cseboss wrote:ADVENTUS wrote:cseboss wrote:ADVENTUS wrote:EPS wrote:HAYC too announced 3.6 Bn for its Q1.

So, definitely Hayleys Q1 can be massive with their un-listed company numbers including its shipping arm

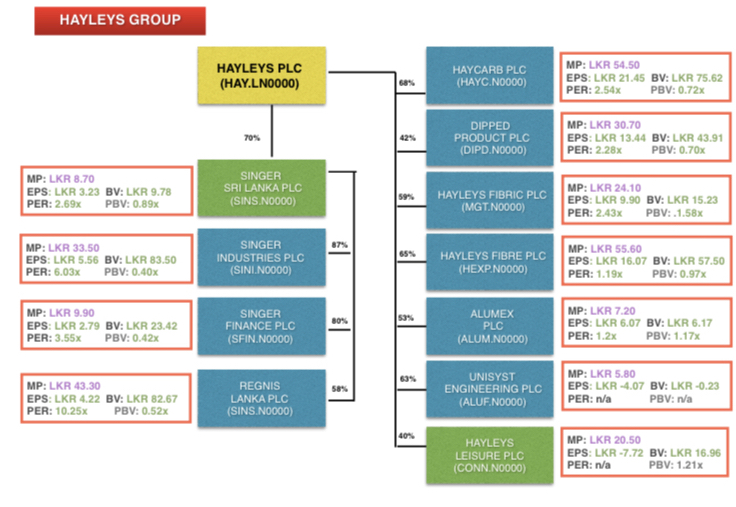

Hayleys is strongest blue-chip company in CSE with having a massive EXPORTS arm + dollar earning company in SL.

I guess HAYL will be the best runner for 2022 with its strong fundamentals, same as previously EXPO.

THEY HAVE A MASSIVE NEGATIVE CASH FLOW BALANCE: A WHOOPING NEGATIVE 35BN!

THIS COULD BE THE REASON WHY SOME AREN'T KEEN ON INVESTING IN HAYLEYS.

Negative people talks about useless negative things but real investors do not care. HAYL will show its strength very soon...

NEGATIVE CASH FLOW IS A BIG DEAL.

IT HAS BEEN THE CASE FOR A LONG TIME.

IT IS A BIG DETERRENT FOR INVESTORS.

IF it is a big deal, then why FINCO's 23+ Mn shares absorbed by HNWIs above 125/- early this year ??? are they stupid ???? lol

THEY PROBABLY THOUGHT LIKE YOU.

MY POINT IS THAT THIS FACTOR IS WHAT SEPARATES HAYL FROM OTHER TOP COMPANIES IN THE CSE WITH GREAT EARNINGS AND GROWTH- THEY ARE CASH RICH, UNLIKE HAYL.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home