Last edited by sriranga on Wed May 09, 2012 6:47 pm; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

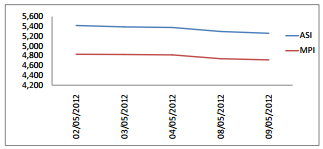

Trade Summary Market - 09/05/2012 Wed May 09, 2012 3:56 pm

Trade Summary Market - 09/05/2012 Wed May 09, 2012 3:56 pm

Last edited by sriranga on Wed May 09, 2012 6:47 pm; edited 1 time in total

Re: Trade Summary Market - 09/05/2012 Wed May 09, 2012 4:28 pm

Re: Trade Summary Market - 09/05/2012 Wed May 09, 2012 4:28 pm

sriranga wrote:

LBT: Market Wednesday Wed May 09, 2012 5:07 pm

LBT: Market Wednesday Wed May 09, 2012 5:07 pm

Re: Trade Summary Market - 09/05/2012 Wed May 09, 2012 6:47 pm

Re: Trade Summary Market - 09/05/2012 Wed May 09, 2012 6:47 pm

Lanka Securities Research - Market Review- 09th May 2012 Wed May 09, 2012 7:00 pm

Lanka Securities Research - Market Review- 09th May 2012 Wed May 09, 2012 7:00 pm

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum