If you are putting 2M on FD,

it is advised to break them down and put in to different maturity periods.

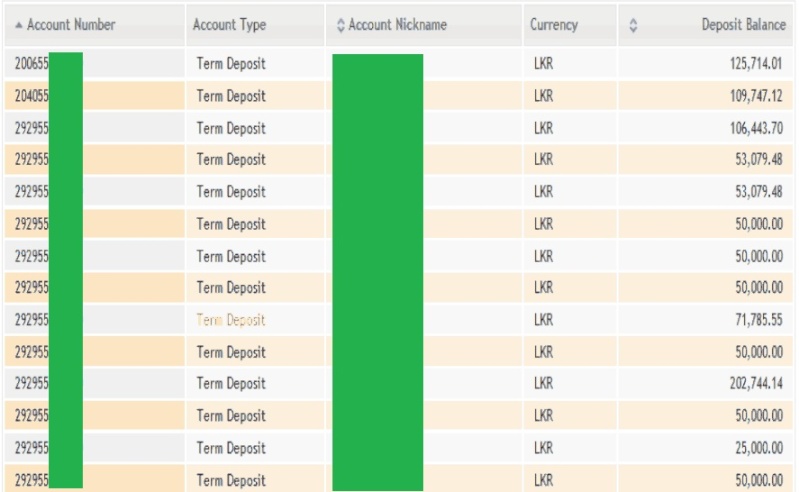

Two years ago me and my wife started opening one FD a month.

First one was a one month FD, then 3x 3Month FD, 6x 6Month FD and so on...

Today we have more than 4 FD's expiring and renewing in every month.

Income is nearly 20K a month and increasing.

My advise is,

Don't put your money where you don't have total control over it and watch out for government tax.

Cheers...

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home