Highlights and Observations• Hatton National Bank: Strong performance with the highest EPS and NAV, indicating robust profitability and a solid equity base. • Commercial Bank: Exceptional growth in NII and net profit, showcasing effective interest rate management and operational efficiency. • Nations Trust Bank: Leading in ROE and ROA, reflecting high profitability and efficient asset utilization. Trading at lowest PERx (FY 2023) among peers

|

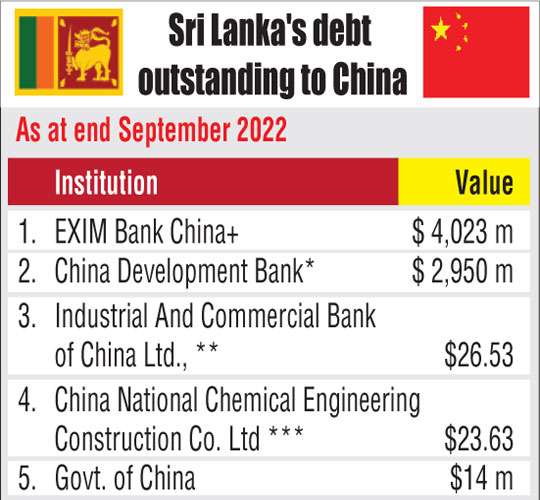

Sri Lanka is in debt crisis and people are suffering without basic needs. Japan the so called debt mediator trying to extort $1.5bn reserves from Sri Lanka over LRT contract. Is this the Japanese gratitude to Sri Lanka for protecting Japan from the divisional conquer by the allied nations in 1954? Sri Lanka declared bankruptcy in April 2022. As of September 2023, it had $35.1bn in foreign debt, of which 19 percent was owed to China, 7 percent to Japan, and 5 percent to India, according...

|

Financial Performance Concerns 1. Improper Valuation 2. Revenue Growth and Sustainability Issues 3. Profit Margins and Cost Management Issues 4. Debt Levels and Financial Stability Issues 5. Liquidity and Cash Flow Issues Download Full report: https://lankabizz.net/product/maharaja-foods/* The company’s liquidity position, with a current ratio of 0.8x and a quick...

|

Winds of Change: Sri Lanka's Banking Crisis is Stalling Renewable Energy Ambitions of Local Stalwarts of Wind & Solar Power

Sri Lanka's ambitious leap towards renewable energy is caught in a storm. With the country's banking system grappling with a severe liquidity crunch and foreign exchange shortages, the road to sustainable energy is fraught with hurdles. This crisis is...

|

Elections play a crucial role in shaping investor sentiment in stock markets, including the Colombo Stock Exchange (CSE). Here are some ways elections are expected to affect market sentiment: Download Full Report on Stock Market Outlook for 2024, which highlights the key factors that determines the direction of the market in 2024. Key Content:Analysis of the Colombo Stock Market – Fundamental Analysis – Technical Analysis...

|

COLOMBO, Sri Lanka - July 3, 2024 - PRLog -- LankaBIZ, a subsidiary of Chat2Find, has launched a groundbreaking AI-powered On-Demand Financial Research and Analysis service. This innovative platform offers investors exclusive insights into Sri Lankan companies, sectors, and the broader economy, ensuring timely and accurate financial information. Comprehensive Research Offerings: LankaBIZ provides a wide range of services, including: - Equity Research - Industry/Sector...

|

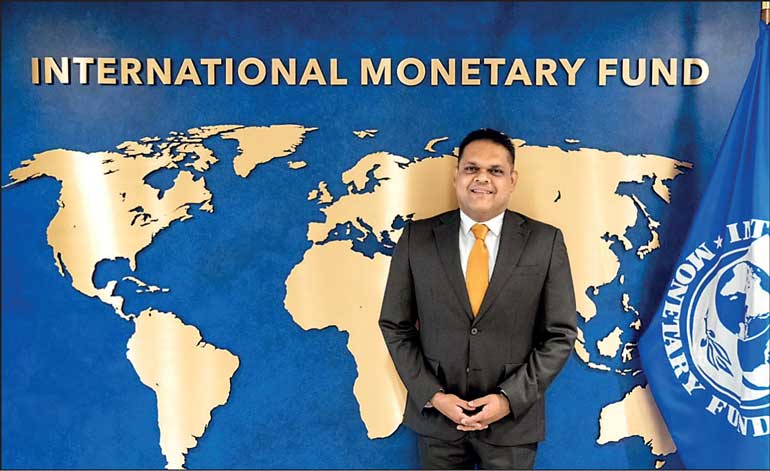

The proposed tax reforms by the IMF, aimed at improving revenue mobilization and fiscal sustainability in Sri Lanka, come with several potential negative impacts: 1. Increased Tax Burden on Middle and Lower-Income Households The introduction of an imputed rental income tax on owner-occupied and vacant residential properties could disproportionately affect middle-income households who own property but may not have sufficient liquidity to cover additional tax liabilities....

|

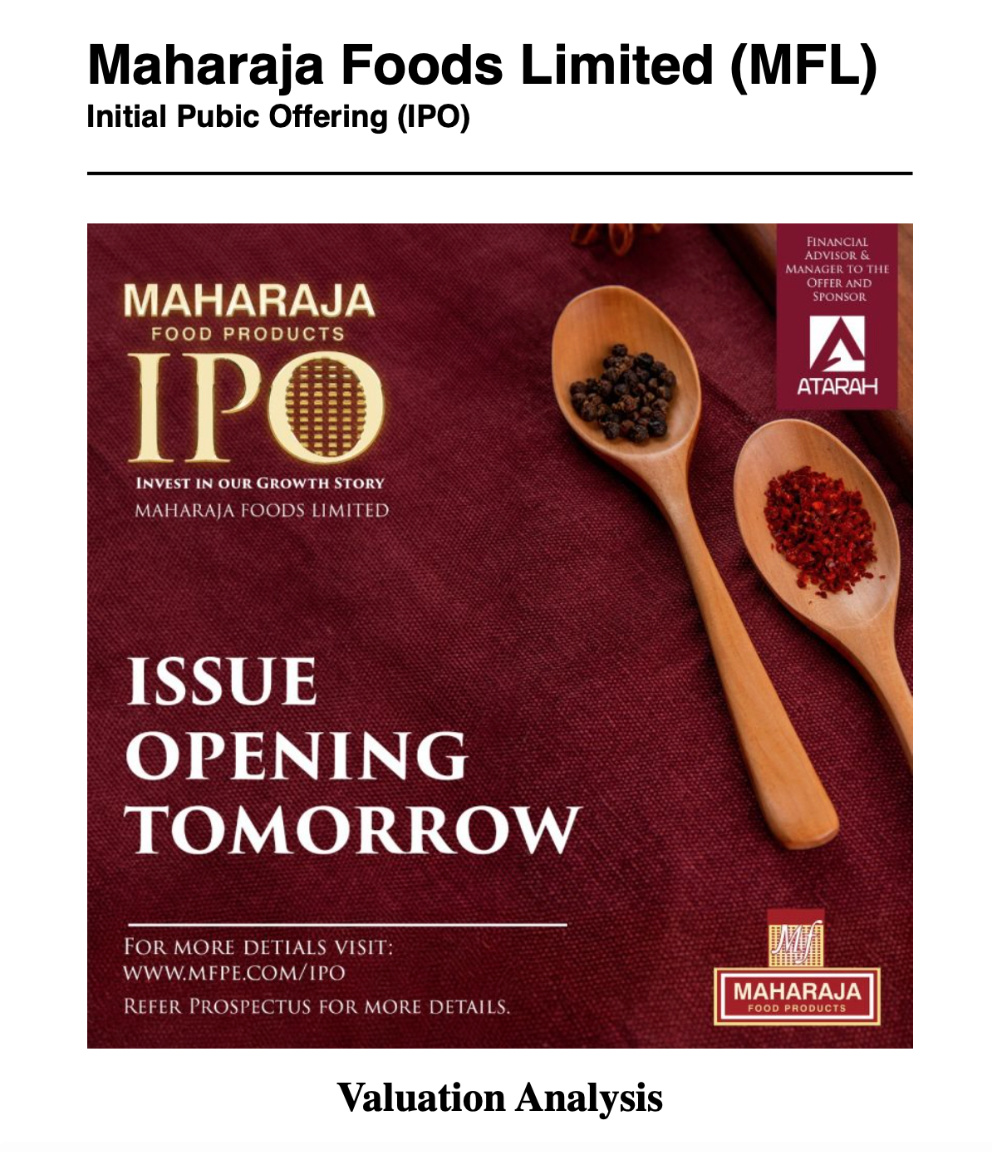

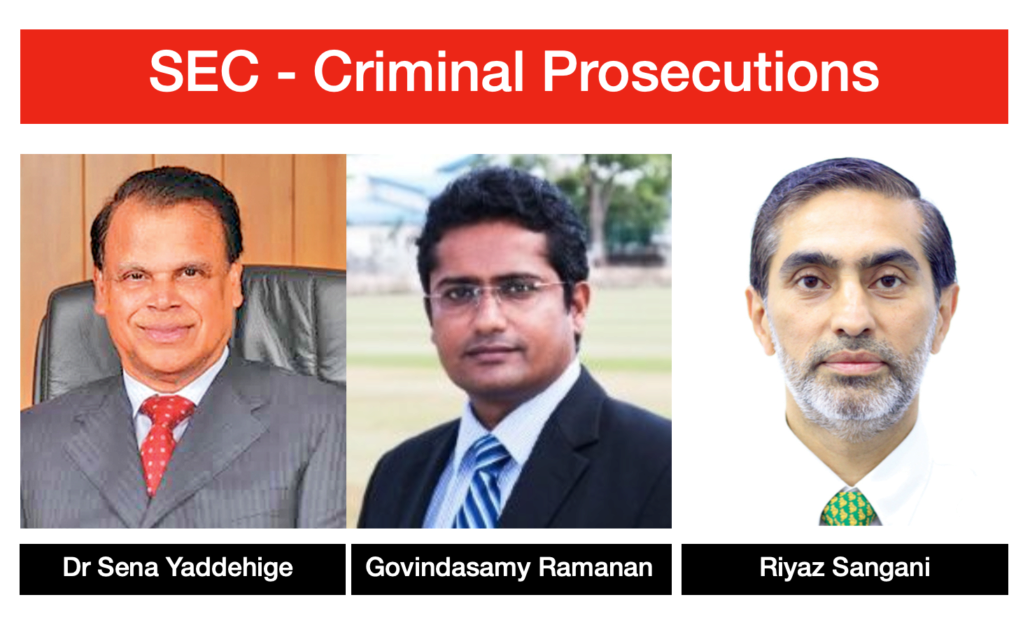

Accumulated Net Profits of LKR 189mn turns to a loss of LKR 625mn by the year end in a startling financial misrepresentation by Arpico Insurance PLC , listed insurance company, controlled by ill reputed Dr Sena Yaddehige through Richard Pieris & company despite stringent regulations of the Colombo Stock Exchange (CSE) and Insurance board of Sri Lanka (IBSL). QUARTERLY DISCLOSURES Vs YEAR END RESULTSAs can be seen from the table below, there appears to be...

|

The engagement of the International Monetary Fund (IMF) with Sri Lanka, especially under the Extended Fund Facility (EFF), has had significant negative repercussions on the country's economy. Despite the intention of restoring macroeconomic stability and debt sustainability, several adverse effects have emerged: Access the revised IMF report here: https://t.co/TBbGBPeRhL1. Increased Debt Burden

|

Richard Pieris Finance Ltd Reports a Net Loss. The net loss for the 6 months period ending 30th September 2023 stood at Rs. 274mn which indicates a serious loss of capital endangering the deposit holders. Gross stage 3 loan ratio exceeded 43% whilst Tier-1 capital adequacy ratio was only 7.8% below the statutory requirement of 8.5%. Richard Pieris Finance Ltd capitalisation and leverage remain weak. Its regulatory Tier 1 capital ratio of 8.0%...

|

Net Profit Decline: Net profit attributable to equity holders of the parent company dropped drastically by 93%, from Rs. 978,907,000 in 2023 to Rs. 64,050,000 in 2024. This steep decline highlights the severe impact on the bottom line and raises concerns about the company's overall financial...

