Net Asset per share - Rs. 2.27

EPS - Rs. -2.18

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

CIFL - Interim Financial Statements as of 30-06-2013 Wed Aug 21, 2013 5:53 pm

CIFL - Interim Financial Statements as of 30-06-2013 Wed Aug 21, 2013 5:53 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Wed Aug 21, 2013 6:13 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Wed Aug 21, 2013 6:13 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 9:03 am

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 9:03 am

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 9:34 am

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 9:34 am

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 11:12 am

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 11:12 am

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 11:19 am

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 11:19 am

[/img]

[/img] Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 12:34 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 12:34 pm

Dont talk rubbish man, Eliminate mean holder of shares less than 300K?? For what? To buy peanut with that?? They got exit above 1 and conceptually made at least 50-100% return as per today price... They get rid of nearly 15 mn shares and u r claiming thatm2_yapa wrote:Jana Do not assume that they have cleared their portfolios ...they may eliminated from top twenty shares holder's list. Not even MAD and Aspic Just sea the chart below

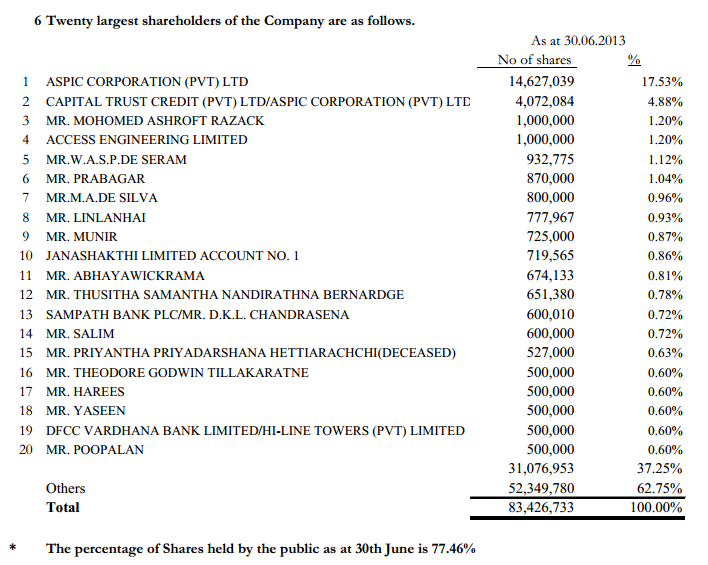

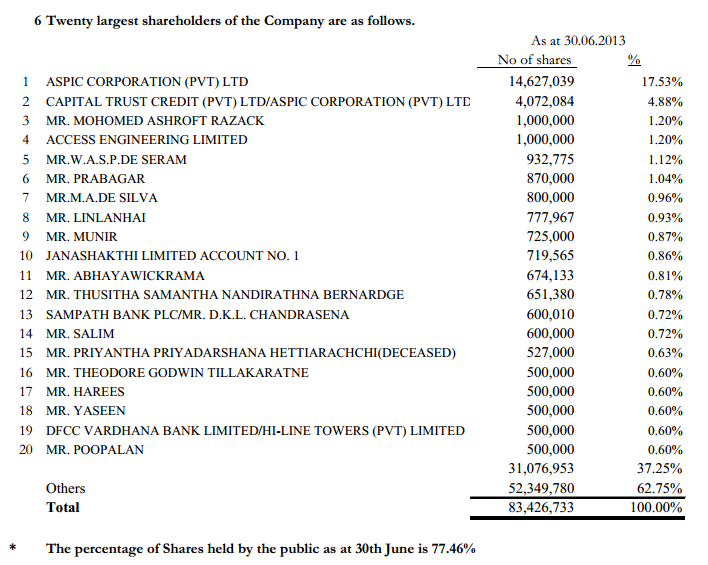

ELIMINATED SHARES HOLDERS FROM TOP TWENTY SHARE HOLDERS LIST AFTER 31/03/2013

Name of Share Holders Number of shares

MR. MALLAWA ARACHCHIGE DEEPTHI PERERA 7,309,580

MR.AMAL SIRIMEVAN LIYANAGE 794,611

MR.H.M.R.MOHAMED 500,000

SEYLAN BANK PLC/MR. MANIKKAVASAGAR THIYAGARAJA 450,000

MRS. LIYANA PALLIYAGE PRIYANGIKA 410,000

MR. THITHTHAGALLA GAMAGE PRABATH NISHANTHA 406,500

MR.B.V.HETTITHANTHRIGE 342,500

MR.R.M.J.RAJAPAKSE 341,698

MR.T.DISSANAYAKE 313,932

MR.M.S.JAUFFER 310,100

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 12:52 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 12:52 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 3:14 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 3:14 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 5:36 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 5:36 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 5:58 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 5:58 pm

CENTRAL INVESTMENTS & FINANCE PLCtroy wrote:Nobody has signed the reports. Why CSE publish these bullshit reports? Who knows the accuracy?

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 6:45 pm

Re: CIFL - Interim Financial Statements as of 30-06-2013 Thu Aug 22, 2013 6:45 pm

Hi Chinwi,Chinwi wrote:No. 13 and No. 19

Horrific margin calls !

---

Public holding 77% !

Aspic has gradually dropped majority of CIFL last 2 season !

MAD Perera , not so Mad.

Then who MAD ?

Percentage of holding of CIFL

2013-1-1

Aspic 48.8 %

MAD Perera 13.8 %

2013-4-1

Aspic 40 %

MAD Perera 8.76%

2013-7-1

Aspic 22 %

MAD Perera - No Mad Perera

Today

Aspic ?

MAD others 99 % ?

Troubled finance company deep in the red Fri Aug 23, 2013 8:40 am

Troubled finance company deep in the red Fri Aug 23, 2013 8:40 amSimilar topics

Permissions in this forum:

You cannot reply to topics in this forum