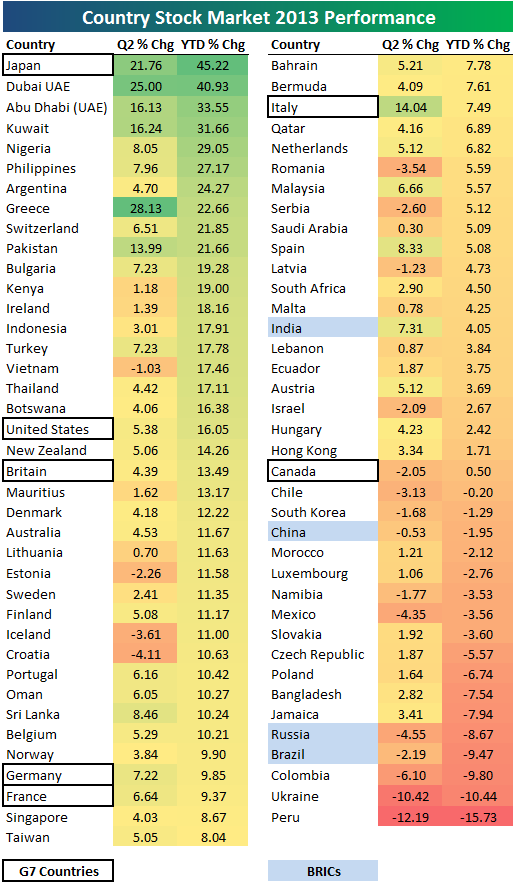

Below is a list of 2013 and quarter-to-date stock market returns for 77 countries around the world. Of the 77 countries shown, 60 are in the green for the year, while 17 are in the red. As shown, Japan is now up the most of any country with a YTD gain of 45.22%. Japan is already up 21.76% in the second quarter as well. This gain of 21.76% for Japan doesn't even rank it first for the second quarter, however. Greece is actually doing the best of any country in the second quarter with a gain of 28.13%. Dubai ranks second for the quarter with a gain of 25%.

On the downside, Peru has been the worst country so far this year with a decline of 15.73%. The Ukraine ranks second to last with a decline of 10.44%, followed by Colombia at -9.8%. Two BRICs round out the worst five -- Brazil is down 9.47% in 2013, while Russia is down 8.67%.

Of the G7 countries, the US is up the second most behind Japan with a YTD gain of 16.05%. The UK ranks third at 13.49%, followed by Germany (9.85%) and France (9.37%). Canada is up the least of the G7 countries with a very small YTD gain of 0.50%. Of the BRICs, India is doing the best in 2013, but the country is up just 4.05% -- not what most investors expect from emerging markets when stocks are rallying like they have lately.

http://www.bespokeinvest.com/

Last edited by sriranga on Sat May 18, 2013 12:57 am; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home