These tips should help you sidestep some common accounting pitfalls.

Alcoholics have 12 steps. Grievers have five stages. Investors have their phases, too, with the biggest leap coming when a fledgling shareholder begins tossing accounting ratios around. I've calculated ratios for years myself and I'll say this: ratios are both powerful and open to misuse by novices. I'd like to share a few tricks with you to help you avoid some common pitfalls.

Trap 1: Focusing too much on return on equity (ROE)

The much-vaunted ROE seems pure: take net profits, divide by shareholders' equity, and you see how efficient a business is with investors' money. ROE is Warren Buffet's favourite ratio, and executive pay is sometimes tied to it.

When it's a trap: When it's enhanced by debt. Borrowing funds to make more money for shareholders isn't necessarily evil, and is sometimes beneficial. But investors strictly watching ROE will miss the additional risk taken by a management team 'gearing up' to meet performance targets.

Protect yourself: Add return on invested capital (ROIC) to your arsenal. Using the same principle as ROE, ROIC essentially compares after-tax operating profits to both debt and equity capital, and thus provides a better measure of operational success that can't be inflated by a financing decision. Moreover, research by American equity strategist Michael Mauboussin of Legg Mason shows that companies whose ROICs either rise or remain consistently high tend to outperform others. Search online to find the precise formula, or drop me a comment in the box below.

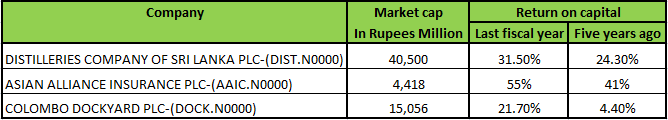

I screened for companies with returns on capital (a near-identical cousin of ROIC) above 20% that have seen an improvement in return on capital during the past five years. These shares are not recommendations, but rather screen results that may be of interest given the discussion.

Trap 2: Taking turnover growth at face value

A sale is a sale, right? Wrong. Turnover is a prime line for accounts manipulation.

When it's a trap: Intricate shenanigans with turnover figures can be tough to uncover, but a simple rule of thumb is to become suspicious if growth in trade receivables (for instance, the amounts customers owe) meaningfully exceeds growth in revenues. This could indicate 'channel stuffing', whereby a company extends overly generous terms to customers simply to gain a short-term turnover boost.

Protect yourself: Using a screening tool or your own sums, compute the relative growth of both sales and trade receivables, particularly for companies whose growing turnover forms a major part of your investing thesis.

Trap 3: Using accounting profits to compute dividend cover

I've done this myself, and feel it's probably acceptable with stable companies clearly able to pay shareholders.

When it's a trap: The first thing a budding investor learns is that for accounting reasons, profits don't always match cash flow -- from which dividends are paid. Though cash flows and profits should theoretically match over time, profits are skewed by 'accrual' calculations, such as spreading the cost of equipment purchases over the life of the equipment, versus charging the costs in the year they occurred.

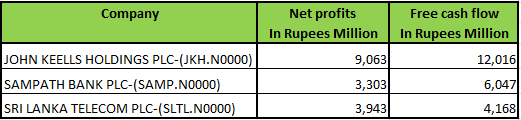

Protect yourself: Experienced analysts use free cash flow instead of reported earnings to produce a more reliable measure of dividend safety.Swapping cash flow for accounting profits in your dividend cover calculation should increase its reliability.

These companies as having cash flows materially exceeding accounting profits.

There you have it. You're now three traps wiser, which is a step ahead of most investors. Indeed, while spotting numerical chicanery may be best for sidestepping share-price stinkers, avoiding losers is more than half the battle to building a winning portfolio.

Accounting skills in action

Just to finish off, I applied these accounting tricks when I double-checked the numbers at one of my favourite shares for 2012. You see, I calculated this blue chip's ROIC, compared its sales to trade receivables and used cash flow to evaluate its dividend cover -- and needless to say, I was very happy with the resulting ratios.

I wrote this post based an article on fool.co.uk

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home