Colombo Bourse fluctuated on a narrow range whilst the daily turnover levels were predominantly dominated by few notable transactions. During the week profit booking was evident which diminished the exorbitant price gains witnessed over the past week. Furthermore, week witnessed the release of 4QFY13 earnings of several blue chip companies where most conglomerates posted mixed results in their cumulative FY13 earnings on the back of the macroeconomic shocks witnessed in the country.

The week also marked a change in ownership in JL Morrison Sons & Jones when Hemas Holdings acquired a controlling stake. As per CSE disclosure, approx 4.1mn voting shares of JL Morrison that represents 71.51% of voting shares and approximately 872K of nonvoting shares which represents 50.06%, was directly purchased by Hemas Manufacturing (Pvt) Ltd which is a fully owned subsidiary of Hemas Holdings PLC.

Subsequent to the aforementioned deal JL Morrison Sons & Jones spearheaded the weekly turnover contributing a circa 64%. John Keells Holdings also emerged amongst the top turnover list backed primarily by institutional and retail participation. As a result of the above strategic deal on JL Morrisons, the Chemicals and Pharmaceuticals sector made the highest contribution of circa 34% to the week’s turnover tally, followed by the Banking, Finance & Insurance sector with a 16% contribution supported mainly by heavy buying witnessed in Nations Lanka Finance and its Warrant 21.

During the week crossings were also recorded in counters such as Carsons Cumberbatch, National Development Bank, Asiri Hospitals Holdings and Lanka Floor Tiles. As a result of these transactions, the week posted an average turnover of circa LKR 1.1bn and an average share volume of 40.1mn.

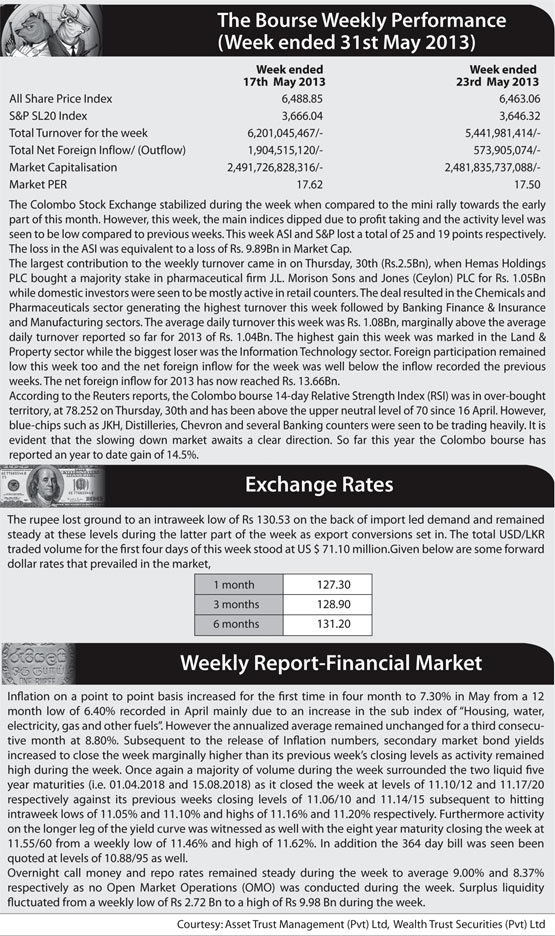

Furthermore, Nations Lanka Finance, Nations Lanka Finance (Warrant 21), Panasian Power, Environmental Resources Investments and Blue Diamonds topped the list in terms of volume traded during the week. The week saw foreign purchases amounting to LKR 1,067.4 mn whilst foreign sales amounted to LKR 493.7 mn. Market capitalisation stood at LKR 2,478.8 bn, with an YTD performance of 14.5%.

Conclusion:

Launch of the 30-year bond is likely to ease treasury yields in the long run...

Both indices showed signs of consolidation during the week while strong retail participation continued to drive the All Share Index and activity levels of the Colombo Bourse. The first 30 year bond worth LKR 2.0bn issued by Sri Lanka was oversubscribed over three times settling at a cut off annual yield of 12.5%. This indicates a general flow of savings towards government debt market from private investments, a trend that was apparent in financial markets from towards the end of 2012. On the flip side however, the launch of the 30-year debt instrument will expand the scope of government securities market and more importantly will provide added fiscal space to continue its growth agenda led by infrastructure spending, amidst moderating state revenue growth in the face of contraction in economy’s external trade.

Furthermore, Central Bank’s target of achieving 3.5 – 4 years range in average time to maturity of domestic currency debt by 2016 from the current figure of approximately 2.4 years will be assisted by the launch of the 30-year bond. Hence, we are of the view that the long-term outlook on government bond rates would turn favourable given that government’s cash outflows in the form of capital repayments would be significantly delayed through the introduction of the 30-yearbond. This would assist to limit government’s borrowing requirements to refinance debt repayments.

Given the fact that a strong negative correlation exists between the ASI and treasury yields, we are of the view that the launch of the new debt instrument would prove favourable towards equity trade in the long run.

Source: Asia Wealth Research

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home