As per the agreement reached in January 2023, China Exim Bank agreed to give a 2 year extension for debt service due in 2022 and 2023 as an immediate contingency measure "based on Sri Lanka's request". As per this agreement, the Government would be required start repaying the debt due in 2022 and 2023, from 2024 onwards, or to seek further extension from China Exim Bank.

This is likely to widen the external financing gap as per the IMF Programme Financing Plan for Sri Lanka and cause further set back to the IMF Programme in Sri Lanka.

According to a letter reviewed by Reuters, China EximBank said it was going to provide "an extension on the debt service due in 2022 and 2023 as an immediate contingency measure" based on Sri Lanka's request. It had also stated, "You will not have to repay the principal and interest due of the bank's loans during the above-mentioned period", adding that China EximBank wanted to expedite the negotiation process with the Sri Lanka side regarding medium and long-term debt treatment in this period.

Source Articles

China offers Sri Lanka debt moratorium, IMF help still in doubt Published on 24th January 2023

The Export-Import Bank of China has offered Sri Lanka a two-year moratorium on its debt and said it would support the country's efforts to secure a $2.9 billion loan from the International Monetary Fund, according to a letter reviewed by Reuters.

According to the letter, China EximBank said it was going to provide "an extension on the debt service due in 2022 and 2023 as an immediate contingency measure" based on Sri Lanka's request.

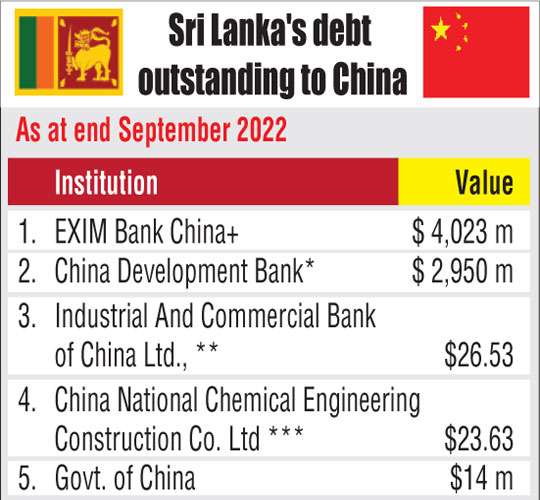

"You will not have to repay the principal and interest due of the bank's loans during the above-mentioned period," the letter said, adding China EximBank wanted to expedite the negotiation process with your side regarding medium and long-term debt treatment in this period. By end-2020, Sri Lanka owed China EximBank $2.83 billion or 3.5% of the island's external debt, according to IMF data.

https://www.reuters.com/markets/asia/chinas-exim-bank-offers-sri-lanka-debt-extension-letter-2023-01-24/

Sri Lanka says China debt deal covers $4.2 billion as other talks drag on Published on 12th October 2023

Sri Lanka said on Thursday it reached an agreement with the Export-Import Bank of China covering about $4.2 billion of outstanding debt, while talks with other official creditors stall.

Sri Lanka, mired in its worst financial crisis in decades, has been trying reach restructuring deals with creditors since last autumn, having being forced to default on its foreign debt in May 2022 after its foreign exchange dwindled to record lows.

https://www.reuters.com/markets/asia/sri-lanka-says-it-has-deal-with-china-exim-bank-cover-42-bln-debt-2023-10-12/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home