13.5% for one month deposite at

ABANCE FINANCE

COMMERCIAL CREDIT

SOFT LOGIC

PLC

PLEASE ADVICE..THANKS...

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

Go to page : 1, 2

Best finance company for fixed deposit.Expert view. Tue Sep 03, 2013 11:56 pm

Best finance company for fixed deposit.Expert view. Tue Sep 03, 2013 11:56 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 8:24 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 8:24 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 9:22 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 9:22 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 11:47 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 11:47 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 11:55 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 11:55 am

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 12:43 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 12:43 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 3:57 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 3:57 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 5:11 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 5:11 pm

Give reasons for your recommendations. Otherwise we treat is as a promotion. I remind you that this is not the first time you have done this type of irresponsible things.Harry82 wrote:

LFIN

VFIN

COCR

CDB

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 6:30 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 6:30 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 7:26 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 7:26 pm Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 7:33 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 7:33 pm

OK good one. All these companies got A and above rating by credit agencies and I guess this is what you should look at more than anything else. However latest quarterly reports should be looked at to see any post rating developments. These companies would be more stable to any severe macro shocks (if any) than other finance companies.shehani.perera.1612 wrote:In my opinion the the following is the Order.

1. Peoples Leasing and Finance

2. Central Finance

3. LB Finance

Last edited by balapas on Wed Sep 04, 2013 7:36 pm; edited 1 time in total (Reason for editing : Add new information)

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 7:49 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 7:49 pm

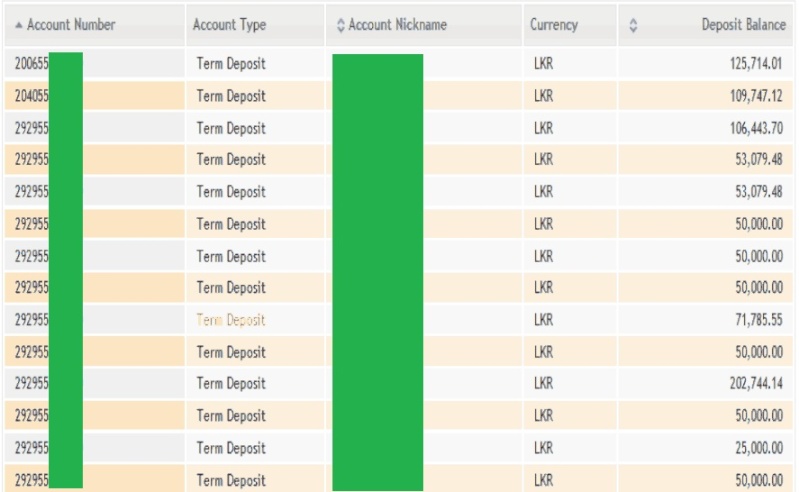

Looks like you have fair amount of money.econ wrote:I have FDs in ,

MBSL savings bank, Commercial Credit, CDB , Vallibel Finance, LBFinance, Softlogic Finance, ETI finance,Peoples leasing ..

So far no problem with any FDs.

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 9:55 pm

Re: Best finance company for fixed deposit.Expert view. Wed Sep 04, 2013 9:55 pmI did not invest in the stock market recently since I have huge unrealized losses. So all new money are gone to FDs.sikka89 wrote:Looks like you have fair amount of money.econ wrote:I have FDs in ,

MBSL savings bank, Commercial Credit, CDB , Vallibel Finance, LBFinance, Softlogic Finance, ETI finance,Peoples leasing ..

So far no problem with any FDs.

Re: Best finance company for fixed deposit.Expert view. Thu Sep 05, 2013 9:35 am

Re: Best finance company for fixed deposit.Expert view. Thu Sep 05, 2013 9:35 am

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 8:47 am

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 8:47 am

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 9:20 am

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 9:20 am

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 11:46 am

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 11:46 am

?On what basis. Please give reasons.nalinkene wrote:CSF

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 11:49 am

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 11:49 am

We too have opinions but they may not work without plausiable reasons. ?Can you give reasons behind your opinions.shehani.perera.1612 wrote:In my opinion the the following is the Order.

1. Peoples Leasing and Finance

2. Central Finance

3. LB Finance

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 12:05 pm

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 12:05 pm

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 12:10 pm

Re: Best finance company for fixed deposit.Expert view. Fri Sep 06, 2013 12:10 pm

I have not studied this company, but as a general rule, keep in mind, that, those who offer highest rates are desparately in need of cash at the moment.kelumhewage wrote:well....just need to find how come valible finance gives highest interest rates in sri lanka at the moment...????thanks for you advice bull...cheers....

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 2:56 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 2:56 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 3:34 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 3:34 pm

Dear Sir,K.Haputantri wrote:We too have opinions but they may not work without plausiable reasons. ?Can you give reasons behind your opinions.shehani.perera.1612 wrote:In my opinion the the following is the Order.

1. Peoples Leasing and Finance

2. Central Finance

3. LB Finance

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 3:59 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 3:59 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 5:40 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 5:40 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 6:19 pm

Re: Best finance company for fixed deposit.Expert view. Sat Sep 07, 2013 6:19 pm

This is an outdated report, the latest report is here http://www.ram.com.lk/reports/1357792419.pdf done in 2013 but rating has not improved. AMF has a rating of BB- which is the lowest rating one would get. It falls in to the speculative grade. http://www.ram.com.lk/ram_rating_scale_en.phpsumma wrote:No one address about AMF. Stable company and gives higher return than others.

http://www.ram.com.lk/reports/1315979402.pdf

Last edited by balapas on Sat Sep 07, 2013 6:24 pm; edited 1 time in total

Go to page : 1, 2

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum