1 Thai Baht = 4.2 Rs

and Thailand inters rates are very low. deposit maximum rate is 2.8% (which is i found)

please state your ideas...

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

Go to page : 1, 2

GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 8:02 pm

GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 8:02 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:01 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:01 pm

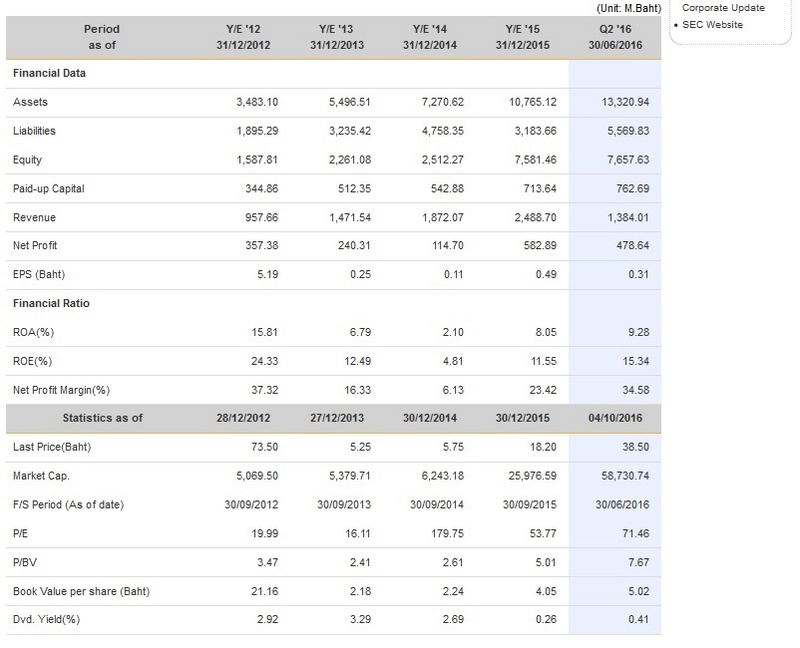

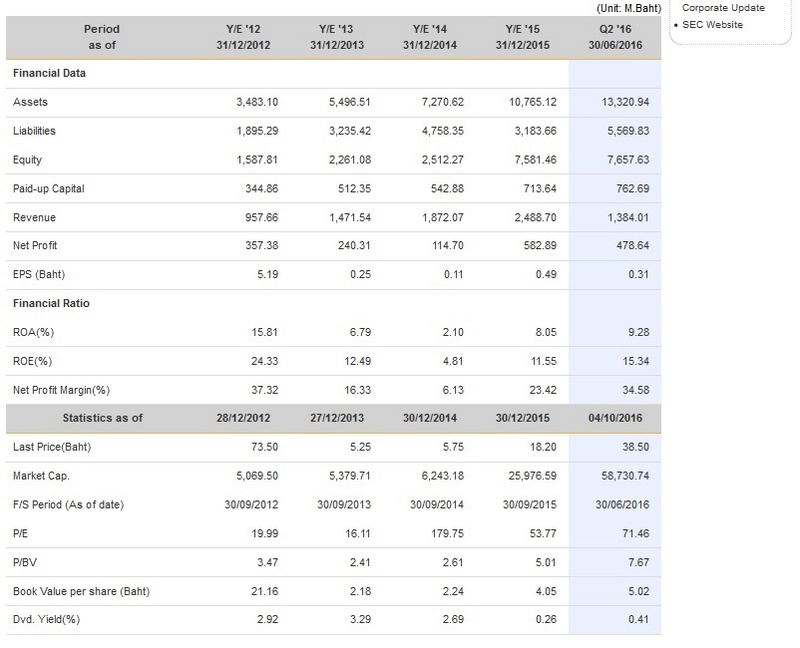

stockback wrote:PLease go through this image. this is Group Lease PLC. details. then you can understand why they choose commercial credit. according to this data they. they will bring more money to here and expand the business. this is very good deal for both parties.

1 Thai Baht = 4.2 Rs

and Thailand inters rates are very low. deposit maximum rate is 2.8% (which is i found)

please state your ideas...

