http://www.srilankaequity.com/2010/02/colombo-fort-land-building-company-plc.html

http://www.srilankaequity.com/2010/03/colombo-investment-trust-cit-crown.html

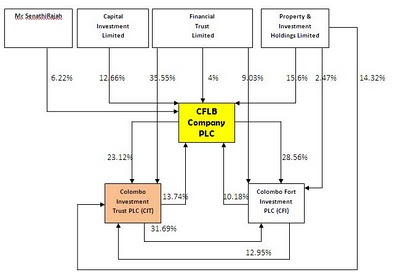

Group Structure of CFLB & CIT

Shareholdings of CFLB

As per the shareholdings of CFLB the Colombo Investments Trust PLC (CIT) and Colombo Fort Investment PLC (CFI) owns 13.74% (4,947,517 shares) and 10.81% (3,890,076 shares) of CFLB respectively. Further in addition the above direct holdings in CFLB, there is a clear cross holdings between the two companies CIT and CFI. CIT owns 31.69% (1,584,571 shares) of CIT whereas CFI owns 12.95% (732,402 shares) of CIT.

Importance of CIT to CFLB Shareholders

Majority shareholdings in CFLB is vested between three unlisted companies namely Property Investments holdings Limited, Capital Investments Limited and Financial Trusts Limited. Jointly these three companies control approximately 33.10% and Mr Senthirajah the Chairman of CFLB directly owns approximately 6.22% shareholdings. The two Investment Trusts CFI and CIT approximately control 24.5% of CFLB and further 17.17% is held by the Public (Outside top 20 shareholders).

As seen from the shareholdings of CFLB it is crucial for the majority shareholders to be in firm control of CIT& CFI. The control CFI can be achieved with the control of CIT as the latter owns approximately 31.69% of CFI. Therefore control of CIT is the most significant to the control of CFLB.

Who Controls Colombo Investment Trust PLC (CIT) ?

It is important to disregard the CFLB's and CFI's shareholdings in CIT when considering the ownership of CIT as shareholders cannot control CFLB and CFI without the control of CIT.

Majority of shares of CIT are presently held by two unlisted companies namely Financial Trust Limited, Property and Investment Holdings Limited. Jointly theses two companies control approximately 49.87%. This was as result of Financial Trust Limited increasing its shareholdings from 32% to current 35% during latter part of FY 2009.

Therefore we could determine that the shareholdings of Financial Trust Limited is the key to the control of CFLB. Financial Trust Limited is an unlisted company and the shareholdings are not available to the public. In the event if the control of Financial Trust Limited becomes unclear due some unforeseen reason then most important company within the CFLB group undoubtedly is the CIT. Therefore one could consider Colombo Investment Trust PLC (CIT) to be the Crown Jewel of the CFLB group.

Courtesy- Sri Lanka Equity Analytics

Stock Pick said...

Very Interesting analysis.

after reading this article, you may wonder which company is the ultimate holding company of this large conglomerate. It is not incorrect to say CIT is the ultimate holding company of the group although CFLB look the most obvious on paper.

This seems the work of a genius like Mr Senathiraja, he deserves a honorary title like "Deshabandu" for this great piece of craftsmanship.

MARCH 14, 2010 7:25 PM

Jeewantha said...

CSE disclosure made by CIT secretaries indicates that some Directors have indirectly purchased shares of CIT at price above Rs 80/= per share.

APRIL 21, 2010 7:25 PM

Last edited by Quibit on Thu Feb 10, 2011 1:39 pm; edited 2 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home