would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

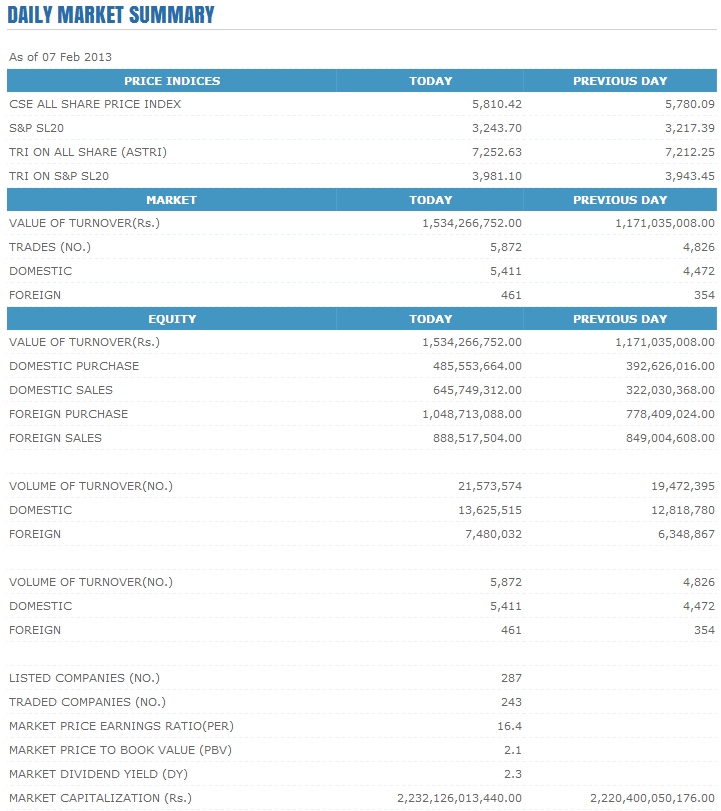

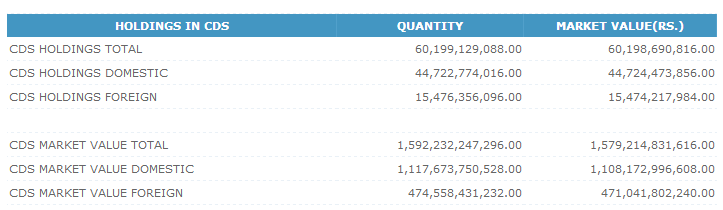

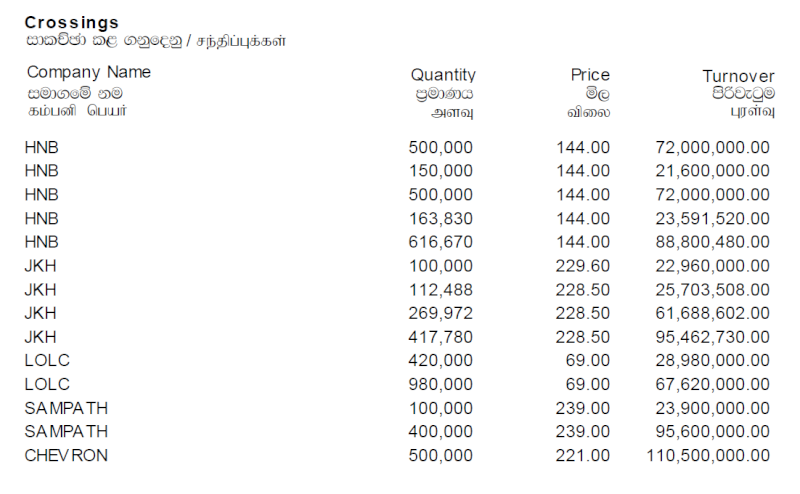

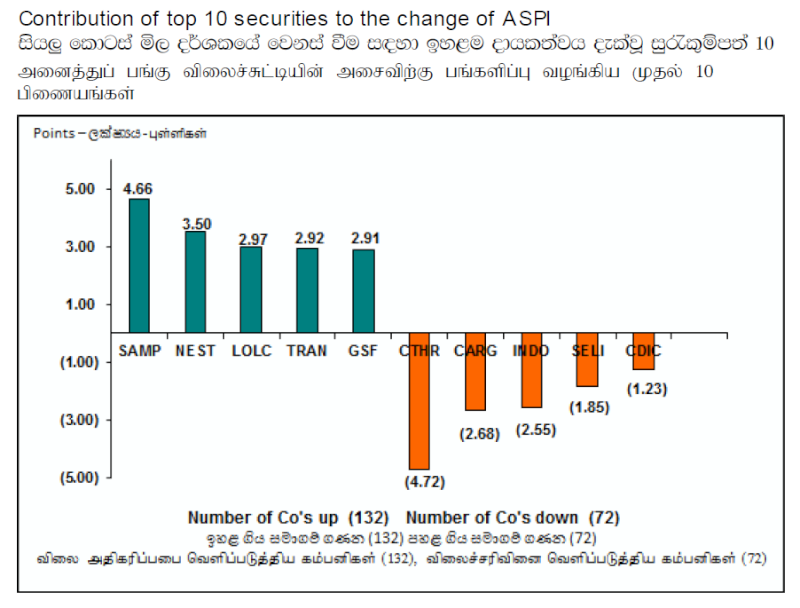

Crossings - 07/02/2013 and Top 10 Contributors to Change ASPI Thu Feb 07, 2013 4:33 pm

Crossings - 07/02/2013 and Top 10 Contributors to Change ASPI Thu Feb 07, 2013 4:33 pm

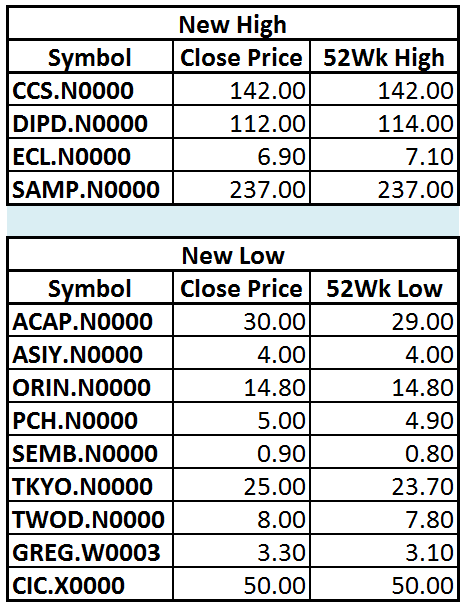

Following Stocks Reached New High / Low on 07/02/2013 Thu Feb 07, 2013 5:04 pm

Following Stocks Reached New High / Low on 07/02/2013 Thu Feb 07, 2013 5:04 pm

Institutional buys boost Bourse Thu Feb 07, 2013 7:40 pm

Institutional buys boost Bourse Thu Feb 07, 2013 7:40 pm

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum