would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

Following Stocks Reached New Low on 23/10/2013 Wed Oct 23, 2013 4:29 pm

Following Stocks Reached New Low on 23/10/2013 Wed Oct 23, 2013 4:29 pm

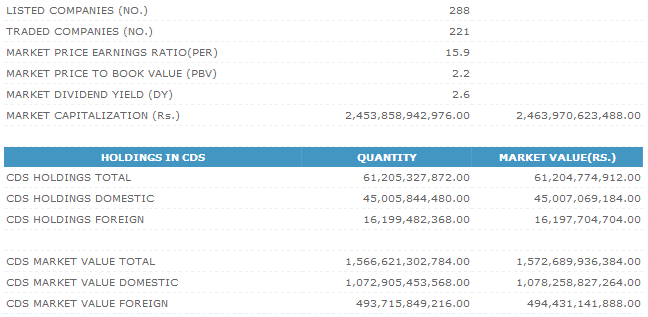

Year 2013 - Indices / Value of Turnover / No of Trades / Volume / Foreign Purchase/ Foreign Sale Wed Oct 23, 2013 4:30 pm

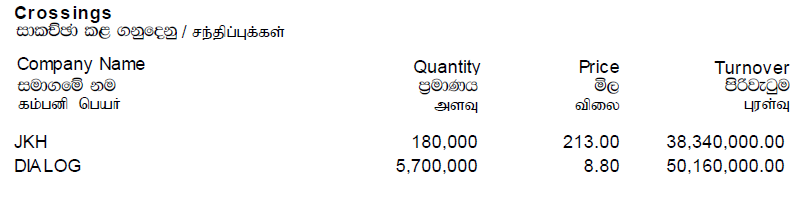

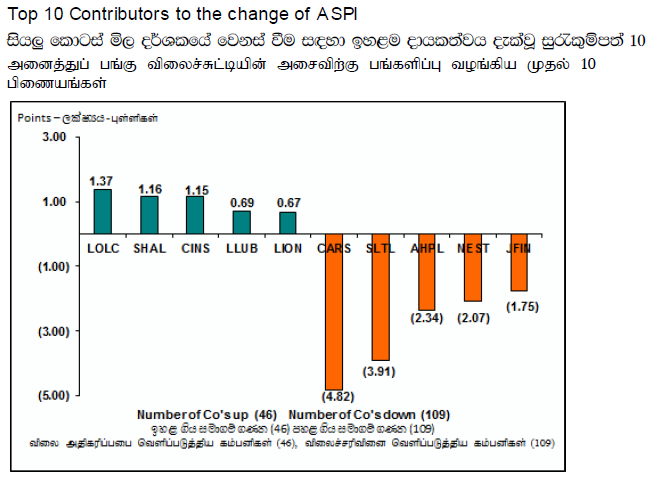

Year 2013 - Indices / Value of Turnover / No of Trades / Volume / Foreign Purchase/ Foreign Sale Wed Oct 23, 2013 4:30 pm Crossings - 23/10/2013 & Top 10 Contributors to Change ASPI Wed Oct 23, 2013 4:34 pm

Crossings - 23/10/2013 & Top 10 Contributors to Change ASPI Wed Oct 23, 2013 4:34 pm

LSL Market Review – 23rd Oct 2013 Wed Oct 23, 2013 8:40 pm

LSL Market Review – 23rd Oct 2013 Wed Oct 23, 2013 8:40 pm Indices down, turnover modest.JKH continues to hold the floor Thu Oct 24, 2013 2:35 am

Indices down, turnover modest.JKH continues to hold the floor Thu Oct 24, 2013 2:35 am

Permissions in this forum:

You cannot reply to topics in this forum