would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

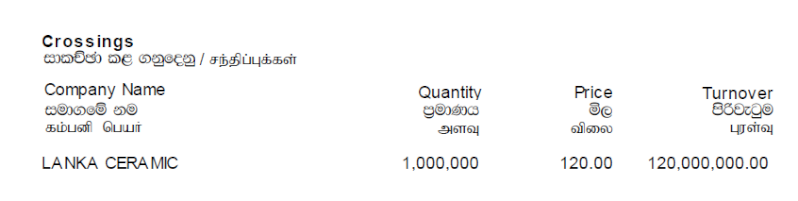

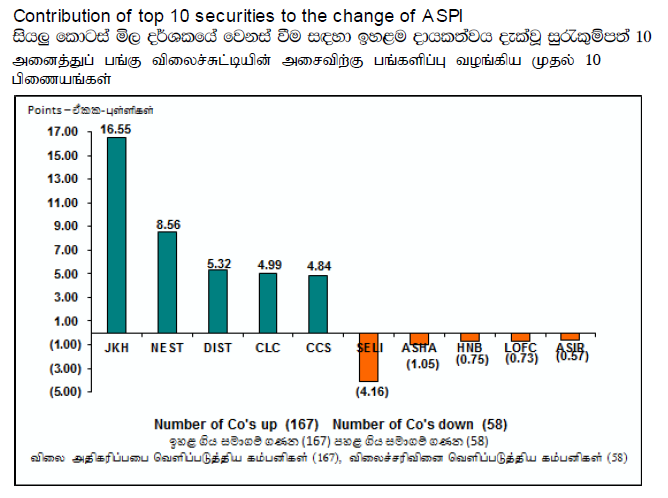

Crossing - 06/05/2013 and Top 10 Contributors to Change ASPI Mon May 06, 2013 4:23 pm

Crossing - 06/05/2013 and Top 10 Contributors to Change ASPI Mon May 06, 2013 4:23 pm

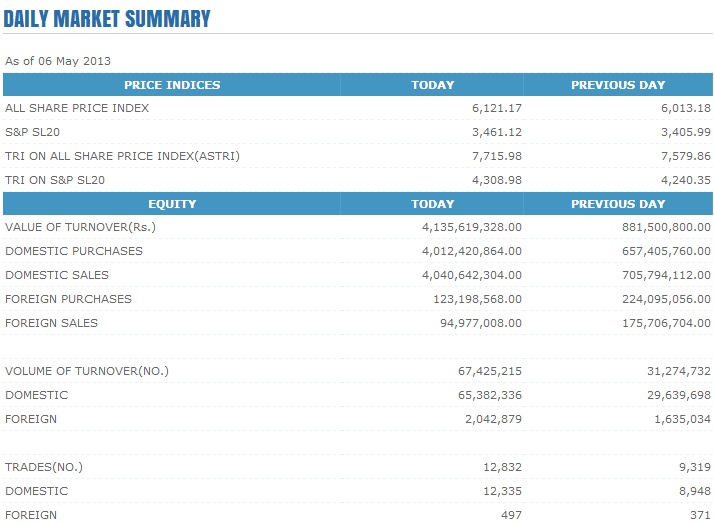

Re: Trade Summary Market - 06/05/2013 Mon May 06, 2013 4:56 pm

Re: Trade Summary Market - 06/05/2013 Mon May 06, 2013 4:56 pm

Re: Trade Summary Market - 06/05/2013 Mon May 06, 2013 6:05 pm

Re: Trade Summary Market - 06/05/2013 Mon May 06, 2013 6:05 pm

LSL Market Review – 6th May 2013 Mon May 06, 2013 6:08 pm

LSL Market Review – 6th May 2013 Mon May 06, 2013 6:08 pm Bourse surges to 17 month high, turnover over Rs. 4bn Mon May 06, 2013 10:07 pm

Bourse surges to 17 month high, turnover over Rs. 4bn Mon May 06, 2013 10:07 pmPermissions in this forum:

You cannot reply to topics in this forum