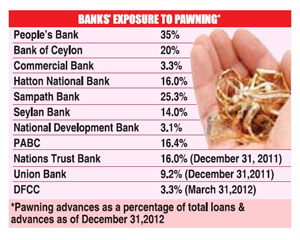

The market leader in pawning business, state-owned People’s Bank, which has pawning advances amounting to as much as 40 percent of the total loans and advances, has already taken measures to minimize its exposure to a possible gold price crash in view of the falling international prices.

“In anticipation of possible global price decline, we have brought down our pawning advances to around 35 percent (from the total advances) and we are daily monitoring the situation as a control measure. We no more encourage gold-backed loans as we did before,” People’s Bank Deputy General Manager Retail Banking G.P.R. Jayasinghe said.

As of September 30, 2012, the total outstanding pawning advances of the bank stood at a staggering Rs.190 billion, even bigger than the total balance sheets of some smaller banks.

According to ‘kitco.com’, which provides live spot prices for precious metals, gold has lost its glitter that kicked off more than a decade ago and peaked during the 2009-2011 period.

Although analysts forecasted gold prices to reach US $ 2,000 per ounce, it never reached its peak in 2012. Instead, the corrections that took place during 2011 and 2012 were strong enough to pull the gold prices down below US $ 1,700.

When this edition went to print, the price of an ounce of gold stood at US $ 1,570.20 (based on New York Close).

A senior official at Hatton National Bank PLC (HNB) echoing similar sentiments said that the bank having foreseen this type of a scenario as early as three years ago, took steps to minimize its exposure by not encouraging gold-backed loans.

“Although there is no sudden risk of gold bubble bursting, the prices could decline gradually. We are monthly monitoring our situation and the figures are adjusted accordingly,” he said on condition of anonymity, adding that the bank is in the business of pawning just to move with the flow (competition) and does not encourage aggressively.

Loan-to-value ratio (LTV), the lending risk assessment ratio typically used by the banks, stood at around 80 percent in respect of the pawning portfolio, demonstrating it is currently in the expected average.

However, falling gold prices could lift the ratio above 80 percent indicating a higher risk.

http://www.dailymirror.lk/business/other/27668-banks-cut-gold-exposure-on-possible-price-crash-.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home