* Sri Lanka's February inflation release

* When: Wednesday, Feb. 29, 3.00 p.m. (0930 GMT)

REUTERS FORECAST:

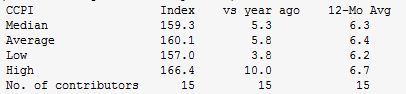

* Forecast: Sri Lanka's annual inflation is expected to have risen to a five-month high of 5.3 percent in February from January's 3.8 percent, measured on a new index with a 2006/7 base year, according to a Reuters poll of 15 analysts.

The 12-month moving average inflation is expected to have slowed to a 11-month low of 6.3 percent, from last month's 6.5 percent, with analysts' estimates ranging from 6.2 percent to 6.7 percent.

FACTORS TO WATCH:

- The effects on inflation caused by the rupee currency's depreciation and the increase of as much as 37 percent in state-controlled fuel prices. The rupee has fallen 6.2 percent against the dollar this month, making essential imports expensive.

- The impact of the central bank's inflation-fighting monetary policy. It raised policy rates by 50 basis points on Feb. 3, the first increase since 2007. Already, market interest rates have risen more than 83 basis points since then.

- Impact on growth and investment due to rupee depreciation, increasing borrowing cost, and expensive fuel prices. The moves are expected to cool the economy and curb demand-driven inflationary pressure. However, economists expect significant cost-push inflation to result in higher overall prices.

- Whether the central bank will allow the market to determine the rupee exchange rate, having already spent at least $2.7 billion defending it since July. Just two weeks after saying it would let the market decide, the central bank has intervened once again.,

- Whether Sri Lanka requests the remaining $800 million of the $2.6 billion International Monetary Fund (IMF) loan, in the face of a potential balance-of-payments crisis.

MARKET IMPACT:

- Whether the government inflation figures show a big increase or not, the spectre of high inflation is likely to cool investment decisions and banks' desire to lend. Economists say official inflation data has yet to reflect significant price increases across the board. The central bank says improved local food supplies have offset inflation pressure.

- Higher interest rates will draw people into the fixed-income market and away from the slumping Colombo Stock Exchange.

- The rupee is expected to depreciate more in the absence of central bank intervention, unless the monetary authority raises interest rates further.

Following is the poll's forecast for the February inflation data due to be released on Wednesday:

(Inflation figures are in percent)

Note: The following contributors participated in the poll:

Commercial Bank of Ceylon, HSBC, Bank of Ceylon, National Development Bank (NDB), Citibank, People's Bank, Standard Chartered Bank, ICICI Bank, Hatton National Bank (HNB), Asia Capital, CT Smith Research, Frontier Research, SC Securities and MAS Capital.

($1 = 121.500 Sri Lanka Rupees)

(Reporting by Shihar Aneez; Editing by Bryson Hull)

http://in.reuters.com/article/2012/02/28/srilanka-economy-inflation-idINL4E8DS2J320120228

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home