Turnover levels dropped on Tuesday’s session but foreigners still remained bullish on blue-chips. Commercial Bank, Aitken Spence and John Keells Holdings were the top foreign picks for the day with retail bullish sentiment picking up on Access Engineering. Retail participation still remains on the sidelines.

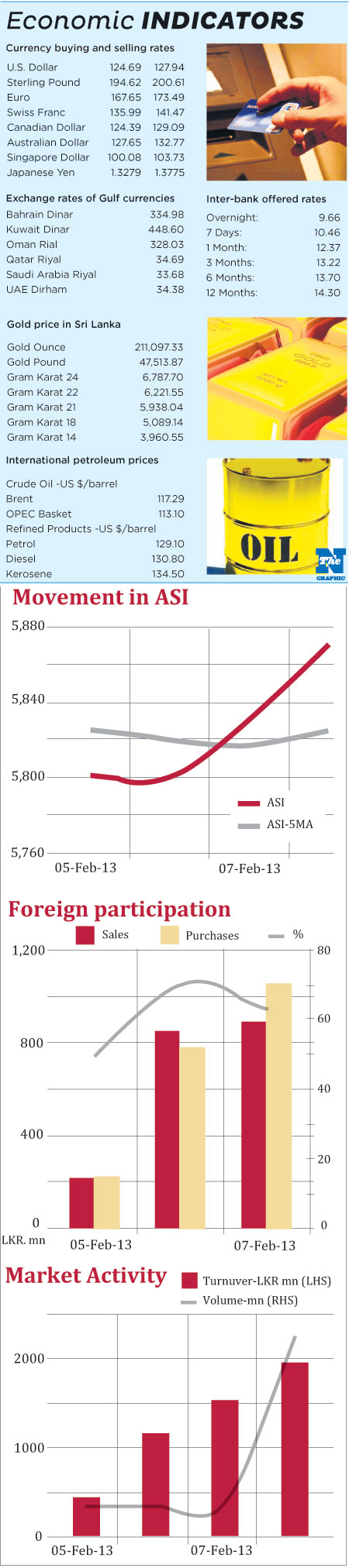

ASI dipped 18.39 points (0.32%) to close at 5,781.30 and the S&P SL20 index gained 7.10 points (0.22%) to close at 3,203.91. Turnover was Rs. 447.3Mn.

Gains on banking sector counters such as Commercial Bank and Sampath Bank failed to uplift the broader index as retail selling persisted throughout trading on Wednesday. Foreigners were seen on the buying side of banking and financials such as Hatton National Bank, Commercial Bank and Sampath Bank. Yields on most treasury bills fell in today’s auction but a period of stable interest rates could be expected going ahead.

ASI fell points 1.21 points (0.02%) to close at 5,780.09 and the S&P SL20 gained 13.48 points (0.42%) to close at 3,217.39. Turnover was Rs1, 171.1Mn.

Market rallied on the back of institutional buying on blue-chips on Thursday. Banking & financials again contributed immensely in terms of gains on the broader index and almost 55% of turnover. Sampath Bank was the highest gainer in the mentioned sector with the counter also witnessing retail activity.

Sampath Bank, Ceylon Cold Stores, E-Channeling and Dipped Products reached their 52 week highs today.

ASI gained 30.33 points (0.52%) to close at 5,810.42 and the S&P SL20 index gained 26.31 points (0.82%) to close at 3,273.70. Turnover was Rs. 1,534.3Mn.

Analyst’s noteMarket closed higher this week helped by foreign buying on blue-chips such as John Keells Holdings, Commercial Bank and Sampath Bank. Retail activity picked during the latter part of the week and may last for few more days. However, market sentiment seems dependent on foreign buying into blue-chips.

On the other hand, the Central Bank is to review the policy rates next week. A reduction will further assist the upward trend in the market but may also cause inflationary pressures in the mid-term.

Friday:

Positive momentum prevailed in the market led by Banking sector counters such as National Development Bank (NDB) and telecommunication sector counters. NDB is set to receive Rs. 5.9Bn from NDB Capital’s share buyback whilst booking a capital gain of Rs. 5.4Bn. The capital gain per share is Rs. 32.72. ASI gained points (%) to close at and the S&P SL20 index gained points (%) to close at. Turnover was Rs. 1,950.9Mn.

Top contributors to turnover were Hatton National Bank with Rs. 613.1Mn, John Keells Holdings with Rs. 180.2Mn and Commercial Bank with Rs. 162.5Mn. Most active counters for the ay were Textured Jersey, National Development Bank and Commercial Bank.Notable gainers for the day were Environmental Resource Investments warrant-6 up by 13.2% to close at Rs. 4.30, Sierra Cables up by 8.7% to close at Rs. 2.50 and Textured Jersey up by 8.7% to close at Rs. 10.00. Notable losers for the day were Citizen’s Development Bank down by 3.5% to close at Rs. 30.10, Grain Elevators down by 3.0% to close at Rs. 52.50 and Vallibel Power down by 2.9% to close at Rs. 6.60.Cash map for today was 41.09%.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home