The positives of large scale foreign buying seemed to have rubbed off against local institutions as the latter stepped up buying throughout this week. Retail activity remained subdued though as interest rates still remain at high levels.Market opened on Monday on a positive note but on very low activity. Thereafter, turnover was dominated by private deals which contributed almost 62%. Indices closed in negative territory as losses on many blue-chips didn’t help the cause. Retail participation was subdued ahead of the seasonal spending period. ASI dropped 19.21 points (0.35%), MPI lost 33.30 points (0.66%) and the S&P SL20 index gained 2.07 points (0.07%). Turnover for today was Rs. 532.9Mn.

On Tuesday a major deal on Asiri Central and few blue-chips helped to bolster activity after a relatively slow start. Indices managed to close in positive ground helped by gains on blue-chips such as Commercial Bank. It is worthwhile noting that John Keells Holdings is trading approximately at around the same price levels as it did during the peak of the All Share Price Index in February 2011. Conversely, the ASI has lost approximately 2,300 points to date since the peak. ASI gained 4.28 points (0.08%), MPI gained 27.40 points (0.55%) and the S&P SL20 index gained 10.18 points (0.34%).Turnover was Rs. 2,587.6Mn.

Market traded with mixed sentiments throughout Wednesday with few blue-chips losing ground. Commercial Bank continued to provide activity in the market whilst turnover was dominated by blue-chips. Gains on Bukit Darah helped to prop up the indices as a private deal took place above the market price. Yields on treasury bills dropped across all maturities in today’s auction helping revive the equity market. ASI gained 4.87 points (+0.09%), MPI lost 18.44 points (-0.37%) and the S&P SL20 Index lost 1.63 points (-0.05%). Turnover was Rs. 464mn.

Market seemed to have build-up some momentum on Thursday as foreign and local institutions were seen collecting parcels and retail quantities at these low levels of several blue-chips. Blue-chips received the lion’s share of the activity as retail participation remains on the sidelines. Plantation companies attracted renewed investor interest as tea prices fetched record prices in the most recent auction. ASI gained 14.70 points (0.27%), MPI gained 9.76 points (0.19%) and the S&P SL20 index gained 12.87 points (0.43%). Turnover was Rs. 811.9Mn.

Although the broader market showed mixed sentiments, foreign and local institutional activity remained positive today (Friday) whilst retail push was seen on few plantation companies and on Asian Alliance Insurance. Kotagala Plantations announced an acquisition of Union Commodities which is a fully fledged tea export company for consideration equaling almost 75% of the formers equity value. Transfer of Asiri Surgical shares took place today which helped to boost turnover and activity.

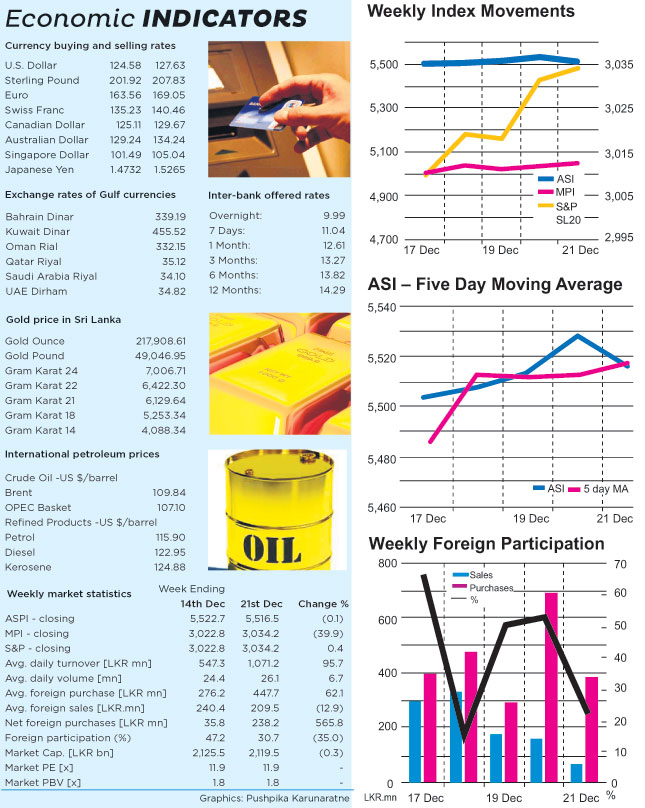

ASI dropped 10.87 points (0.2%) to close at 5,516.49, MPI gained 13.96 points (0.3%) to close at 5,044.58 and the S&P SL20 Index gained 3.38 points (0.1%) to close at 3,034.24. Turnover was Rs. 959.3Mn. Top contributors to turnover were Asiri Surgical with Rs. 364.3Mn, John Keells Holdings with Rs. 326.1Mn and Chevron Lubricants with Rs. 48.3Mn. Most active counters for the day were Asian Alliance Insurance, Balangoda Plantations and Lanka IOC. Notable gainers for the day were Balangoda Plantations up by 11.0% to close at Rs. 38.40, Dolphin Hotels up by 4.6% to close at Rs. 36.50 and Asiri Surgical up by 4.4% to close at Rs. 9.40. Notable losers for the day were Renuka Holdings non-voting down by 5.8% to close at Rs. 24.50, Lanka IOC down by 2.5% to close at Rs. 19.50 and Aitken Spence Hotels down by 1.6% to close at Rs. 72.30.Cash map for today was 66.15% which still indicates that investors are upbeat. Foreign participation was 23.4% of total market turnover whilst net foreign buying was Rs. 310.5Mn.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home