What is a Unit Trust?

A Unit Trust is a collective investment scheme where investors pool their monies together to establish a Fund. Investors are allocated units for their investments and they are known as unit holders of the Fund. The Fund will make investment in various asset classes and the returns from these investments are distributed to the unit holders. The FMC and the Trustee play an important role in the operation of a Unit Trust. The Securities & Exchange Commission of Sri Lanka (SEC) grants a license to the FMC to operate a Unit Trust. The FMC does the marketing and manages the investments of the Fund. The Trustee, who is a financial institution will have the custody of all assets of the Fund and will monitor that the Fund is operated as per the rules & regulations specified in the Unit Trust Code and the Trust Deed. Both the FMC and the Trustee are regulated by the SEC.

A brief history of Unit Trusts in Sri Lanka

Unit Trusts were introduced to Sri Lanka during 1991/92 where four Fund Management Companies obtained licenses from SEC to operate four funds. When it was introduced to Sri Lanka, an investment relief was granted to the investors who invested their monies in Unit Trusts during the first year of operation.

Types of Unit Trusts currently operating in Sri Lanka

Unit Trusts can be broadly classified into Open-ended Funds and Close-ended Funds. Open-ended Funds are funds where investors can enter and exit at any time they wish. There is no limitation to the number of units that can be issued by an Open-ended Fund. Close-ended Funds are funds which issue a limited number of units and have a maturity period. Investors could subscribe for the units in a Close-ended Fund only during the initial offer period and they can get their investment together with the returns earned only at maturity. In both these categories there can be different types of Unit Trusts catering to the diverse needs of the investors. They are Income Funds, Balanced Funds, Growth Funds, Index Funds, IPO Funds and Sector Funds etc.

Income Funds will confine its investments only to fixed income securities such as Treasury Bills, Treasury Bonds, Bank Deposits, Repurchase Agreements, Debentures and other Short-term Corporate Debt instruments. Within the Income Fund category there are Gilt Edged Funds, Money Market Funds, Corporate Debt Funds catering to the diverse needs of the investors. The main objective of these funds is to provide a regular return to the investor at low risk.

Balanced Funds are funds which invest in Equity Securities as well as Fixed Income Securities. The main objective of these funds is to provide a regular return and a capital appreciation in the medium to long term.

The asset mix between equity securities and fixed income securities will be decided by the Fund Manager based on the market conditions. These funds are suitable for investors who wish to take some risk in order to achieve some capital appreciation for their investments.

Growth Funds are funds which primarily invest in equity securities with a medium to long term horizon. These funds temporarily invest part of their money in Fixed Income Securities as well. The main objective of these type funds is to provide investors a capital appreciation in the medium to long term. These funds may not declare any dividends to the unit holders but investors can redeem their units when they are satisfied with the growth achieved by the Fund. These funds are ideally suitable for investors who are willing to take a higher risk for a higher growth.

Indexed Funds are funds which invest in an index of equity securities. The Fund Manager can select the equity securities and create an index and then investments are made in these securities in the same proportion each security is represented in the index. The main objective of these type funds is to replicate the performance of the selected index. These funds invest only in equity securities and are suitable for investors who are willing to take a higher risk for the performance of the index.

IPO Funds are funds which invest mainly in Initial Public Offering of shares and dispose those securities when the security starts trading in the secondary market. In the interim, until such time an IPO comes to the market, the fund may place its cash in fixed income securities and earn some interest. These funds are ideal for investors who want to benefit from the IPO market.

Sector Funds are funds which invest in the companies of a particular sector. For example a Banking Sector fund may invest in the shares of some of the selected banks and a Tourism Sector fund may invest in the shares of the selected hotels coming under the sector. These funds are ideal for investors who believe that a particular sector would do well in the market. These funds have the risk of not performing when the sector as a whole is affected due to certain adverse economic conditions. When the economic environment is conducive for a particular sector, that sector fund may perform better than the market.

How can an investor decide on which fund to invest?

First of all an investor must be very clear in his/her mind about the following:-

a) The investment objective: Do I want regular income from my investment or only growth of my investment or both?

b) The risk tolerance level: Am I prepared to take a higher risk for higher return or am I risk averse?

c) The time horizon: How long can I keep my investment? Is it short term or long term?

Once you have answered the above questions you are in a position to select a unit trust that meets your requirements.

The safety for an investor in a Unit Trust

As explained earlier every Unit Trust must have a Trustee, who is generally a financial institution. The Trustee must be an independent party. The main objective of the Trustee is to look after the interests of the investors in the Fund. The Trustee will monitor whether the FMC is managing the Unit Trust Fund in accordance with the rules & regulations stipulated in the Trust Deed and the Unit Trust Code. Further, both the Trustee and the FMC are regulated by the SEC. Therefore the investors are assured that the monies collected from them are utilized to meet the objective of the Fund. However, the investors still need to bear the market risk.

The real benefit to an investor in a Unit Trust

There are several benefits that accrue to an investor who has invested his/her funds in the Unit Trust. First of all, the investor gets the Professional Fund Management service. An ordinary investor who does not know anything about the Stock Market or the Fixed Income Securities Market reaps the benefit of the market through the Professional Fund Management skills of the FMC by investing in the Unit Trust. The Fund Managers usually take an investment decision only after carrying out rigorous research on the companies. This is really a great advantage for the investors in the Unit Trusts.

Secondly, an investor can benefit from the Diversified Investment Portfolio of the Unit Trust by investing even a small amount of money in the Unit Trust. As Unit Trusts have a large pool of funds, the investment portfolios are generally well diversified. This is an ideal opportunity for a small investor to reap the returns from a diversified investment portfolio.

Investors have the privilege of investing a regular sum of money in the Unit Trust of their choice just like depositing in a Savings Account. They can withdraw their investments anytime they wish. The returns from the investments, whether it is dividend or capital gains, are tax free in the hands of the investors.

Performance of Unit Trusts against Treasury Bills and Bank Deposits?

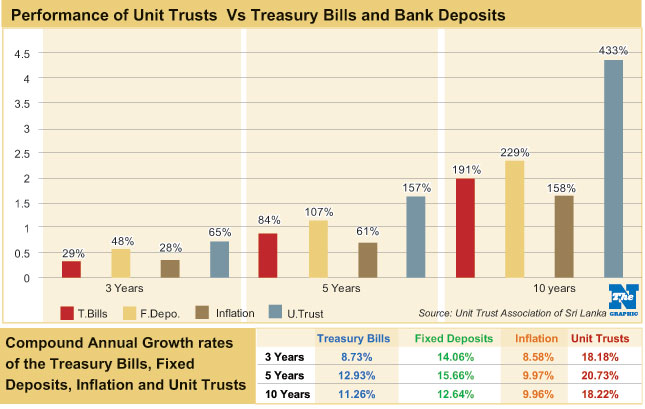

Equity Funds, especially the Growth Funds have performed better than Treasury Bills and Bank Deposits over a medium to long term. The graph below indicates the comparative performance of Treasury Bills, Fixed Deposits, Inflation and Unit Trusts as at December 31, 2012. If an investor had invested a sum of money in all three investments five years ago, his investment in Treasury Bills would have grown by 84%, the Fixed Deposits would have grown by 107% and the Units of the Growth Funds would have grown by 157%. Over a 10 year period the Unit Trusts have provided significantly higher return than the other two investments. In terms of real return (inflation adjusted) the Unit Trusts have provided a much higher real return in all three periods.

(The article was released by the Securities and Exchange Commission of Sri Lanka)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home