SOFTLOGIC DILEMMA

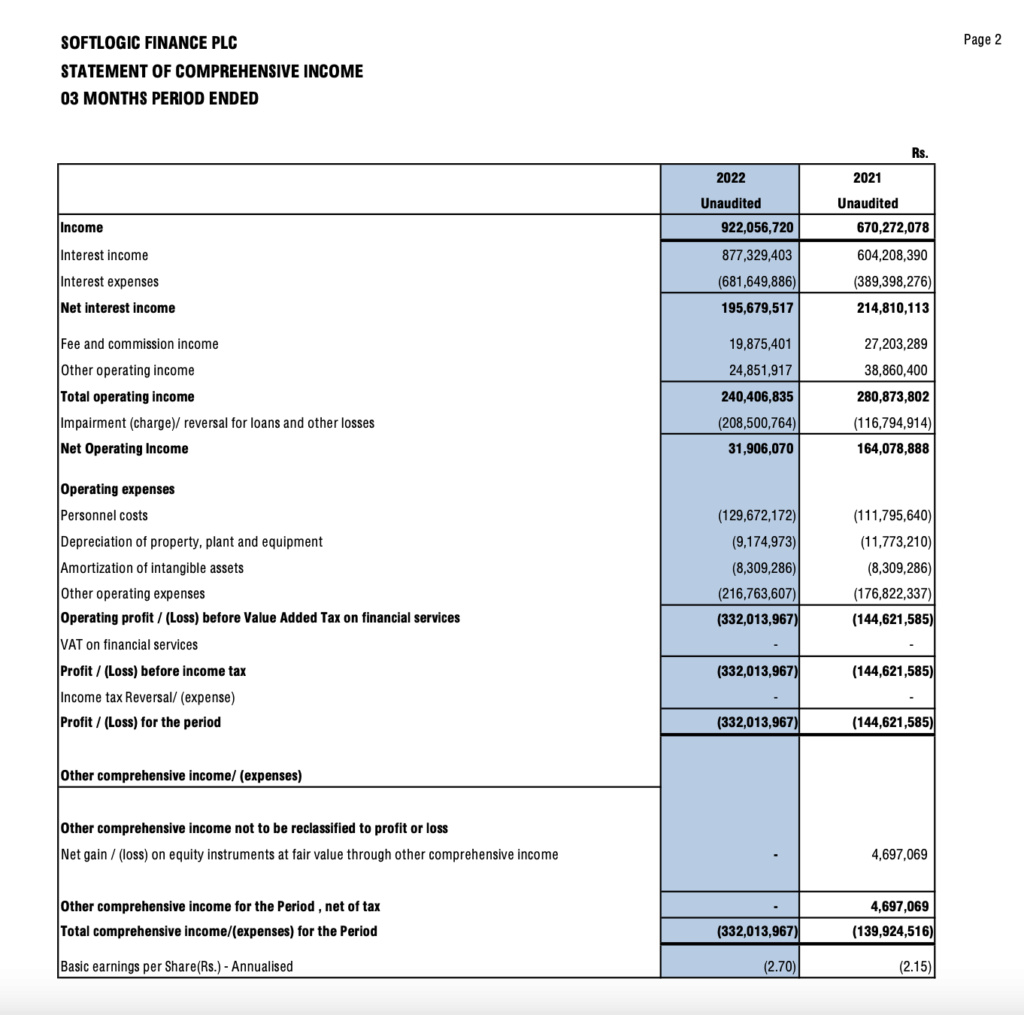

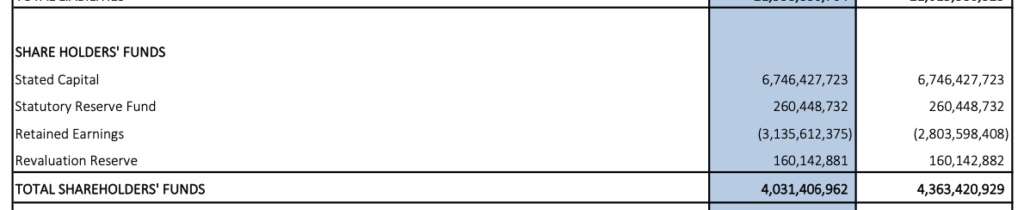

- Retained Losses exceeds LKR 3.2bn with LKR 332mn loss in FY 2022

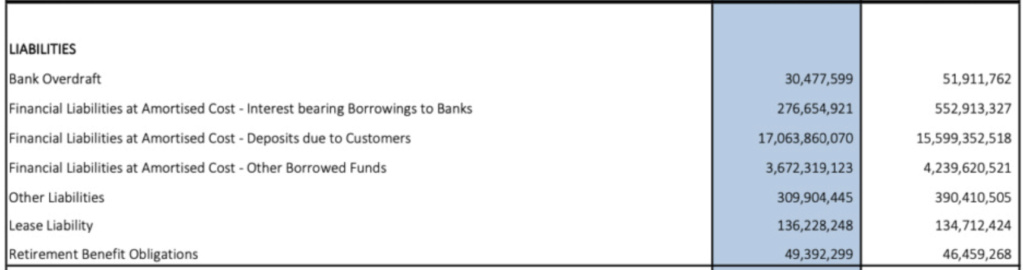

- Depositors liabilities exceeds LKR 17bn.

