The country’s most profitable sector, the commercial banks, whilst having increased bottom line also saw their Board directors taking home a tidy sum.

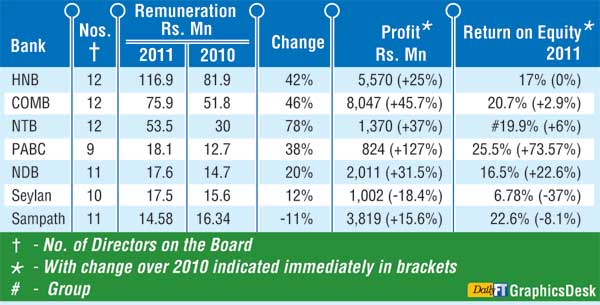

A sample of seven commercial banks analysed by the Daily FT revealed that their Boards of Directors have earned a collective Rs. 314 million in 2011, up by 41% from Rs. 223 million from the previous year.

Cost of living had no influence in the rise since in 2011 inflation was at single digit but the higher take home could be the quality of personnel and their time. However some Boards are likely to have exposed themselves for some criticism for lavishness.

Nevertheless under new laws, Directors carry a huge fiduciary duty and also carry substantial liabilities. With greater focus on non-executive independent director in 2012, it is likely that directors’ remuneration for banks and other listed entities in 2012 will be higher.

As per the Daily FT analysis, HNB, the second biggest private sector bank had the most expensive Board with its 12 directors enjoying a princely Rs. 117 million, up 42% from Rs. 82 million in 2010. Though their take home leaped the Directors failed to ensure a movement in return on equity. However after-tax profit at HNB grew by 25% to Rs. 5.5 billion in 2011. The percentage increase in 2011 of HNB directors take home was slightly below the 46% recorded in 2010 over 2009.

HNB Board appears expensive. For example, premier blue chip JKH’s Board directors remuneration was only Rs. 86.5 million in 2010/11 up by 22% over the previous year low in comparison to HNB’s 46% rise in 2010. In comparison to a multinational HNB Board also got more. For example remuneration of Board Directors of CTC was Rs. 91 million in 2011. Though quantum is high, there were other banks whose Boards saw higher percentage rise in remuneration than that of HNB.

The most profitable bank and listed corporate, Commercial Bank’s Board of 12’s remuneration amounted to Rs. 76 million, up 46% from Rs. 52 million in 2010. Commercial’s bottom line swelled by 46% to cross the Rs. 8 billion mark but return on equity saw only a 3% improvement over 2010. However Commercial produced best overall results in 2011. Though fifth largest in private sector banking, NTB’s Board was the third most expensive. Its 12 directors took home Rs. 53.5 million, 78% more than 2010. Its bottom line saw only 37% increase whilst return on equity improved by 6%.

Relatively small PABC Bank equalled its fast growing tag on the Board remuneration as well. Its 9 member- Board cost Rs. 18 million in 2011, up by 38%. However PABC’s bottom line saw a whopping 127% rise whilst return on equity grew by 73%.

The most interesting development in Board Room pay in banking sector came from Sampath Bank. Despite being the third largest, Sampath Bank Board in 2011 was the least paid, with only Rs. 14.5 million. Apart from being poorer, the take home also was down from Rs. 16.3 million in the previous year. Sampath’s bottom line improved by 15% though return on equity saw a contraction by 8%.

Seylan which performed worst among the 7 banks analysed by Daily FT however saw its Board getting richer. Its 10 members took home Rs. 17.5 million, up from Rs. 15.6 million. However Seylan’s bottom line dipped by 18% to Rs. 1 billion whilst return on equity saw 37% contraction.

NTB and NDB Annual Reports weren’t very shareholder friendly with regard to disclosure on remuneration to directors since comparative data for the previous year wasn’t indicated though NTB was the only bank to give a breakdown on executive and non-executive director remuneration. These two banks also opted not to show directors remuneration in notes to financial statement under operating expenses but separately disclosed in the Annual Report of the Directors on the State of Affairs.

Of the HNB Board for 2011, Rienzie T Wijetilleke, V. Theagarajah and R Seevaratnam resigned on March 31, 2011 which meant they enjoyed only three months pay. The vacancies were filled with Dr. Ranee Jayamaha appointed as Chairperson along with Dr. Willie Gamage on 31 March, 2011 and Dr. L.R. Karunaratne coming in from 6 October 2011. Harry Jayawardena and Raj Obseyeksera served during the year before resigning at end 2011. Other members of the Board during 2011 were Pamela Cooray, Rose Cooray, N.G. Wickremeratne and CEO/MD Rajendra Theagarajah.

http://www.ft.lk/2012/04/23/boom-for-bank-boards/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home