would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

Activities levels become dreary as the holiday mood creeps into the market. Fri Dec 13, 2013 8:31 pm

Activities levels become dreary as the holiday mood creeps into the market. Fri Dec 13, 2013 8:31 pm

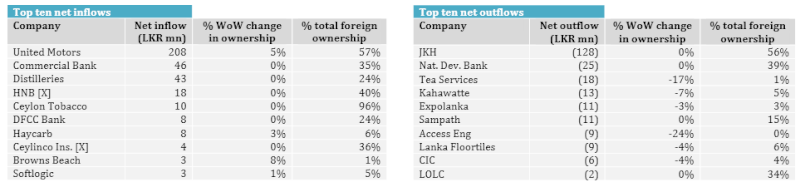

The Bourse Weekly Performance (Week ended December 13th,2013) Sun Dec 15, 2013 1:15 am

The Bourse Weekly Performance (Week ended December 13th,2013) Sun Dec 15, 2013 1:15 am

FINANCIAL CHRONICLE™ » DAILY CHRONICLE™ » The Bourse Weekly Performance (Week ended December 13th,2013)

Permissions in this forum:

You cannot reply to topics in this forum