would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

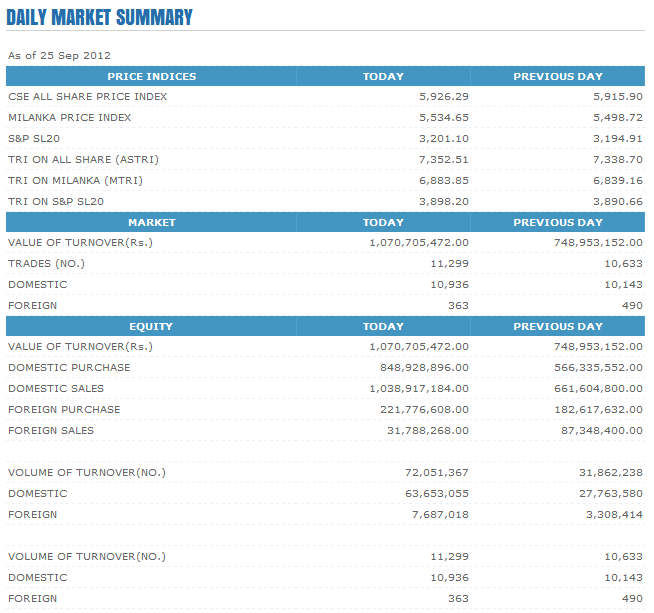

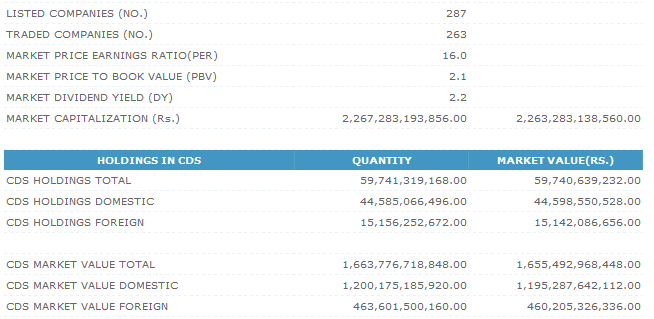

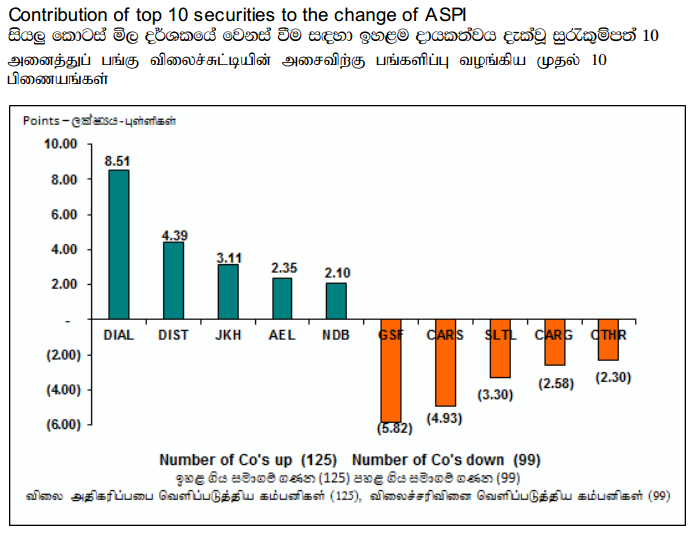

Crossings - 25/09/2012 and Top 10 Contributors to Change ASPI Tue Sep 25, 2012 4:37 pm

Crossings - 25/09/2012 and Top 10 Contributors to Change ASPI Tue Sep 25, 2012 4:37 pm

Trading Tuesday - Sri Lanka stocks closed up 0.18 pct Tue Sep 25, 2012 6:38 pm

Trading Tuesday - Sri Lanka stocks closed up 0.18 pct Tue Sep 25, 2012 6:38 pm LBT : Market Tuesday Tue Sep 25, 2012 6:43 pm

LBT : Market Tuesday Tue Sep 25, 2012 6:43 pm

Market extends gains Tue Sep 25, 2012 6:47 pm

Market extends gains Tue Sep 25, 2012 6:47 pm

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 6:48 pm

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 6:48 pm

sriranga wrote:

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 6:50 pm

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 6:50 pm

.jpg)

.jpg)

.jpg)

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 6:59 pm

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 6:59 pm

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 8:02 pm

Re: Trade Summary Market - 25/09/2012 Tue Sep 25, 2012 8:02 pm

Yep macho foreigners are buying but localssahan8896 wrote:Foreigners have sold only 31m.Ohh come-on locals real bull is yet to come.

Re: Trade Summary Market - 25/09/2012 Wed Sep 26, 2012 2:38 pm

Re: Trade Summary Market - 25/09/2012 Wed Sep 26, 2012 2:38 pmslstock wrote:Interesting . When ASI at 7800 ASIR was 12. N ow ASI 5900 ASIR at 12. Managemen news, activity can sometimes give life to a share. But much further appreciation will need overvalue these shares. They will need earning to catch up.

sriranga wrote:

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum