- During last 5 years CSE value has appreciated only 44% with an average growth of 8.8% per annum. (Details given below)

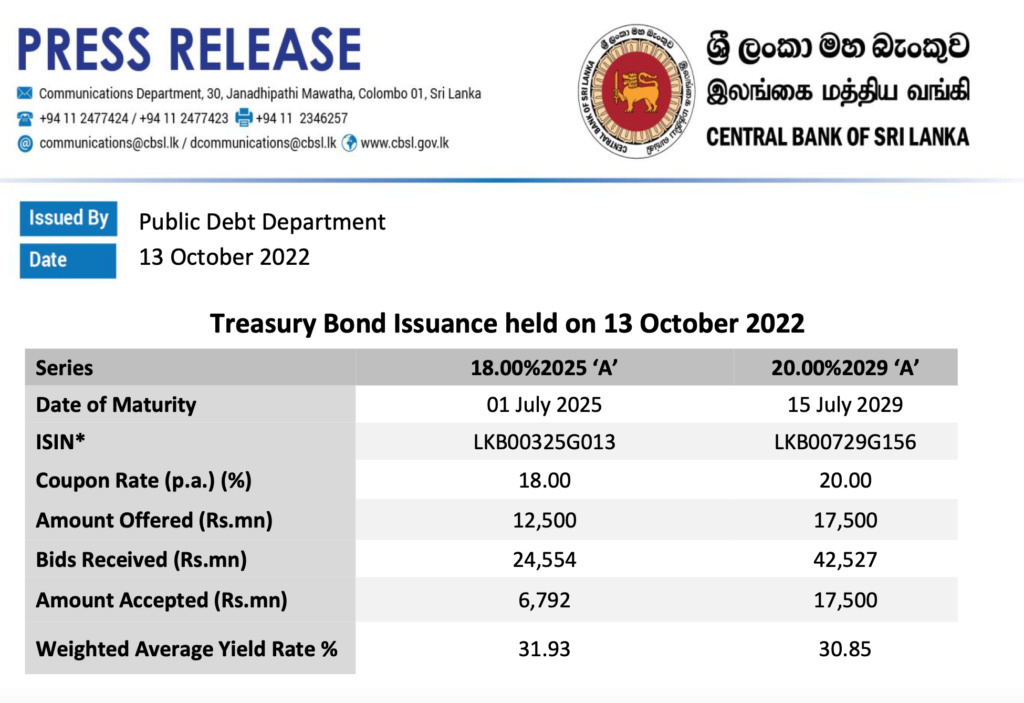

- Latest 5 Year Treasury Bond rates reached 31% per annum at the latest auction held on 13th October 2022. (Details Given below)

- Net Profit margins of an average Sri Lankan company is less than 20% per annum (without adjusting for increased taxation)

- Stock market investment carry high risk whereas government bonds are risk free.

CSE Growth during last 5 years

ASPI on 14th October 2017 - 6380

ASPI on 13th October 2022 - 9148

% yield/gain during 5 years - (9148-6380)/6380 = 44%

Average per year = 44%/5 = 8.8% p.a

https://www.investing.com/indices/cse-all-share

Treasury Bill/Bond Yield for next 5 years

Annual yield for next 5 years by investing in Government treasury Bonds reached 31% per annum at the latest bond auction. Press realease given below.

https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/press/pr/press_20221013_treasury_bond_issuance_held_on_13_october_2022_e.pdf

Forecast Operating Margins of JKH up to year 2025

Please find below the operating margins of Sri Lanka most diversified conglomerate John Keells Holdings PLC. It indicates an operating margin of 5.7% p.a forecast for 2025.

https://m.marketscreener.com/quote/stock/JOHN-KEELLS-HOLDINGS-PLC-6491987/financials/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home