On Tuesday Stock market regained and closed with positive returns for the first time in month of September ASI gained 62.07 points (1.11%) and the S&P SL20 index gained 18.59 points (0.59%). Turnover was LKR 630mn. Top contributors to turnover were John Keells Holdings with LKR 325mn, Ceylon Guardian Investments with LKR 91mn and Commercial Bank with LKR 37mn. Most active counters for the day were Central Investment and Finance, PC House and Environmental Resources Investments. Foreign participation was 37% of total market turnover whilst net foreign selling was LKR 287mn.

Colombo Stock market indices advanced further on Wednesday increasing the market cap by LKR 26bn (+1.1%). 14 day Relative Strength Index on ASI passed the oversold threshold of 30 to 37. Broad market index advanced by 62.88 points (1.11%) and S&P SL 20 Index gained 28.27 points (0.90%). Daily market turnover reached LKR 1.2bn, which was the highest recorded after five week period. John Keells Holdings which was among the heavily traded stocks emerged as the largest contributor to the market turnover with LKR 846mn. Further, Sampath Bank and Commercial Bank recorded the next top turnover levels of LKR 123mn and LKR 35mn respectively. Further heavy retail participation was seen in HVA Foods, E-Channelling and Blue Diamond non-voting. Foreign participation was 43% whilst recording a net inflow of LKR 712mn.

On Thursday market closed with positive returns as ASI improved by 14.29 points (0.25%) and S&P SL 20 Index increased marginally by 5.94 points (0.19%). Daily turnover was LKR 387mn which is 56% below the year-to-date average turnover of LKR 883mn. John Keells Holdings recorded the top turnover of LKR 116mn followed by Sampath Bank (LKR 66mn) and Ceylon Cold Stores (LKR 21mn). Meanwhile Blue Diamond (voting and non-voting shares), Swarnamahal Financial Services and HVA Foods were the mostly exchanged stocks during the day. Foreign participation for the day was 41% whilst recording a net inflow of LKR 80mn.

Penny stocks rally was witnessed during Friday trading session in Colombo Stock Exchange where most of such stock prices closed with notable gains purely due to the demand & supply. Troubled Touchwood Investment and Central Finance & Investment were the top gainers with heavy trading where the prices are appreciated by 46% and 25% respectively.

Market indices closed with mixed results. ASI increased marginally by 4.96 points (0.09%) to end at 5,749.49 and S&P SL 20 Index declined by 8.16 points (-0.26%) to end at 3,176.74. Market turnover reached LKR 980mn with the support of negotiated transactions took place in John Keells Holdings (~2.7mn shares at LKR 209-210.) which accounted for 58% of the total turnover. Accordingly JKH emerged as the highest contributor to the daily turnover with LKR 645mn followed by Sampath Bank with LKR 70mn and Chevron Lubricants by LKR 35mn.

Further, Blue Diamond (voting and non-voting shares), PC House and PCH Holdings were among the mostly traded stocks for the day.

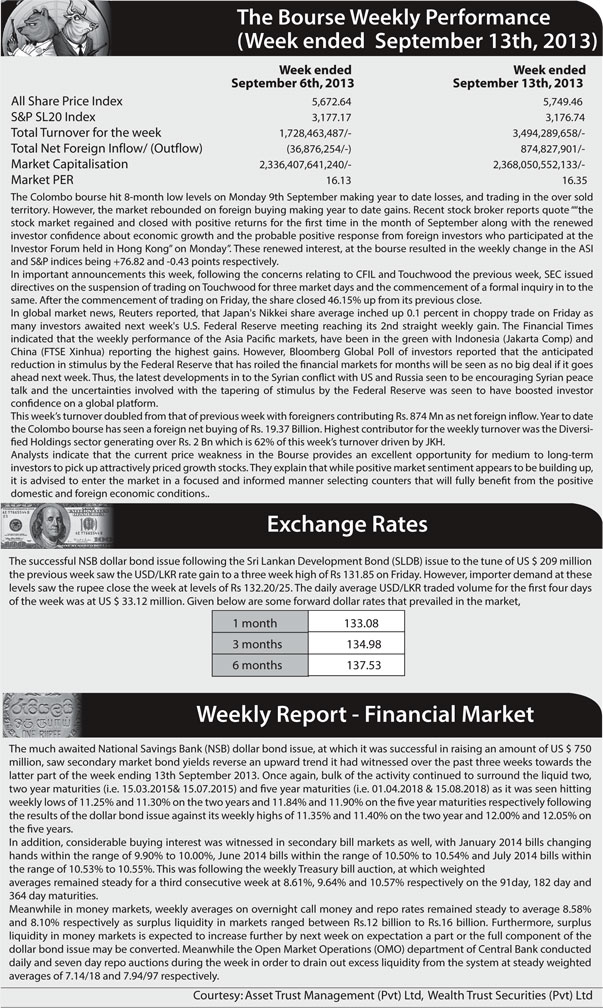

During the week ASI advanced by 1.4% and resumed to the positive year-to-date yield. World stock market indices also advanced during the week (S&P- USA by 2%, FTSE – UK by 1%, Nikkei – Japan by 3%, Shanghai – China by 6%, BSE Sensex – India by 4%, KSE – Pakistan by 3%) after Syria accepted a Russian proposal to give up chemical weapons and win a reprieve from US strikes on Tuesday. Further Gold spot prices fell by 6% on uncertainties over the timing and pace of US monetary stimulus. Goldman Sachs said that there’s a risk that bullion may drop below USD 1,000 an ounce. However Gold futures haven’t traded below USD 1,000 since October 2009.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home