COMB every year paying good dividend and year to year they issue bonus , rights , script-dividend... to their own (COMB) shares ...

then why they never promote or issue any benefits to the COMD ?

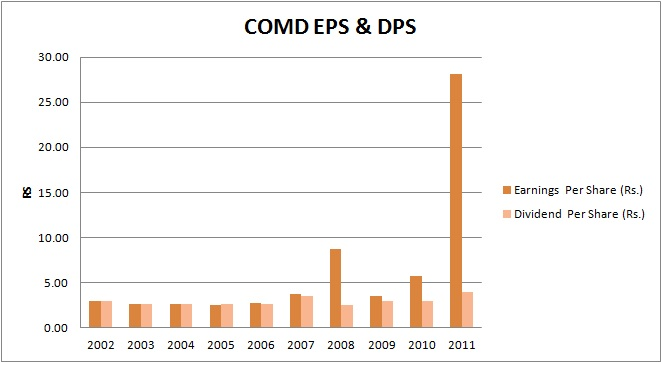

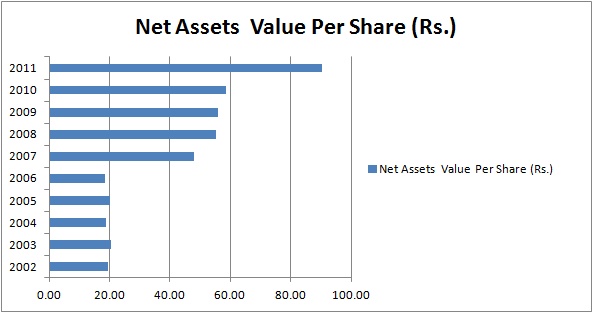

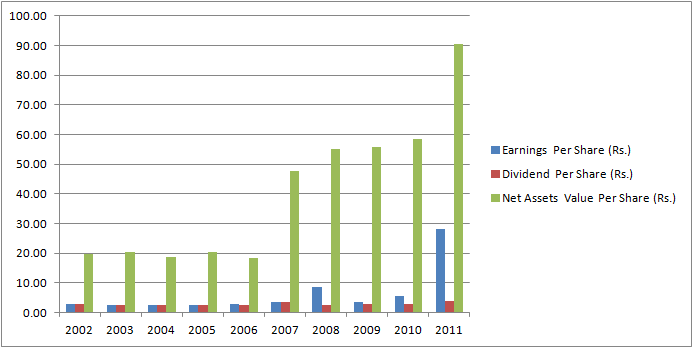

COMD also have lot of reserve and good earnings,NAV ( we can't compare with COMB)..

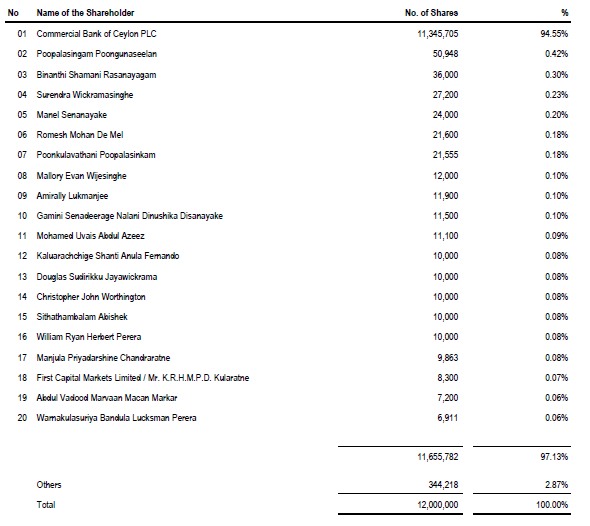

Even If they announce any benefit then they also can enjoy because they already hold 94.55%...

Then Why ??? still COMD trading @ 56/= ...60/= level .. I thing that big seller already disposed their shares .. in the past two three month period..

any hope or possible to go up COMD ????

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home