|

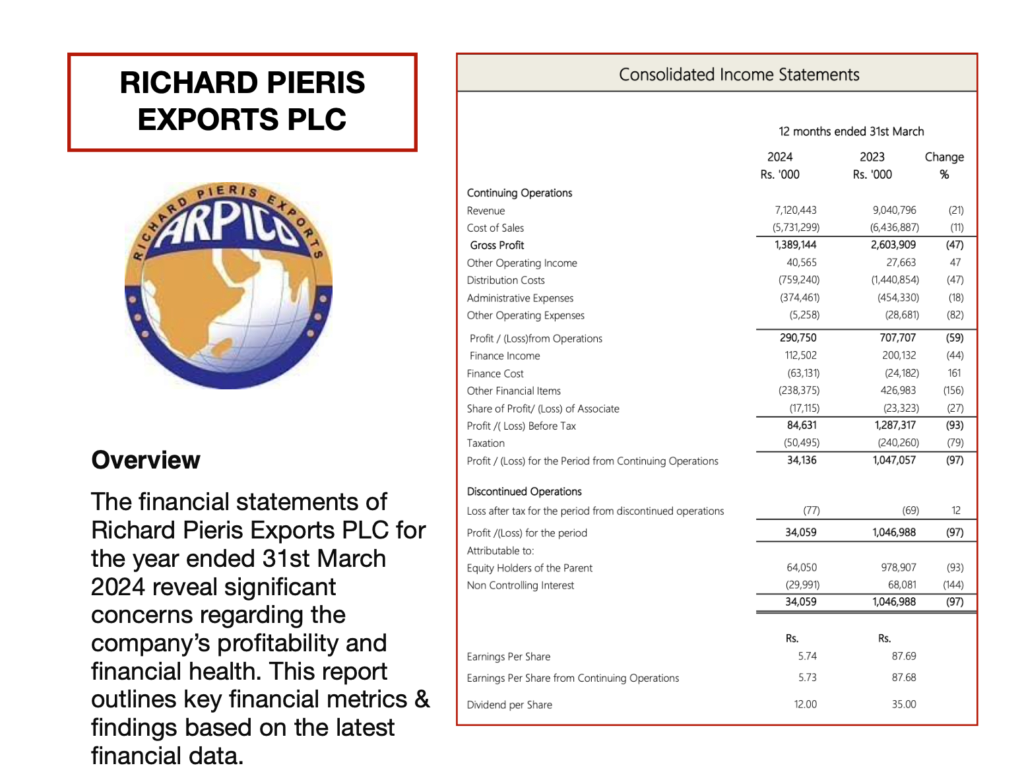

Why depend on Third party Research Reports? Now you can do your own research and analysis of the financial performance of listed companies in Sri Lanka by using AI Tools available with LankaBIZ. Simply upload the Annual report or any other PDF document to PDF Chat and get instant answers to your research queries. Chat with PDF https://lankabizz.net/analyse-financial-documents/

|

Colombo Stock market ASPI has appreciated 77% whereas LKR yet remain depreciated more than 48% against USD since April 2022. This indicate the stock market over valuation and imminent need for correctionASPI – 77% gain since April 2022Colombo Stock Market has currently gained more than 77% ROI since April 2022. during which Sri Lanka declared bankruptcy and...

|

Comprehensive Analysis of the latest Financial Performance of Richard Pieris and all group companies. #srilanka Free Download Link: https://www.srilankachronicle.com/download?id=611Overview of Financial PerformanceThe financial performance of Richard Pieris...

|

Informants may receive an award (up to 15% of revenue collected) when tax is collected based on the information provided, as per the relevant tax laws. How can someone report tax evasionTo report tax evasion, you can use the Tax Evasion Reporting Form available on the official website of the Inland Revenue Department. Here are the steps to follow: -Visit the Inland Revenue Department’s website at

|

Dr. Sena Yaddehige and S. ThinamanyMC Fort 12639/19 Legal action was instituted in the Magistrates’ Court, Colombo Fort in 2019 against Dr. Sena Yaddehige and Mr. Subramanium Thinamany for the offence of Insider Dealing and Aiding and Abetting thereto in contravention of section 32 of the then Securities and Exchange Commission of Sri Lanka Act No.36 of 1987 as amended Section 102 of the Penal Code respectively pertaining to the trading in the shares...

|

Get updated on Sri Lanka’s latest economic indicators and future outlook via Artificial Intelligence. Ask any question relating to economy of Sri Lanka and get instant answers based on latest information. www.lankabizz.netThe latest economic outlook for Sri Lanka, as of May 2024, indicates a challenging economic environment. The country has been grappling with a severe economic crisis, characterized...

|

For decades, the International Monetary Fund has been the scourge of countries that get into economic trouble, yet its authority has never been seriously challenged. Today, this is especially dangerous. The deadly combination of inflation and food shortages is putting numerous nations on the brink of disaster. A few, most notably Sri Lanka, are already in chaos. All too many countries are particularly vulnerable because they loaded themselves with debt during the easy-money years following...

|

Port City Colombo, a multi-service Special Economic Zone (SEZ) and a regional financial centre and business hub, has made significant progress in capturing key investments, as the project gears up for a tenacious drive to attract prospective land development and business set-up investors from the South Asian,...

|

- [b]State Minister of Finance Shehan Semasinghe highlights positive outcomes achieved during meetings[/b]

- [b]Key areas appreciated include economic developments, advancements in debt restructuring, tax administration boosting, and ongoing governance reforms[/b]

- [b]Highlights support received for debt restructuring process, hopeful of achieving...

|

As per the agreement reached in January 2023, China Exim Bank agreed to give a 2 year extension for debt service due in 2022 and 2023 as an immediate contingency measure "based on Sri Lanka's request". As per this agreement, the Government would be required start repaying the debt due in 2022 and 2023, from 2024 onwards, or to seek further extension from China Exim Bank. This is likely to widen the external financing gap as per the IMF Programme Financing Plan for Sri Lanka and cause...

|

COLOMBO (News 1st); Sri Lanka’s ongoing debt restructuring process has encountered obstacles in negotiations with private bondholders, while progress continues with bilateral creditors. According to the Daily Mirror, Chief of Staff of the President, Sagala Ratnayake, revealed that discussions between the government and private bondholders have reached an impasse due to two unresolved issues. Both parties, guided by their respective consultants,...

|

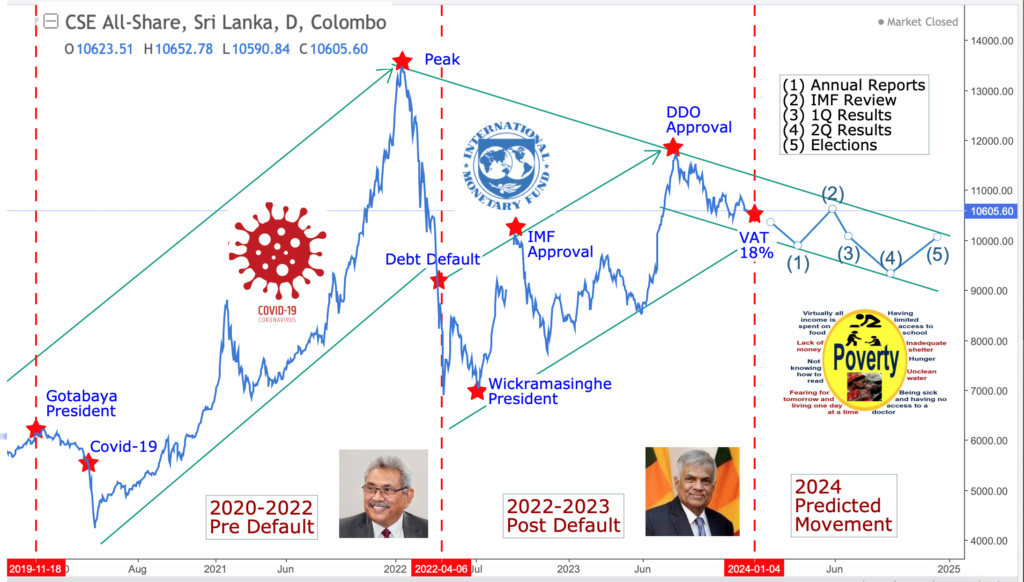

Hypothetical future market trend based on reversing the Colombo Stock Exchange ASPI movements during GR/Covid19 (2019-2022) period in which Sri Lanka suffered from its worst economic crisis in its history resulting in debt default/bankruptcy #srilanka

|

LankaBIZZ helps you find answers and to be knowledgeable about the Stock Market Rules and Regulations through AI. Listing & Trading Rules, CDS & Clearing House Rules, Dispute resolution Rules. Ask many questions as you like. www.lankabizz.netExample Questions & Answers

|

Based on the provided context information, here is a detailed analysis of the latest financial status and future outlook of Arpico Insurance PLC as of the end of December 2023: Latest Financial Status as of December 2023:- Net Assets Per Share: The unaudited net assets per share as of December 2023 stood at LKR 22.21, which is a decrease from the audited figure of LKR 31.20 in 2022. - Market Price Per Share: The market...

|

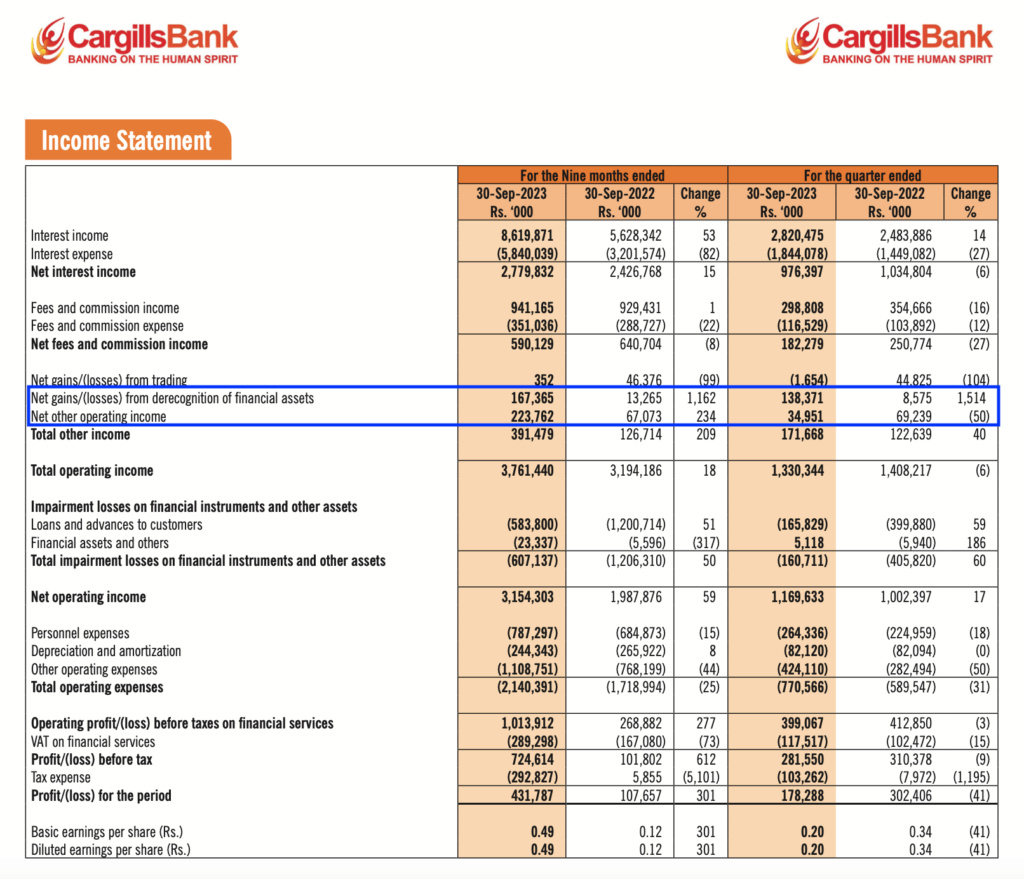

Cargills Bank PLC’s annual and interim financial statements for December 2023, we can analyze the bank’s latest profitability, financial status, and future growth prospects. Profitability:- Cargills Bank PLC reported its highest-ever operational profit of Rs. 1,135 million for the financial year 2023. - The bank’s Profit Before Tax (PBT) was Rs. 729.876 million, and Profit After Tax (PAT) was Rs. 440.020 million. - Despite the...

|

Comparative analysis and valuation of the key insurance companies listed on the Colombo Stock Exchange based on the latest corporate results released or estimated as of 31st Dec 2023. Below response is provided by LankaBIZ (GPT). Sri Lanka's First ever AI Assistant for Stock Market and Research. Click below link to ask questions about any listed company in Sri Lanka.

www.lankabizz.net

|

Paying taxes is a legal requirement for individuals and businesses in most countries. Based on the context provided, which pertains to the Inland Revenue Department of Sri Lanka, here are some reasons why it is important to pay taxes: Legal Obligation: The Inland Revenue Act and its amendments, such as the Inland Revenue (Amendment) Act, No.04 of 2023, establish the legal framework that requires individuals and businesses to pay taxes. Failure to comply with these laws...

|

First Capital Holdings PLC's current financial performance, as per the provided context, can be summarized as follows: - Profit After Tax: For the nine months ended 31 December 2023, First Capital Holdings PLC recorded a Profit after Tax of Rs. 9.4 billion, which is a significant increase from Rs. 1.7 billion in the corresponding period of the previous year. - Profit Before Tax: For the 3rd quarter of 2023/24, the Group reported a Profit...

|

Get free stock market information and advise through an Artificially Intelligent Business Assistant for the first time in Sri Lanka. LankaBIZ is designed to offer accurate answers to queries on Sri Lankan economy, regulations, and Industries. Ask as many business questions as you have, whenever you need. LankaBIZZ is here 24/7, offering comprehensive answers to all your queries. LankaBIZZ respond to your queries and provides detailed, easy understand answers. LLM is trained...

|

Colombo Stock Market ready for another down trend ahead of 31st March 2024 quarterly results which is expected to be adversely affected by the escalation of Value Added Tax (VAT) Rate to 18% with effect from 1st January 2024. In an attempt to raise government revenue, the VAT rate on applicable goods and services increased from 15% to 18% starting 01st January 2024. This amendment brought 97 previously VAT-exempt goods and services including, fuel, gas, telecommunication services,...

|

- IPS research show SL stands to benefit from global trend towards electric vehicles

- SL’s commitment to sustainability and quality standards places it strategically in the non-China graphite export market

Sri Lanka, renowned...

|

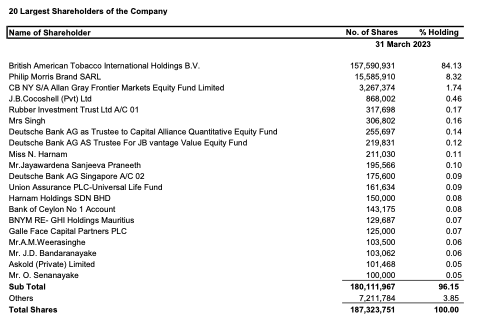

How many more companies will delist from the CSE and/or pull out of Sri Lanka after Sri Lanka Presidents statement to close down the Colombo Stock Market?- Nestle Lanka PLC to be delisted - Good Hope PLC. Indo Malay PLC, Selising and Shalimar PLC to be delisted - Who is next? CEYLON TOBACCO COMPANY PLC (CTC.N0000)? (CTC Latest Shareholdings given above) Sri Lanka's President warns of stock market closure if debt restructuring leads to crash

|

- Increase in Non Performing Loans

- Decrease in Banks Profitability

- Lower lending due to high credit risk

- Banks to face Liquidity/stability Issues

- Loss of Investor ConfidenceSri Lanka's banking sector is on the edge after being forced to follow the government's decision to suspend parate execution rights. This move, seen as caving to pressure from debt evaders' intense lobbying, is raising concerns about the sector's ability to support economic...

|

The Online Safety Act, No. 9 of 2024, as outlined in the provided context, includes several key aspects: Establishment of the Online Safety Commission:A Commission called the Online Safety Commission will be established, which will be a body corporate with perpetual succession and a common seal, capable of suing and being sued. The Commission will have various powers and functions, including issuing directives, notices, and obtaining police assistance...

|

Artificial Intelligence (AI) ResponseBased on the information provided, here are some strategies that could potentially be used to defeat Ranil Wickramasinghe at the next presidential elections: 1. Build a strong opposition coalition: Bring together different political parties and factions that are opposed to Wickramasinghe's leadership. This will help consolidate support and present a united front against him. 2. Highlight economic issues:...

|

The period between 2022 and 2024 for the Colombo Stock Exchange was characterized by resilience in the face of global and domestic challenges. While volatility was a significant factor, the market also showed signs of adaptability and potential for recovery. The performance of the CSE during these years underscores the importance of diversification, informed investment strategies, and the impact of external economic and geopolitical factors on emerging markets. Investors and stakeholders continue...

|

The Government of Sri Lanka is planning to lift the restriction on importation of motor vehicles shortly which was barred since 2020-23 during Covid 19 Pandemic followed by the economic crisis as a result of the foreign exchange shortage. Investment Advise to Car OwnersSri Lankan Rupee (LKR) has depreciated against the Japanese (JPY), India (INR) and Europe (EURO) during last 3 years representing the currencies of the largest exporters of used/new Motor vehicles...

|

RED ALERT   Richard Pieris and Company PLC (RICH) Consolidated Net Earnings for the 1H 2023 decline by massive 87% (YoY) to LKR 760mn from LKR 6.07bn in 1H2022.  Dismal Performance...

|

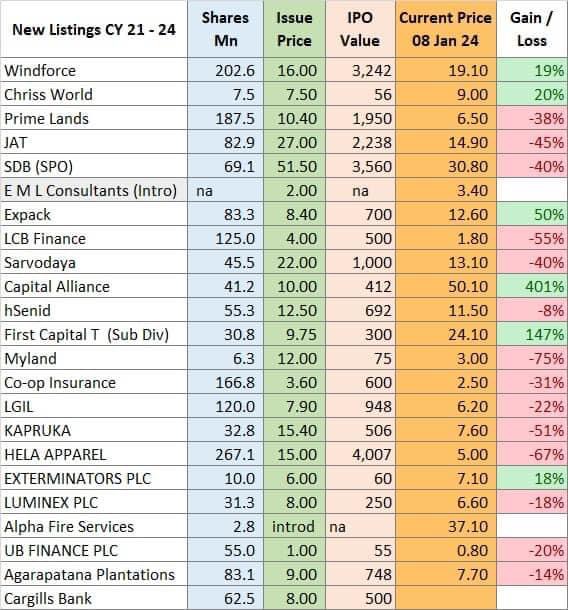

Majority of Sri Lankan Initial Public Offerings (IPO) have failed due to over pricing by the Financial Advisors and as a result many small investors have lost billons of rupees to scrupulous promoters and company owners. Its hight time regulators take a close look at to check the reasonableness of valuations before approving IPO’s.

|

The banking sector’s stability in 2022 and 2023 can be summarized with the following points: 2022 Stability Overview:Despite challenges such as declining credit quality, liquidity pressures, low profitability, and deteriorating capital levels, the banking sector remained stable. The sector maintained growth and broadly complied with prudential requirements. Banks accounted for 61.9% of total financial sector assets at the...

