By Wealth Trust Securities

The tariff reductions in fuel and electricity which acts favorably on inflation, robust GDP growth of 7.80% for the second quarter and a healthy external sector performance coupled with the outcome of the weekly Treasury bill auction at which its weighted averages declined, reflected favorably in bond markets as secondary market yields were seen dipping during the week ending 19th September, on the back of considerable buying interest ahead of this month’s monitory policy announcement due on the 23rd of September 2014.

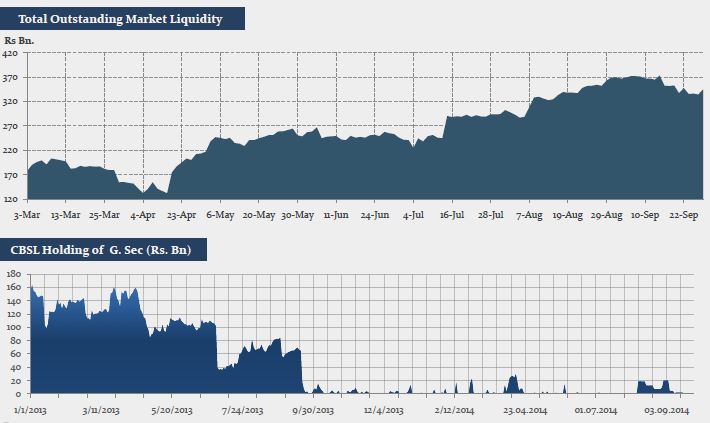

Activity remained very high, with the market favorite five year maturity of 01.07.2019 reflecting the sharpest decline of 46 basis points (bp) week on week to a weekly low of 7.05% closely followed by the seven year maturity of 01.05.2021 dipping by 38 bp to a low of 7.60%, the eight year maturity of 01.07.2022 dipping by 35 bp to a low of 7.78%, while on the longer end of the yield curve the nine and a half year maturity of 01.01.2024 dipped by 21 bp to a low of 8.07% and the fifteen year maturity of 01.05.2029 by 10 bp to a low of 9.00%. Meanwhile, on the belly end of the yield curve, the three year maturity of 15.05.2017 dipped by 35 bp to a low of 6.70% closely followed by the two four year maturities of 2018 (i.e. 01.04.2018 and 15.08.2018) by 35 bp and 32 bp respectively to lows of 6.90% and 6.98% reflecting an overall parallel shift downwards on the yield curve. Meanwhile, in secondary bill markets, continued demand for the 182 day and 364 day bills and duration centering it saw it been quoted marginally below its respective weighted averages for the first in a few weeks. Meanwhile in money market, overnight call money and repo rates remained steady to average 6.70% and 6.52% for the week as surplus liquidity in the market remained high to average Rs. 31.85 Bn for the week as well. Interestingly the surplus amounts were deposited at CBSL’s Standing Deposit Facility Rate (SDFR) of 6.50% during the week as Central Bank refrained from conducting any auctions under its Open Market Operations (OMO) throughout the week

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home