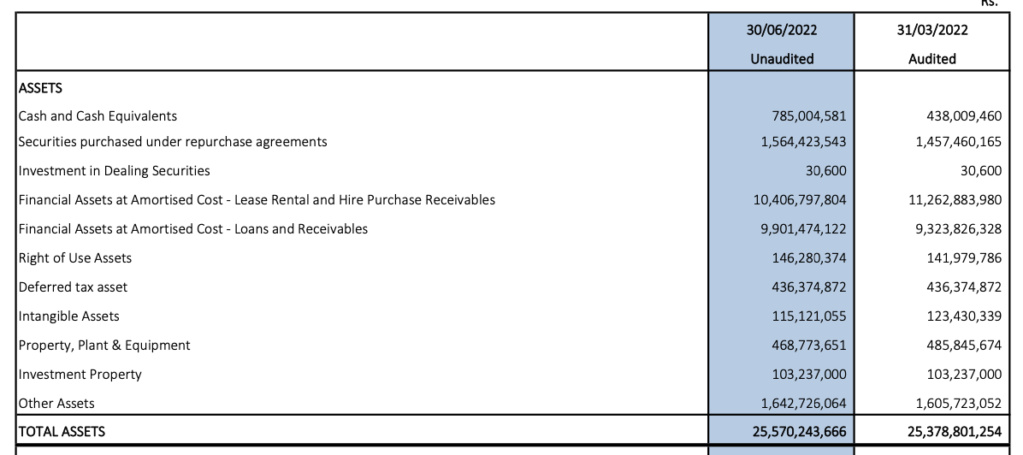

- Cash/Near Cash liquid assets of less than LKR 800mn.

- Decline of lease and loans receivables portfolio up to 10%

- Rights issue to raise LKR 850mn from existing shareholders in a depressed stock market conditions.

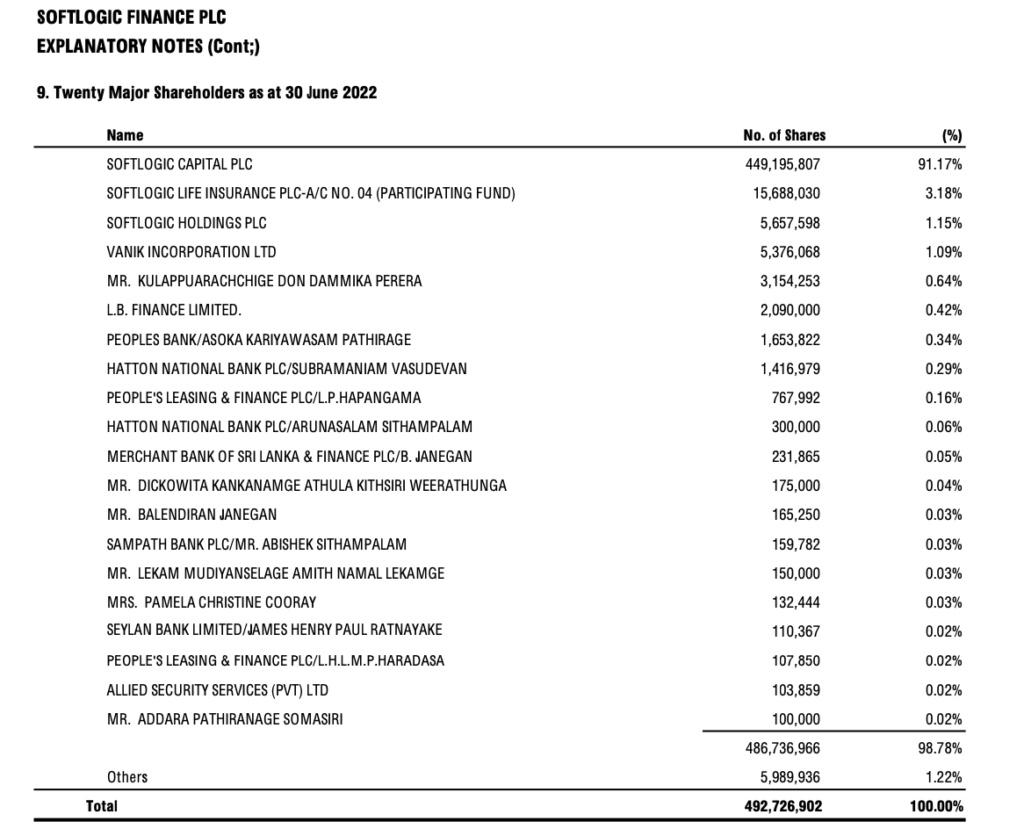

- Majority shares are held by Softlogic Capital PLC and Softlogic Holdings PLC.

Sri Lanka’s Softlogic to raise Rs850mn from cash call

Softlogic Finance Plc, a publicly trade unit of Sri Lanka’s Softlogic Capital Plc said it was planning to raise 850 million rupees in equity to boost capital by offering 116 million shares at 7.31 rupees a share to existing shareholders.

Shareholders would be given a rights issue of 100 shares for every existing 423 shares.

Ivon Brohier, Acting Chief Executive Officer, Softlogic Finance PLC said the said Softlogic was expanding business and going on a digitalization drive amid the “following two years of the pandemic and the worst financial crisis the country has ever seen.”

The infusion will improve Tier 1 Capital, while complying with Capital Adequacy Requirements. The new shares will be listed on the ‘Diri Savi’ board of the stock exchange. (Colombo/Oct22/2022)

https://economynext.com/sri-lankas-softlogic-to-raise-rs850mn-from-cash-call-101385/?utm_source=dlvr.it&utm_medium=twitter

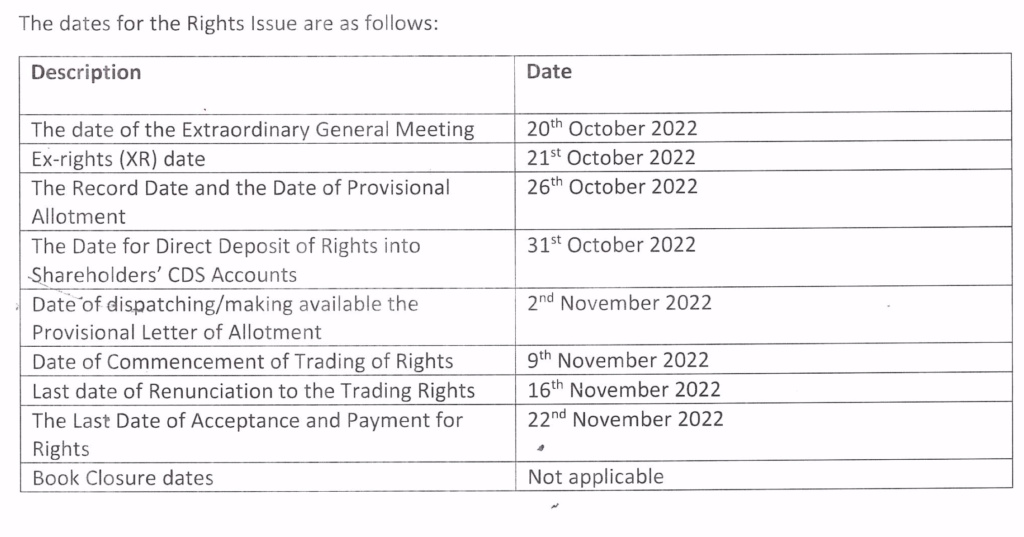

Proposed Cash Call

https://cdn.cse.lk/cmt/announcement_portal_prod/Rights%20Issue%20Dates_35990891083217.pdf

SOFTLOGIC FINANCE PLC (CRL.N0000) is a loss making finance company Regulated by the Central Bank of Sri Lanka.

Softlogic Finance PLC is fully compliant with the Capital adequacy ratio Both Tier 1 & Tier 2 as set out in the Direction No.03 of 2018 of Finance Business Act as of 31 March 2022 However with the implementation of new Direction no 01 of 2020 Classification & Measurement of Credit Facilities w.e.f 01.04.2022, Company Capital adequacy requirement (Both Tier 1 & Tier 2) are below the minimum requirement since April 2022 and as of June 2022 Tier 1 ratio reported as 3.31% & Tier 2 ratio reported as 8.27%.

Annual Losses exceed LKR 332mn in FY 2022

Serious Loss of Capital whilst Total Losses exceed LKR 3.2bn

Total Depositor Liabilities Exceed LKR 17Bn with Cash/Near Cash equivalent reserves of less than LKR 800mn

Declining Loan and Hire Purchase Portfolio

Weak asset quality, while the slippages in the new portfolio remains low: The Gross NPA ratio stood at 30.19% in Dec-21, vis-a-vis 34.57% in Mar-21 (32.79% in Mar-20). However, about 95% of the total NPAs are attributable to the discontinued portfolio, which largely consists of SME-related exposures. The new portfolio (recognized after March 2020) which is in the form of asset-backed lending, demonstrated healthy asset quality levels, with GNPA of about 2.44% as in Dec-21 (0.12% Mar-21). However, the rating is constrained by the low provisioning coverage on the legacy portfolio, given the exposures are largely in the form of unsecured lending. Solvency of the company remain weak with Net NPA/ Net worth at 90.74% as in Dec-21, while the same has improved from 147.42% in Mar-21 and 218.71% in Mar-20. Going forward, it will be crucial for the company to expedite the collections from the legacy portfolio while maintaining healthy asset quality levels of the incremental new portfolio.

SoftLogic Group's appeal for further cash

This would require SoftLogic Group raise further cash calls from group companies such as Softlogic Capital PLC and Softlogic Holdings PLC.

Its interesting to see successful Softlogic group meet the funding requirement without the support of the minority shareholders as investors current appetite for the Finance sector is historically low due to current economic crisis in the country.

https://cdn.cse.lk/cmt/upload_report_file/863_1659608832658.23.pdf

Sri Lanka finance companies raise Rs12.5bn in new capital

Nine finance companies in Sri Lanka have raised 12.6 billion rupees to shore up capital and have also proposed consolidation plans, the central bank said.

Sarvodaya Development Finance PLC, Dialog Finance PLC, Asia Asset Finance PLC, Lanka Credit and Business Finance PLC, People’s Merchant Finance PLC, Softlogic Finance PLC, Merchant Bank of Sri Lanka & Finance PLC, UB Finance Co Ltd and Richard Pieris Finance Ltd have raised 12.5 billion rupees.

Another 12 companies are in the process of consolidation.

The full statement is reproduced below:

Masterplan for Consolidation of Non-Bank Financial Institutions being fast-tracked

Under the Masterplan for Consolidation of Non-Bank Financial Institutions (the Masterplan) being implemented by the Central Bank of Sri Lanka (CBSL), the following 9 companies have already introduced fresh capital of Rs 12.56 billion to meet regulatory capital requirements: Sarvodaya Development Finance PLC, Dialog Finance PLC, Asia Asset Finance PLC, Lanka Credit and Business Finance PLC, People’s Merchant Finance PLC, Softlogic Finance PLC, Merchant Bank of Sri Lanka & Finance PLC, UB Finance Co Ltd and Richard Pieris Finance Ltd.

In addition, 12 companies have submitted their acquisition/consolidation plans to CBSL and obtained relevant preliminary approvals as follows:

1. Assetline Leasing Co Ltd – acquisition of finance business licence of Kanrich Finance Ltd and settlement of its deposits.

2. LB Finance PLC – acquisition and subsequent amalgamation of Multi Finance PLC.

3. SMB Leasing PLC – acquisition of finance business licence of Swarnamahal Financial Services PLC and settlement of its deposits.

4. Commercial Leasing & Finance PLC – acquisition and subsequent amalgamation of Sinhaputhra Finance PLC.

5. HNB Finance PLC – acquisition and subsequent amalgamation of Prime Finance PLC.

6. LOLC Finance PLC- amalgamation of Commercial Leasing & Finance PLC.

As a result of the above developments, the Non-Bank Financial Institutions sector has witnessed a significant improvement in compliance with regulatory capital requirements and has recorded the lowest non-compliance levels during recent times.

https://economynext.com/sri-lanka-finance-companies-raise-rs12-5bn-in-new-capital-90054/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home