Both indexes gained notably during the week amidst the positive trends witnessed in U.S and Asian equity markets. U.S bond yields dropped significantly during the week, indicating the positive sentiment of markets towards the world’s largest economy in the face of current global economic downturn. However, employment and output figures from the Euro zone continued to deteriorate where PMI index fell below 50 for Germany’s industrial output in April indicating contraction. Furthermore, France, Spain, Italy, Portugal, Greece and Cyprus unemployment levels have hit record high levels reaching 10.6%, 27.2%, 11.6%, 17.5%, 27.2% and 14% respectively while the overall unemployment rate for Euro zone economies remain at 12%. Given that EU is U.S’s largest market for her exports, conditions in Europe may affect bilateral trade between the two economic zones in the medium term. However, the continuation of expansionary monetary policy in U.S despite the significant cuts in government spending assisted the rise in U.S markets as opposed to European markets which are engulfed with heavy fiscal tightening.

Upward revision in electricity tariffs is likely to cause a dip in market interest rates and a strengthening of the LKR in the medium run and a further strengthening of the local banking system by improving the asset quality of the two large public banks in the medium term. Sri Lanka’s equity market gained notably during the week partly on account of these developments where the highest contribution was made by the banking, diversified and manufacturing sector counters.

Interest was seen across the board where the week’s turnover level was driven mainly by large cap counters representing a number of sectors such as banking, food & beverages, diversified, land & property, hotels and healthcare. This indicates that buying interest was well spread across both indexes and the positive sentiment has targeted a larger section of the economy. Nevertheless, banking sector counters such as Commercial Bank of Ceylon, National Development Bank, Sampath Bank and Pan Asia Bank contributed circa 20% to the week’s turnover. In terms of the price movement of key sectors, the manufacturing sector witnessed the largest price increase by recording 3.3% WoW gain in the price index while hotels and travels sector increased by 2% WoW. On the back of these developments, the week saw an average turnover of LKR 978.4mn and an average volume of 77.7mn. It is also significant that the volume of shares traded during the week rose by as much as 69.6% indicating the fact that interest on mid and small cap counters have revived and retail participation in the market is gaining in momentum.

Furthermore, Commercial Bank of Ceylon, Lion Brewery, Pan Asia Power, John Keels Holdings, Colombo Land and Development Co and National Development Bank topped the list in terms of turnover during the week.

The week saw foreign purchases amounting to LKR 1,246.6 mn whilst foreign sales amounted to LKR 465.7mn. Market capitalisation stood at LKR 2,284.2bn, and the YTD performance is 5.7%.

Conclusion:

Active participation of investors lifts the ASI to cross 6,000 mark…….

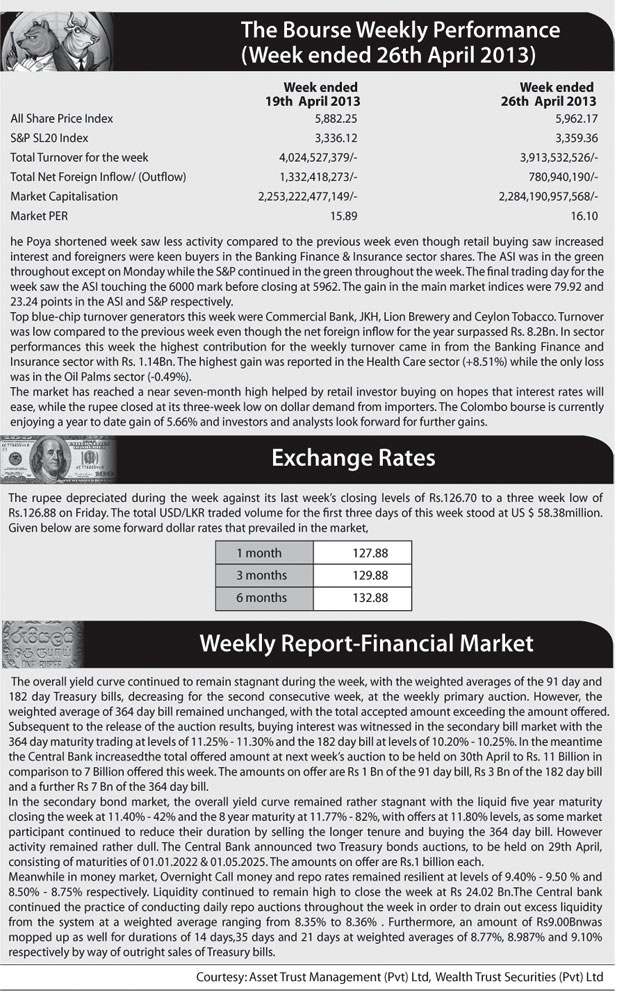

The bench mark index crossed the 6,000 mark on Friday for a short period, whilst the indices made healthy gains for the week on the back of collective contribution made by retail, foreign and institutional investors. The bourse regained momentum with the activities being energized after witnessing profit taking towards the end of the last week.

Indices trended upwards during the week with majority of the counters ending in the green witnessing substantial price appreciation. Foreign interest was sustained especially in the banking counters where Commercial Bank spearheaded the list, whilst retail favourite counters such as Colombo Land & Development Company, Touchwood Investments, The Colombo Fort Land & Building, and Kalpitiya Beach Resort garnered heavy retail participation. This in turn propelled the ASI to rise sharply with the average weekly turnover being LKR978.4mn.

Further, the Central Bank (CB) revealed that the government crowding out of the private sector has eased for the month of February. Whilst the state borrowing continues to be high, private sector borrowing has witnessed a recovery in February from the slow down witnessed in January. The CB indicated that the government’s reliance on the domestic banking system is likely to come down with the expected adjustments to administratively determined prices and continued fiscal consolidation. It further indicated that the availability of additional funds subsequent to the government’s reduction in borrowings from the banking sector coupled with the options available to the banks to obtain cheap foreign borrowings is likely to stimulate private sector activities by opening doors for new investments. The aforementioned developments coupled with the expected fall in market interest rate are likely to improve equity market activities. Hence, we continue to advice investors to align their portfolios with fundamentally sturdy counters which are trading at attractive multiples and have promising growth prospects.

Source: Asia Wealth Management Research

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home