Last edited by Quibit on Sat Nov 05, 2011 11:41 am; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

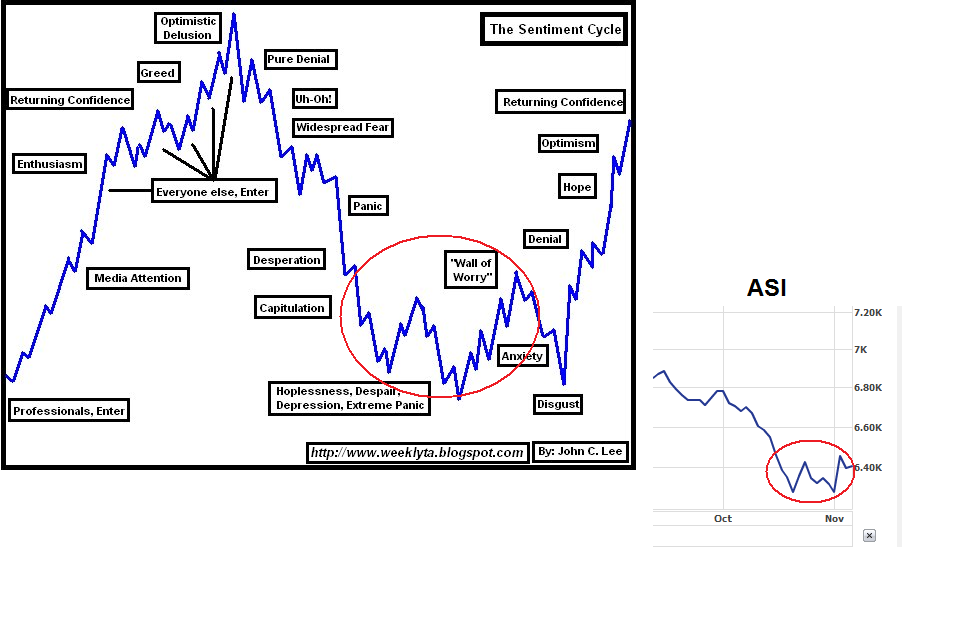

Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 11:35 am

Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 11:35 am

Last edited by Quibit on Sat Nov 05, 2011 11:41 am; edited 1 time in total

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 11:38 am

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 11:38 am

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 11:52 am

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 11:52 am

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 12:05 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 12:05 pm Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 12:07 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 12:07 pm

I think we are at a range of capitulation,despondancy,depression and of course some are at hope.slstock wrote:Okay the key point where are we at now?

Will be interesting topic.

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 12:34 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 12:34 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 1:39 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 1:39 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 2:33 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 2:33 pm

amilaela wrote:kkkkkkk

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 5:07 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 5:07 pm

sriranga wrote:

http://www.ritholtz.com/blog/2010/04/lagging-psychology-at-turning-points/

.

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 6:54 pm

Re: Market Sentiment Cycle - Where are we? Sat Nov 05, 2011 6:54 pm

At this point the majority becomes exceedingly bearish and throws in the towel, fearful of further declines and the potential disappearance of their assets. This is the capitulation phase, when stocks are sold on fear and emotion rather than on rational analysis. It is at that point that the market is finally ready to make an important bottom.

Trading Psychology, The 14 Stages of Investor Emotions Sun Jun 17, 2012 3:02 pm

Trading Psychology, The 14 Stages of Investor Emotions Sun Jun 17, 2012 3:02 pmGMNet wrote:

Re: Market Sentiment Cycle - Where are we? Sat Jul 21, 2012 2:58 am

Re: Market Sentiment Cycle - Where are we? Sat Jul 21, 2012 2:58 am

sriranga wrote:GMNet wrote:

Efficient markets are based on the assumption that rational people enter transactions with the intent to maximize gains and minimize losses. While this theory is sound, most investors are not the purely rational robots that efficient markets rely upon. Instead, emotions often cloud our decision-making and prevent us from acting in a rational manner.

Knowing we can never conquer our inherent emotional biases, we should seek to understand the range of emotions we may experience as investors and how it affects our interactions with the market. A common market psychology cycle exists that shines light on how emotions evolve and the effect they have on our decisions. By understanding the stages of this cycle, we can tame the emotional roller coaster. The fourteen stages are:

Optimism – A positive outlook encourages us about the future, leading us to buy stocks.

Excitement – Having seen some of our initial ideas work, we begin considering what our market success could allow us to accomplish.

Thrill – At this point we investors cannot believe our success and begin to comment on how smart we are.

Euphoria – This marks the point of maximum financial risk. Having seen every decision result in quick, easy profits, we begin to ignore risk and expect every trade to become profitable.

Anxiety – For the first time the market moves against us. Having never stared at unrealized losses, we tell ourselves we are long-term investors and that all our ideas will eventually work.

Denial – When markets have not rebounded, yet we do not know how to respond, we begin denying either that we made poor choices or that things will not improve shortly.

Fear – The market realities become confusing. We believe the stocks we own will never move in our favour.

Desperation – Not knowing how to act, we grasp at any idea that will allow us to get back to break even.

Panic – Having exhausted all ideas, we are at a loss for what to do next.

Capitulation – Deciding our portfolio will never increase again, we sell all our stocks to avoid any future losses.

Despondency – After exiting the markets we do not want to buy stocks ever again. This often marks the moment of greatest financial opportunity.

Depression – Not knowing how we could be so foolish, we are left trying to understand our actions.

Hope – Eventually we return to the realization that markets move in cycles, and we begin looking for our next opportunity.

Relief – Having bought a stock that turned profitable, we renew our faith that there is a future in investing.

Individuals clearly follow this cycle in their decision making process.

By Sean Hannon, CFA, CFP is a professional fund manager.

Edited article from http://www.stocktradingtogo.com

Re: Market Sentiment Cycle - Where are we? Tue Dec 25, 2012 12:41 am

Re: Market Sentiment Cycle - Where are we? Tue Dec 25, 2012 12:41 am

Re: Market Sentiment Cycle - Where are we? Tue Dec 25, 2012 8:00 am

Re: Market Sentiment Cycle - Where are we? Tue Dec 25, 2012 8:00 am

Re: Market Sentiment Cycle - Where are we? Wed Dec 26, 2012 11:23 pm

Re: Market Sentiment Cycle - Where are we? Wed Dec 26, 2012 11:23 pm

Re: Market Sentiment Cycle - Where are we? Thu Dec 27, 2012 10:16 am

Re: Market Sentiment Cycle - Where are we? Thu Dec 27, 2012 10:16 am

Re: Market Sentiment Cycle - Where are we? Thu Dec 27, 2012 10:35 am

Re: Market Sentiment Cycle - Where are we? Thu Dec 27, 2012 10:35 am

gamaya wrote:Just curious if this cycle thing works for CSE? Any guys with above 10 yr experience?

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum