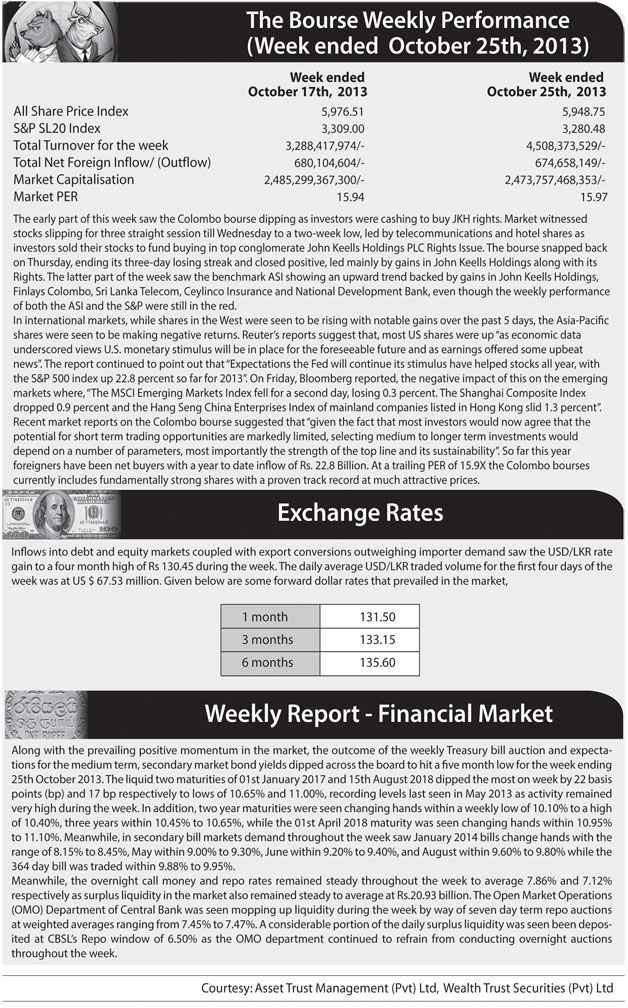

The Colombo bourse opened the floor for trading on a negative note; however it gradually gathered momentum during the last two days of the week yet closed the week down WoW. The ASI lost 27.8 points WoW to close at 5,948.8 points (-0.5%), whilst the S&P SL20 Index lost 28.5 points WoW to close at 3,280.5 points (-0.9%). Indices lost mainly on the back of losses made by Ceylon Tobacco Company (-3.0% WoW), Bukit Darah (-2.8% WoW), Carson Cumberbatch (-2.5% WoW), Sri Lanka Telecom (-2.5% WoW) and Commercial Bank of Ceylon (-1.7% WoW).

The bench mark index trended down during the first three days of the week, however it managed to gain momentum towards the end of the week. Turnover and volume levels were high during first two days lifted by crossings and a mix of foreign, high net worth and institutional interest on selected counters, whilst activities slowed down during mid week.

However, 4 crossings totaling to over 6.9mn shares witnessed on National Development Bank on Friday boded well for the day’s turnover to cross LKR1.4bn, whilst WoW foreign participation remained flat during the week. Despite the average daily turnover during the week being notably high cf. 12 month average daily turnover, it dipped 17.7% WoW to LKR901.7mn, whilst the average daily volume during the week rose 126.9% WoW to 40.5mn. Meanwhile, John Keells Holdings-rights that commenced trading on Tuesday last week ended its trading during this week on Thursday with approx.26m rights being traded (c.20% of total issued qty) during this period. Rights opened the trading at LKR40.0 and reached its all time high of LKR72.0 yesterday despite witnessing much volatility during trading days. Further, investor interest was centered on Union Bank towards the latter part of the week following a disclosure made by the bank regarding a foreign institution expressing their interest in investing in Union Bank. However, the bank in its announcement indicated that no firm offer has been made yet.

Moreover, Fitch Ratings raised concerns over Sri Lanka’s increasing reliance on foreign borrowings which in turn could result in currency risks for borrowers who may not have forex revenues. It further indicated that the country has been able to raise only a net FDI averaging 1.2% of GDP since the war ended in 2009, which fueled the state foreign borrowings.

According to Fitch, state foreign debt burden is currently 57% of GDP, which is much higher than the all other Asian emerging markets except for Mongolia.

Further, Dialog Axiata witnessed two crossings accounting to over10mn shares, whilst counters such as Hatton National Bank, John Keells Holdings, John Keells Holdings-rights, Access Engineering, Commercial Bank, Distilleries and Union Bank also encountered crossings during the week, where the crossings contributed c. 38% towards the week’s turnover. Furthermore, Seylan Merchant Bank (non-voting), PCH Holdings, Union Bank, Seylan Merchant Bank and Dialog Axiata topped the list in terms of highest volume traded stocks during the week.

The week saw foreign purchases amounting to LKR 1,341.8 mn whilst foreign sales amounted to LKR 666.8mn. Market capitalisation stood at LKR 2,473.8bn and the YTD performance is 5.4%.

Conclusion: Expansionary monetary policies likely to spread positive vibes on the equities market

Despite the Central Bank of Sri Lanka (CBSL) slashing policy rates by 50bps last week, the Colombo bourse failed to show a positive reaction spontaneously as it was on a losing streak for 3 consecutive days during the week.

However, the bourse regained on its 4th day of trading to end the week on a positive note partly paring the initial losses, to end the week on WoW dip of 0.5%. This could be possibly due to investors being watchful ahead of the release of 3QCY2013 financial results.

Expansionary policies adopted by the CBSL has so far brought down policy rates by 100bps in total for 2013 (125bps since November 2012), whilst the country has managed to maintain the inflation at single digit throughout 2013, with the inflation for September 2013 being at 6.2% (MoM dip of 0.2%). Fitch during a revisit on the country’s economy has commented that the expansionary monetary policies coupled with relatively lower levels of inflation could support the country’s economic growth momentum, with Fitch expecting a growth of 6.0% for 2013E and 6.6% for 2014E. Thereby, on the back of these developments we expect the possible downward trend in the interest rates to improve corporate performance from 1CY2014. Whilst lower interest rates could improve the bottom lines of corporates, it could also enable companies to go forward with expansions, which have been relatively curtailed due to high cost of financing.

In addition, we expect the banking sector, which has been witnessing a marked slowdown in private sector credit growth to witness a revival. Finally, the possible drop in market rates is also likely to improve the attractiveness of equity investment cf. to fixed income securities and improve equity trading activities.

Source: Asia Wealth Management Research

To read the entire report - http://research.srilankaequity.com/t844-25-10-2013-weekly-review-asia-wealth-management-co-ltd#962

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home