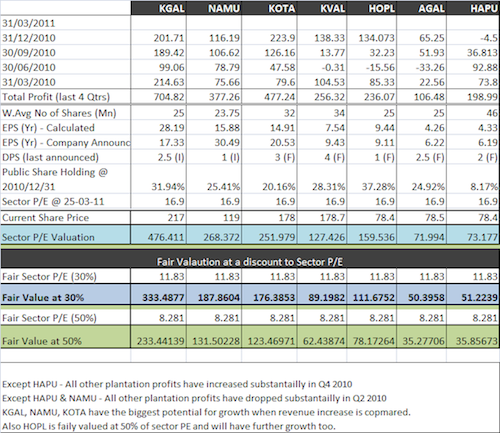

I surprisingly have found the plantations sector PE has come down as @ 25-03-11.. Hence I just had a quick revaluation on the most popular counters in this sector.

Here's a screen shot of my calculations..Also with this I'm giving you all in one comparison with adjusted figures. You can what counters are performing well at current prices and the valuation based on the last qtr results..

All the figures are taken after deducting "Other income" & "minority interest" portions from the quarterly reports, therefore; yu may see slight difference in stated figures and my figures. So I've indicated the company announced EPS (wherever necessary Annualized) and my calculation as well..The purpose of removing such income was to find out how much the core business is thriving without any other income.

Hope this will be useful for your investment decisions...Also my original valuation on two most prominent counters still remain same

Note:- To have a better view, you have to save this image to your PC.. cuz the last part is not displayed due to forum restrictions I think.

Need your views on this as well and pls Do more analysis...

Last edited by Quibit on Sun Mar 27, 2011 9:31 am; edited 2 times in total (Reason for editing : Width of the Picture adjusted to 550 Pixel)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home