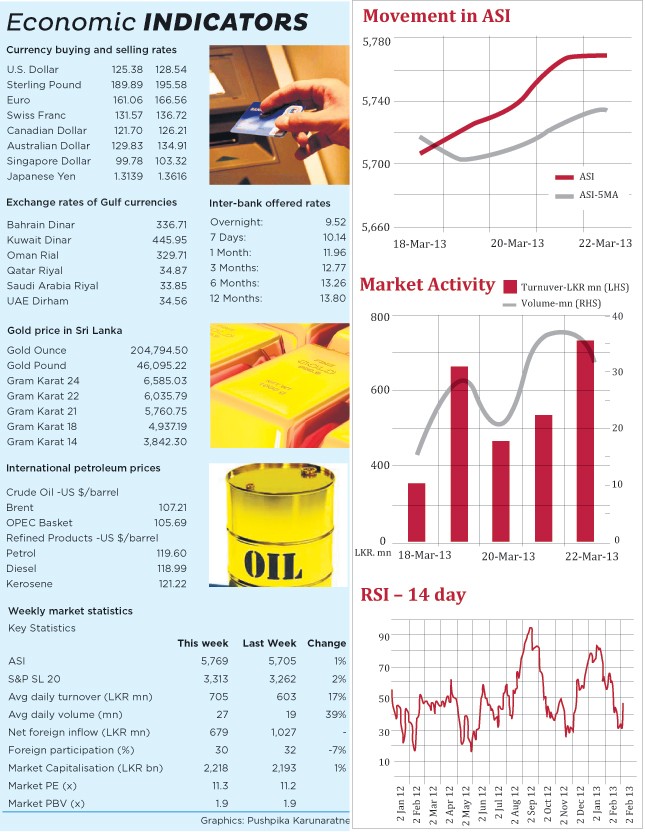

On Monday indices gained helped by Hatton National Bank, Commercial Bank, Carson Cumberbatch and Bukit Darah. Ceylon Tobacco Company saw its shares sliding today whilst John Keells Holdings and National Development Bank saw their share prices reaching 52-week highs. Turnover was a paltry site as institutions were having an off-day. ASI gained 3.48 points (0.06%) and the S&P SL20 index gained 7.77 points (0.24%). Turnover was LKR 309.4m.

A late rally in blue-chips saw indices driven higher on Tuesday. Nestle reached an all-time high price of LKR 1,800.00 whilst John Keells Holdings is trading at a higher adjusted price than its pre-split all-time high price. Meanwhile, National Development Bank continued to gain ground today whilst DFCC also gained good ground on thin volumes. John Keells Holdings continued to dominate turnover followed by banking counters. ASI gained 14.85 points (0.26%) and the S&P SL20 index gained 13.58 points (0.42%). Turnover was LKR 933.7mn.

Investors continued to favor Financial Services counters, including leading banks and small cap insurer, Janashakthi and Blue-chip John Keells Holdings on Wednesday’s trading session and respective sectors represented 86% of the total market turnover and 57% of the aggregate trading volume. Janashakthi Insurance turned out to be the heavily traded stock amid the most awaited dividend announcement of LKR 1.00 per share with 8% dividend yield and 45% dividend payout. John Keells Holdings and Seylan Bank non-voting were the next best traded stocks and reached 52 week high of LKR 249.70 and LKR 37.50 during the day while recording several off-the floor deals at LKR 250.00 and LKR 36.30 per share respectively. All Share Index gained 11.96 index points (+0.21%) and S&P SL 20 Index advanced by 15.77 points (+0.48%). Market turnover was LKR 539.7m.

Colombo Bourse continued with positive momentum on Thursday. ASI gained 29.01 points (0.5%) and S&P SL 20 Index gained 13.72 points (+0.4%). Market turnover was LKR 672.4m. Foreign investors were net buyers with a net inflow of LKR 99.7mn and it accounted for 25% participation. Notable price appreciations were seen in counters such as Nestle Lanka, DFCC Bank, HNB Bank.

On Friday retail activity helped to boost the indices although most blue-chips saw profit taking. Turnover levels were boosted by private deals John Keells Holdings related counters. Retail activity was mainly focused on poultry counters. DFCC saw its counter trading at a 52-week high price. The negative impact of a UN backed resolution against Sri Lanka didn’t seem to have had notable effect at the CSE.

ASI gained 5.05 points (0.09%) to close at 5,768.88 and the S&P SL20 dropped 0.57 points (0.02%) to close at 3,312.71. Turnover was LKR 1,070.9m.

Top contributors to turnover were John Keells Holdings with LKR 284.6mn, Union Assurance with LKR 261.8mn and Sampath Bank with LKR 123.1mn. Most active counters for the day were Ceylon Grain Elevators, Bairaha Farms and Three Acre Farms.

Notable gainers for the day were Ceylon Grain Elevators up by 9.0% to close at LKR 48.40, Three Acre farms up by 8.6% to close at LKR 44.00 and Renuka Shaw Wallace non-voting up by 5.8% to close at Rs. 14.70. Notable losers for the day were Sunshine Holdings down by 3.6% to close at LKR. 26.50, MTD Walkers down by 3.6% to close at LKR 24.00 and Panasian Power down by 3.5% to close at LKR 2.80.Cash map was 68.06%. Foreign participation was 31.53% of total market turnover whilst net foreign buying was LKR 153.8m.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home