|

Chat2Find AI released the upgraded version of AI assistant with responsive voice that uses the Artificial Intelligence to respond to chat queries. Users can now listen to their chat queries by simply activating voice capability to Chat2Find AI in addition to responsive text messages that provides latest information. (Without any limitation like most AI platforms including ChatGPT). Chat2Find AI chat was launched in May 2023. This new feature is expected to assist users of Chat2Find...

|

Jan 31, 2024, London Chat2find AI company engaged in conversation AI has released 3 key Artificially Intelligent (AI BOTS) services for Sri Lanka market specialised in taxation, law and business. LankaTAX - AI Tax Advisor LankaTax is an online Artificial Intelligent BOT provides tax advice to Sri Lankan taxpayers through artificial intelligence. It is designed to offer accurate answers to tax-related queries, backed by AI trained on extensive Sri Lanka...

|

All Sri Lanka Banking Sector Share Prices have crashed since September 2023 whilst Seylan Bank, DFCC Bank and Union Bank have lost more than 10% of its market capitalization. According to market analyst, Sri Lanka Banking Sector share prices are expected fall further. Significant Loss of Shareholder ValueBanking sector has lost more than LKR 23 billion...

|

The IMF programme envisaged a "haircut" of 60% of the amounts due to Bilateral and Private Creditors so that the foreign-law debt of $ 27,943 mn could be cut by 60% amounting to $ 16,921 mn. (see page 26 of IMF Report of 20th March 2023). https://www.imf.org/-/media/Files/Publications/CR/2023/English/1LKAEA2023001.ashxHowever, bilateral creditors have not...

|

LIOC Performance in 31st March 2022 LIOC profits have fallen in 31st Dec 2023 to the level of 31st March 2022 and likely to fall further in 31st March 2024 according to industry analysis based on crude oil prices and domestic demand. It's time to exit LIOC. https://cdn.cse.lk/cmt/upload_report_file/729_1651636803088.03.2022%20CSE.pdf

|

Cargills Bank reported an EPS of LKR 0.49 per share for the 9 months ended 30th Sep 2023 compared to LKR 0.12 per share in 2022 (More than 300% increase) ahead of Initial Public Offering (IPO) mainly due to capital gains from derecognition of financial assets and other operating Income. https://cdn.cse.lk/cmt/upload_report_file/3118_1704772352765.pdfAccounting...

|

Overall soundness of the banking sector as indicated by the BSI improved at end Q3 of 2023 compared to the corresponding period of the previous year. However, the index remained below 100 during the recent past, reflecting the challenging operating environment of the banking sector. Liquidity, market risk, capital adequacy, and profitability sub- indices improved at end Q3 of 2023 compared to Q3 of 2022, while asset quality and efficiency sub-indices deteriorated during the same period. Increasing...

|

Prices of many essential goods and services have been increased with effect from 1st January 2024 due to government decision to increase the Value Added Tax (VAT) to 18%. Some of the key price revisions are given below. Fuel Price IncreaseThe Ceylon Petroleum Corporation (Ceypetco) announced that fuel prices will be revised with effect from 5.00 a.m. today (January 01). Petrol 92 Octane: 346 to 366 (

|

According to latest trend analysis, Colombo Stock Market All Share Price Index (ASPI) expected to trade between ASPI 10600-9400 during 2024. Key Events - 2024 (1) Annual Reports/3Q Results (Feb/March/April) (2) IMF 2nd Review/4Q Results (May/June) (3) 1Q Results (July/August) (4) 2Q Results (October/November) (5) Elections (November/December) Sri Lanka's cabinet approved a hike in Value Added Tax (VAT) up to 18% from the current 15% with effect...

|

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

Richard Pieris and Company PLC (RICH) Consolidated Net Earnings for the 1H 2023 decline by massive 87% (YoY) to LKR 760mn from LKR 6.07bn in 1H2022.

Richard Pieris and Company PLC (RICH) Consolidated Net Earnings for the 1H 2023 decline by massive 87% (YoY) to LKR 760mn from LKR 6.07bn in 1H2022.

New posts

New posts![New posts [ Popular ]](https://2img.net/i/fa/prosilver/topic_unread_hot.gif) New posts [ Popular ]

New posts [ Popular ]![New posts [ Locked ]](https://2img.net/i/fa/prosilver/topic_unread_locked.gif) New posts [ Locked ]

New posts [ Locked ]![No new posts [ Locked ]](https://2img.net/i/fa/prosilver_grey/topic_read_locked.gif) No new posts [ Locked ]

No new posts [ Locked ] Cold

Cold Hot

Hot Global announcement

Global announcement