would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

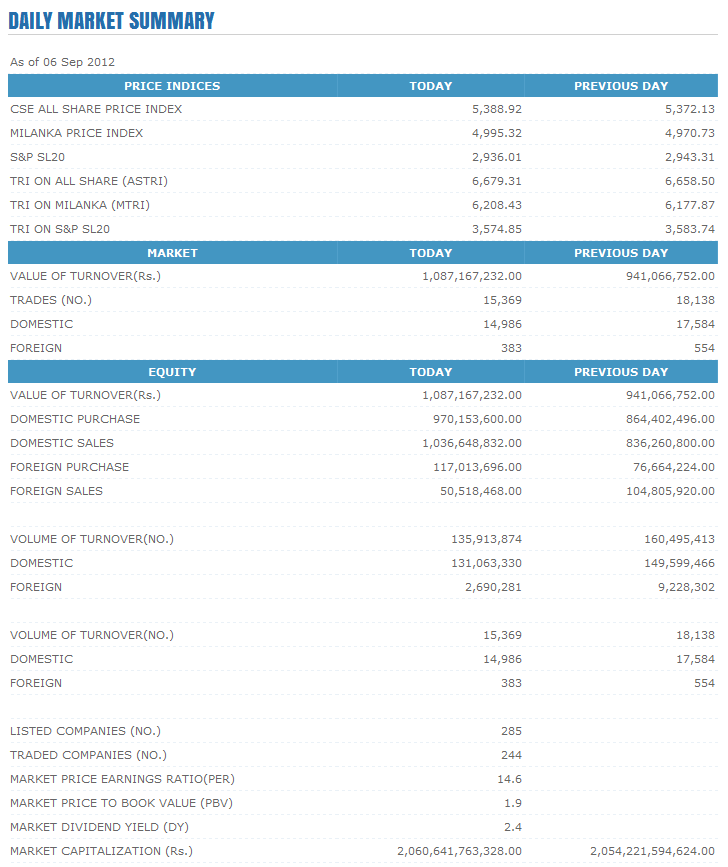

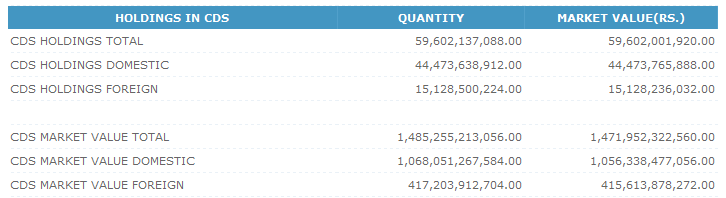

Trading Thursday - Sri Lanka stocks close up 0.3-pct Thu Sep 06, 2012 5:17 pm

Trading Thursday - Sri Lanka stocks close up 0.3-pct Thu Sep 06, 2012 5:17 pm Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 5:26 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 5:26 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 6:20 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 6:20 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 6:34 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 6:34 pm

.jpg)

.jpg)

.jpg)

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 6:35 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 6:35 pm

K.Haputantri wrote:We all hope for continous improvements in indices. Turnover is good. ?Can any one explain the signal given in S&P. Idea

Is the current run is driven by craps while blue chips being ignored. This is similar to the trend we saw when bear began some time back. I remember, when the then DG SEC cautioned traders to pay more attention to blue chips he was heavily criticized by crap promoters. This was the time when they started credit control. Basketball

I am worried. study

LBT:Market Thursday Thu Sep 06, 2012 6:43 pm

LBT:Market Thursday Thu Sep 06, 2012 6:43 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 10:33 pm

Re: Trade Summary Market - 06/09/2012 Thu Sep 06, 2012 10:33 pm

Permissions in this forum:

You cannot reply to topics in this forum