Sector: Diversified Holding

Nature of Business: Real Estate & Investing holdings

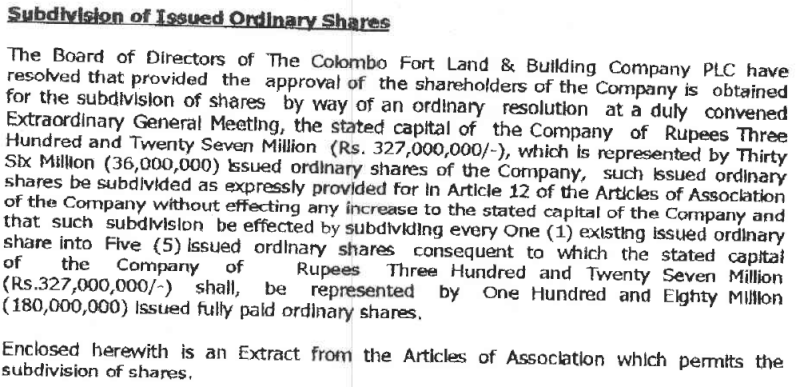

No of shares : 180,000,000

Price : Rs 28.20 (31/12/2013)

NAV - Rs 44/= ( 30 Sep 2013 )

All time High : Rs 580/- low : Rs 1.75

Market Price 2012 - Highest - Rs 45.50 Lowest - Rs 34.50

Market Price 2013 - Highest - 34.50 Lowest - 26.00

Public Holding (as of 30 September 2013) - 41.43%

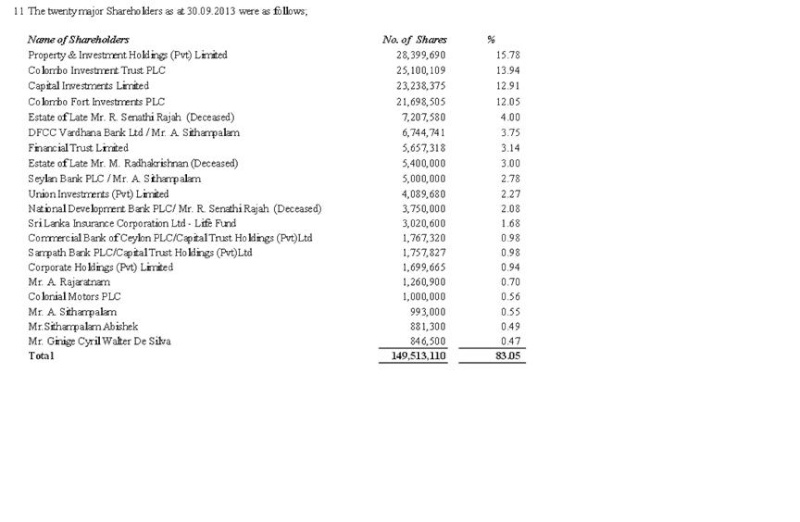

Top 20 Shareholders holding = 83.05%

Subsidiaries : Holding %

Colonial Motors : 64.06 %

EB Creasy & Company PLC : 59.75 %

Muller & Phipps : 30.65 %

York Arcade : 49.83 %

Lankem Ceylon : 60.07 %

Marawila Resort : 31.64 %

Sigiriya Village Hotel : 39.72 %

C.W. Mackie PLC : 33.51 %

Unquoted Investments : Holding %

CF Travels Limited : 100 %

Capital Leasing Co : 55.83 %

Colombo Fort Holdings Ltd : 100 %

Colombo Fort Properties ltd : 99.30 %

Transways (pvt ) ltd : 70 %

Colombo Fort Hotels : 62.37 %

Lankem Plantation Holdings Ltd : 81.02 %

Beruwala Resorts Ltd : 48.69 %

Investment Portfolio (selected)– Company : Number of Shares

CTCE : 285,760

COMB : 906,107

DFCC : 116,937

HNB : 280,091

LOLC : 394,800

NDB : 19,530

NTB : 115,774

PABC : 313,400

SAMP : 67,222

SEYB : 261,133

HDFC : 200,100

RHL : 23,790

HAYL : 101,316

HHL : 459,375

CFLB : 5,339,680

VONE : 104,000

ASIR : 355,660

AMSL : 113,999

AHUN : 100,765

AHOT : 72,200

REEF : 306,195

EDEN : 350,000

JHL : 781,922

LHL : 114,800

GUAR : 149,984

CINV : 590,691

WAPO : 113,000

LVEN : 339,800

CARG : 128,100

CLND : 523,860

TWOD : 602,400

LWL : 100,000

REGNIS : 137,883

SIRA : 826,600

TKYO : 406,604

UML : 23,254

WATA : 437,700

VLL : 396,420

SINGER : 120,310

CFI : 1,406,117 (22 % of the company)

CIT : 1,009,668 ( 16 % of the company)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home