would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

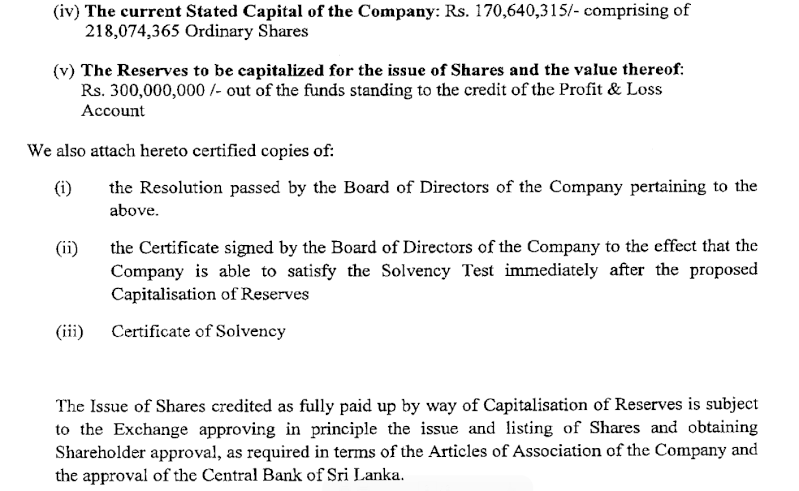

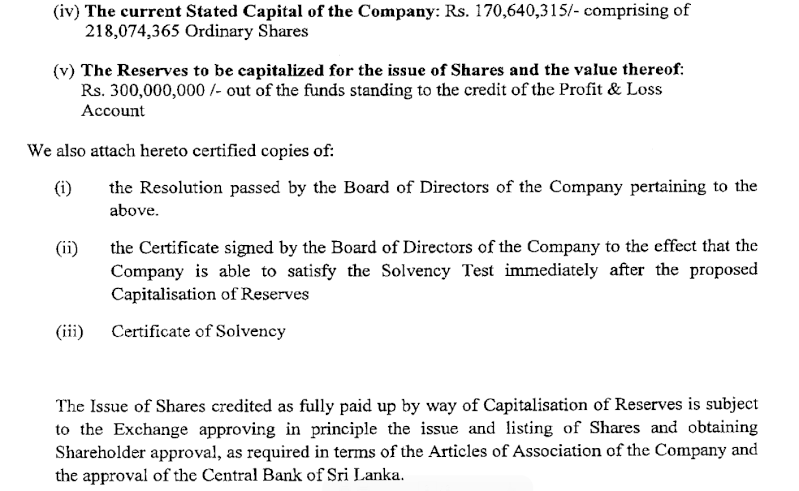

29-Jan-2013 Capitalization of Reserves - Commercial Credit Tue Jan 29, 2013 5:42 pm

29-Jan-2013 Capitalization of Reserves - Commercial Credit Tue Jan 29, 2013 5:42 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Jan 29, 2013 8:27 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Jan 29, 2013 8:27 pm

COCR Capitalization of Reserves - Wed Jan 30, 2013 11:22 am

COCR Capitalization of Reserves - Wed Jan 30, 2013 11:22 am

31-Jan-2013 Capitalization of Reserves - Commercial Credit (Amended - Proportion) Thu Jan 31, 2013 7:54 pm

31-Jan-2013 Capitalization of Reserves - Commercial Credit (Amended - Proportion) Thu Jan 31, 2013 7:54 pm 04-Mar-2013 Capitalization of Reserves - Commercial Credit Mon Mar 04, 2013 1:54 pm

04-Mar-2013 Capitalization of Reserves - Commercial Credit Mon Mar 04, 2013 1:54 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Mon Mar 04, 2013 4:12 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Mon Mar 04, 2013 4:12 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Mon Mar 04, 2013 9:08 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Mon Mar 04, 2013 9:08 pm

worthiness wrote:Is this the stock dividend or bonus shares declared by COCR?

With effect from capitalization of reserves, proportionate drop in dividend rate is to be expected.Any comments.

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 8:20 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 8:20 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 10:30 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 10:30 am

Arena wrote:COCR taking some mature steps. This is the courage business leaders should have. Looks my log term investment will work...........

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 10:39 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 10:39 am

knockknobbler wrote:It may be a good option from the Company's side. They are keeping the money even without even 0.10/ 0.25 cent dividend ( as most of finance companies do !)

I can't think of any additional benefit to shareholders. Even no. of shares increase, share price will drop, as smallville suggests.

Surprised to read this a "mature '' , "courageous ' decision .Arena wrote:COCR taking some mature steps. This is the courage business leaders should have. Looks my log term investment will work...........

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 11:25 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 11:25 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 11:31 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 11:31 am

No wrote:The smart analist and predictors who thought this will be the next blue chip

are vanished now with loses. COCR becoming a mess.Predictions are wrong.

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 11:56 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 11:56 am

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 4:24 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 4:24 pm

rainmaker wrote:I wonder how they will pay the maturity of that debenture.

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 7:02 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 7:02 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 7:40 pm

Re: 04-Mar-2013 Capitalization of Reserves - Commercial Credit Tue Mar 05, 2013 7:40 pm

Rapaport wrote:The rate offered on the debentures looks like its a steep price. maybe around 18% would still have had buyers

The only way they can repay this is by micro credit which has high interest rates. maybe someone can clarify the rates on micro credit. However micro credit can have high rates of default as well

Maybe most of the debenture was bought by some insider and the company can easily report loss as high finance cost and siphon money out as high interest on debentures. Hmmmmmmmmmm........

Only time will tell where this company is heading. The management need to clarify their plans.

Cheers!

FINANCIAL CHRONICLE™ » CORPORATE CHRONICLE™ » 04-Mar-2013 Capitalization of Reserves - Commercial Credit

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum