Benchmark interest rates moved up on Wednesday (11) despite the Central Bank’s announcement that policy interest rates would remain unchanged.

Currency dealers said although policy interest rates would remain unchanged, market expectations remained for interest rates to increase, which was reflected in the Treasury bill auction this week.

The Public Debt Department of the Central Bank offered maturing Treasury bills amounting to Rs. 18 billion at yesterday’s primary market auction which generated bids amounting to Rs. 40.8 billion, of which Rs. 23.5 billion was accepted.

The three-months Treasury bill yield moved up to 11.34 percent from 11.20 percent a week earlier (compared with 7.12 percent a year ago), while the six-months bill saw its yield move up to 12.86 percent from 12.77 percent (7.23 percent a year ago). The yield on the 12-months bill increased to 13.10 percent from 12.99 percent a week earlier (7.35 percent a year ago).

Yesterday, the Central Bank said policy rates would remain unchanged; The repurchase rate for commercial bank overnight deposits with the Central Bank at 7.75 percent (7 percent last year) and the reverse repurchase rate for overnight commercial bank borrowings from the Central Bank at 9.75 percent (8.50 percent a year earlier).

Policy interest rates were raised twice since February as a late response to balance of payments problem in order to contain private sector credit growth which was feeding import demand.

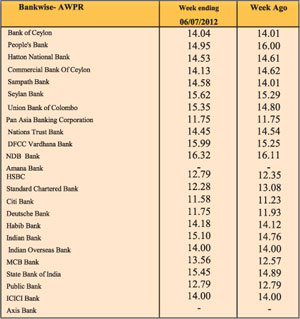

The average weighted prime lending rate (AWPR) for commercial loans to high net-worth individuals and corporates moved up to 13.68 percent last week from 13.39 percent a week earlier. A year ago this rate was at 9.41 percent. Ordinary borrowers would be paying a higher rate because the AWPR applies only to the best customers of the country’s banking system. The average weighted lending rate was 14.59 percent last week, up from 13.71 percent a year earlier.

Citi Bank’s high net worth clients are borrowing at 11.58 percent, Central Bank data showed. HSBC is charging its best clients 12.79 percent, Standard Chartered Bank a little better at 12.28 percent. Bank of Ceylon, People’s Bank, Hatton National Bank and Commercial Bank prime lending rates are in the 14 percent region. NDB Bank’s high net-worths are paying the bank 16.32 percent on loans; DFCC was at 15.99 percent.

Amana Bank, a Sharia compliant bank, does not charge interest on loans.

http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=56551

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home