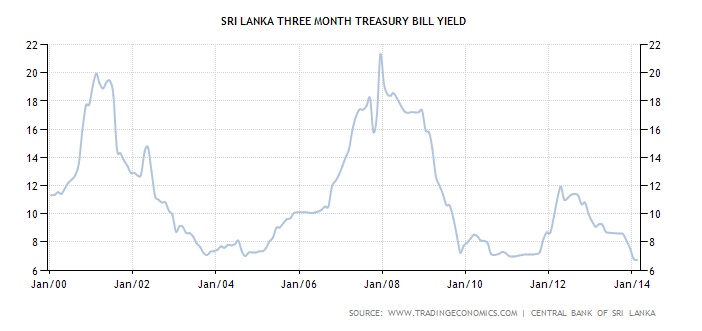

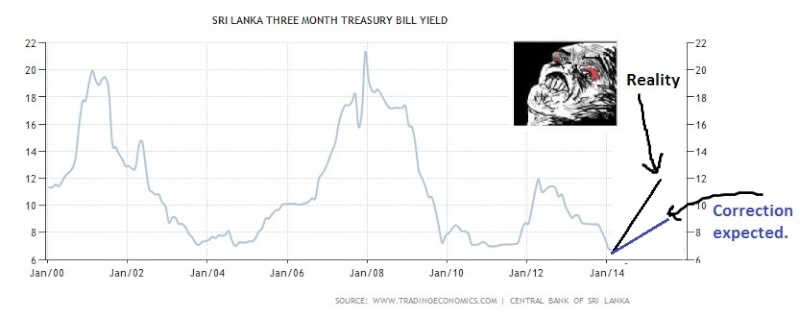

Sstar wrote:During the month of November, December and January there is a huge demand for consumer goods which are mostly imports. This has been witnessed during festive season during April and December. This will have an impact on exchange rate and resultant inflation. These inflationary pressure coupled with government desire to win the heart of the voters before elections will likely to increase the interest rates.

These are my thoughts. I sold my portfolio but bought back few shares and hold them currently. Please don't mix up my analysis with my investment strategy. They are both mutually exclusive.

at this crucial stage, who would think about inflation?

electricity down

gas down

oil down

down down prices are down.... Would rates will be up? do you reckon?

I will tell you for sure, Salary will be up. As you said, there may be something for pensioners too

As shark Aka Tah said, Pensioners also will get encouraged to invest in Stock market.

Miracle of Asia my dear. This is about to happen, in front of our eyes.

My salutes to oops because he said, "halo election wenakal yana tikak thama yanne.eeta passe hulan"

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home