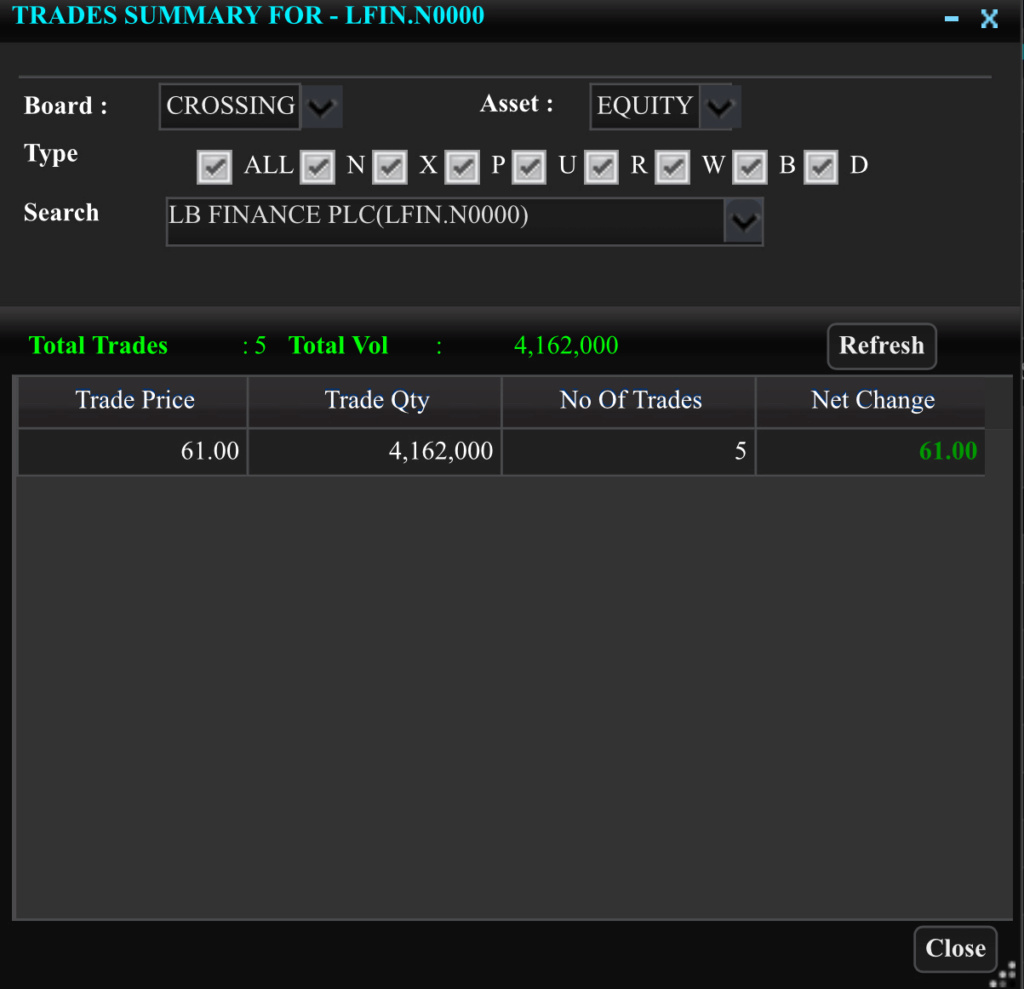

#LFIN and

#PABC have recorded tremendous growth in profits.

It is clear that

#LFIN stable performance and sustainability over the period. The company has satisfied the shareholder value to its maximum through following;

1. One of the richest dividend paying company(pls refer the above analysis)

2. Substantial capital gains in secondary market.

3. Value for long term investors through sub-division of stocks.

We can observe significant level of earnings growth during the quarter and for last 6 months despite losses made in Gold business, interest rate hikes, capitalization of shares. These are challenging situation a company can face. Even larger banks such as

#SAMP found hard to bear the losses made from Gold which was Rs 3.0Bn and the share collapsed to Rs 169/-. However

#LFIN being an street smart and innovative financial solutions provider has idetified key opportunities in the market and always perform exceptionally.

Many worried about above challenges even in this forum.

#LFIN has answered to all.

The key fact to consider is the growth in leasing business in future for

#LFIN. However

#LFIN aggressively market its leases for registered and low optioned Indian vehicles such as two wheeler, three wheeler and other small vehicles. The prices of these vehicles have not increased with later tax revise. Only Japanese vehicles have the major impact. Further with this price hike there is an opportunity cater to registered vehicle market than ever. As an aggressive company we are positive on future of #

LFIN amidst these challenges.

Therefore considering the above facts I would like reconfirm my recommendation on LFIN as a highly undervalue counter with high potential. Currently trading @ 5X forward PE. Many investment funds, corporate investors eye as a medium/Long term investment due to its earnings potential and Dividend Yield . Price targets @ 10 forward PE# LFIN - Rs 220/-# PABC - Rs 45/-Lfin will lead this time.

Lowest pe in the market.

Magic stock

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home