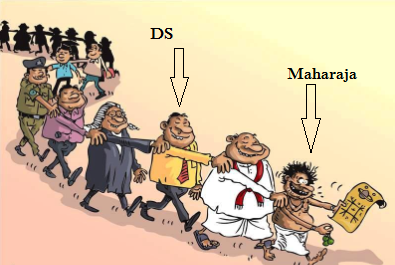

Maharaja wrote: Eugine Fernando wrote: Maharaja wrote: Maharaja wrote:I believe my technical analysis. 6077 will test.

When everybody including asha phillips said 6200 support said I told No, it will break.

Likewise 6077 will test for sure.

Maharaja

Though I don't like your comments, I salutes to your predictions. So tell us now what next.

Thankyou Mr.Fernando. Today ASI reached my support level. Tomorrow we can see how the 6077 support reacts.

What is next ?

I expect a technical bounce tomorrow. But only a short term bounce. Not a market turnaround. Market is in extreme BEAR market category. ASI direction is 100% downwards.

SO there will only be short term trading opportunities when market moves sideways for 100-150 points.

Can ASI break 6077 tomorrow ?

Yes, it can break if selling pressure applied. Bad news is still real selling did not begin. Japanese,Korean,Middle-east & European funds didn't even think to exit the counters. So I expect a technical bounce only due to oversold levels in S&P counters.

When to BUY ?

In this kind of extreme BEAR market I cannot recommend to buy. If we analyse the market, nothing is positive. Earlier company earning were good but now if you analyse financial reports, earnings keep dropping. Main sectors - Banking NPLs higher, Int.expenses higher. Construction sector - SME construction companies closing, No FDIs to start new projects. So in next couple of years company earnings will fall further with interest rates crossing sky high levels.

Politics and CSE ?

As I see, we all must follow a wait and see approach till 2020.

Till 2020 there will be no political change. This government will continue till 2020.

Who will come to power in 2020 ?

The presidential candidate from Pohottu party will surely win the contest without doubts.

Will CSE rise in 2020 ?

I am doubtful. As soon as Pohottu party wins, the European trade bans will be put. Fish ban will come into effect. Human rights cases against SL will begin once again. So conditions will be worse for the country and CSE after election.

But political stability will be there in the country. New investments will begin to flow.

So there will be mixed effects which we will see. It is too early to predict about about these political effects.

When to enter this bear market ?

After presidential election in 2020 we have to see if the new Pohottu government will actually do a change to the economy. If they are able to bring proper growth to country then CSE will grow.

If they also eat the economy CSE will fall.

SIMPLE AS THAT.

Till then we have to follow a wait and see approach.

What is next support level ?

6000 is the psychological support level. Not a technical support level.

If 6077 breaks, next is 6020-6023 area support.

And after 6020-6023, it is down to 5800 support. This is really a strong support. I don't think market needs to test this level soon. May be this month end/ next month it is possible but not this week.

Happy trading,

Maharaja

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home