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:20 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:20 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:24 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:24 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:52 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Wed Oct 05, 2016 11:52 pm

Last edited by stockback on Thu Oct 06, 2016 12:48 am; edited 1 time in total

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 12:39 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 12:39 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 5:30 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 5:30 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 8:59 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 8:59 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:11 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:11 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:44 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:44 am

Bullrunner7 wrote:My broker says it's not advisable to buy at these prices ?

(I think it would be a good short term investment)

What do you guys think ?

Please advise me ?

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:48 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:48 am

Gainer has predicted that this will reach 100+.EquityChamp wrote:Bullrunner7 wrote:My broker says it's not advisable to buy at these prices ?

(I think it would be a good short term investment)

What do you guys think ?

Please advise me ?

I have already published my advise. You may read it.

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:58 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 9:58 am

Ok , lets ask all the brokers what to do with COCR ?samaritan wrote:Gainer has predicted that this will reach 100+.EquityChamp wrote:Bullrunner7 wrote:My broker says it's not advisable to buy at these prices ?

(I think it would be a good short term investment)

What do you guys think ?

Please advise me ?

I have already published my advise. You may read it.

Therefore, my decision is not to buy and your broker is right, you have a sincere broker!

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 10:54 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 10:54 am

Brokrs la dannawa bambuwa.samaritan wrote:Gainer has predicted that this will reach 100+.EquityChamp wrote:Bullrunner7 wrote:My broker says it's not advisable to buy at these prices ?

(I think it would be a good short term investment)

What do you guys think ?

Please advise me ?

I have already published my advise. You may read it.

Therefore, my decision is not to buy and your broker is right, you have a sincere broker!

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 10:58 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 10:58 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:07 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:07 am

I thought I am the only one investing with out listening to my brokerstockback wrote:Brokrs la dannawa bambuwa.samaritan wrote:Gainer has predicted that this will reach 100+.EquityChamp wrote:Bullrunner7 wrote:My broker says it's not advisable to buy at these prices ?

(I think it would be a good short term investment)

What do you guys think ?

Please advise me ?

I have already published my advise. You may read it.

Therefore, my decision is not to buy and your broker is right, you have a sincere broker!

kisima deyak danne naha. e madiwata boruth kiyanawa. ehenam mama RSI RSI 85 di buy karanne naha. Rules hutas patas ekak nisai. dan lehesiyen collect karganna thibba.

thawa drop unoth buy karanawa

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:29 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:29 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:30 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:30 am

So what they said about COCR??????????kapifm wrote:i have the same experience with my brokers...but some times they are right some times wrong but no complains...

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:33 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:33 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:50 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:50 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:57 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 11:57 am

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 12:33 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 12:33 pm

ruwan326 wrote:I thought I am the only one investing with out listening to my brokerstockback wrote:Brokrs la dannawa bambuwa.samaritan wrote:Gainer has predicted that this will reach 100+.EquityChamp wrote:Bullrunner7 wrote:My broker says it's not advisable to buy at these prices ?

(I think it would be a good short term investment)

What do you guys think ?

Please advise me ?

I have already published my advise. You may read it.

Therefore, my decision is not to buy and your broker is right, you have a sincere broker!

kisima deyak danne naha. e madiwata boruth kiyanawa. ehenam mama RSI RSI 85 di buy karanne naha. Rules hutas patas ekak nisai. dan lehesiyen collect karganna thibba.

thawa drop unoth buy karanawa

Also what ever you see in this forum about any share,you need to analyze before planing to buy that share

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 12:48 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 12:48 pm

I wish there will be a day that Sri Lankans can invest in the market with out looking at Foreign buying, foreign investmentsChinwi wrote:So people are not confident of their own conclusions.

If they target over 100 why wait for 2-3 rupee drop ?

buy 68-70 .

Note: -I am not a trader or wave player.

I do not touch this. Too good is too good. This whole story is with lot of blossoming expectations at extreme end.

Now we follow Thais to learn about future Earnings in Sri Lankan company.

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 1:06 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 1:06 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 3:08 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 3:08 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 3:39 pm

Re: GROUP LEASE PUBLIC COMPANY LIMITED vs COCR Thu Oct 06, 2016 3:39 pm

troy wrote:Stockback, How's mine???

These days I'm focusing MAINLY on

CITK

CITW

COCR

ALLI

Go to page : 1, 2

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum