As the expected investment on the project is more than 50% of JKH’s asset base as of end-June 2013, the project is considered to be a ‘major transaction’ and JKH is seeking shareholder approval by way of a special resolution.

The project is to be constructed in the Justice Akbar Mawatha and Glennie Street Properties (owned by JKH subsidiaries) bordering the Beira Lake. Total built up area of the project will be 4.5 million square feet.

Phase 1 is expected to take five years to complete and Phase 2 another three years according to the circular. However, it should be noted that JKH may undertake Phase 2 subject to and based on prevalent market conditions at that time. JKH will have effective control of 96.70% of the project company.

Tax concessions

The project is to receive the following tax concessions under the Strategic Development Projects Act.

Income tax on profits

Income from non-gaming activities would be exempted from income tax for a period of 10 years. The tax exemption period will commence on the first year the company reports a taxable profit or three years after the commencement of operations whichever is earlier. After the 10 years of tax exemption, the profits would be taxed at a lower of 6% or at half the rate at which the hotel industry is taxed at that time, for a period of 15 years.

Income tax on dividends

Tax on dividends from the exempted profits mentioned above will also be exempted for the same 10-year period and one year thereafter.

Withholding tax

The project company is exempted from paying withholding tax on interest paid on foreign loans, debt obtained for capital expenditure and on technical fees.

Further exemptions may be given subject to certain conditions.

PAYE tax

A maximum of 20 expat staff shall be exempt from PAYE tax for a period of five years from the date of commencement of commercial operations.

VAT, Port and Airport Development Levy, Construction Industry Guarantee Fund Levy and Customs duty

The project company will receive exemptions from these taxes as well.

Funding

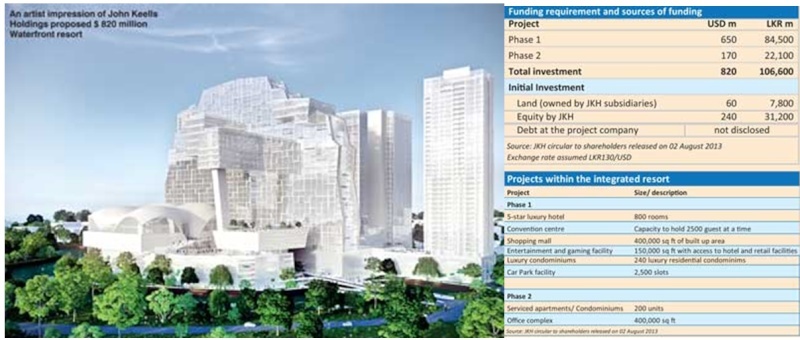

The project is expected to cost approximately US$ 820 million with Phase 1 of the project taking a minimum investment of US$ 650 million.

JKH is planning to fund its equity requirement through existing cash reserves and a combination of debt and equity. At end-June 2013, JKH had cash and cash equivalents close to Rs. 19 billion. If JKH utilises these cash balances fully, it may have to raise another Rs. 12.2 billion from debt and equity to fund the initial investment. The circular further states that the project company would have a debt-to-equity ratio of 60:40 at peak levels of funding. In that case, debt should account to US$ 490 million of total investment. Considering that JKH and its subsidiaries are injecting US$ 300 million equity as initial investment, the project may get another US$ 30 million as equity perhaps from an international party.

JKH’s integrated project is value accretive to the JKH Group

It is rumoured that JKH is tying up with a large and well known player in the industry for the operation of the integrated resort. We too believe that JKH would tie up with one of the best in the industry considering JKH’s past investment track record. A strategic tie up should help JKH to fast track its resort operations by tapping into the international database of its partner.

While shareholders cannot expect immediate returns from the project as this is a medium term project, we believe that returns would be very lucrative once the resort is in operation. Considering the lucrative EBITDA margins the Asian resorts enjoy (35% -40%), we believe that JKH’s profitability too would increase and that JKH would divest certain low-margin businesses increasing its return on invested capital (ROIC).

A point to note is that integrated resort model is much more profitable compared to conventional hotel operations as visitors tend to stay long and therefore spend more on gaming, shopping, food and beverages in addition to accommodation. Further the gaming tax imposed by the Sri Lankan Government is very low at 5% compared to the taxes of Singapore (5%-15%), Malaysia (25%) and Macau (39%).

Valuation

Assuming the integrated resort starts commercial operations by 2020, and that there will be no further investment into the project other than those stated in the report, arrives at a valuation of Rs.350 per share for JKH and hence recommend JKH as a long-term strategic BUY. Candor ascribed only 50% of the project valuation to its target price due to lack of visibility of project details.

Candor’s valuation assumptions include:

* A 30% ROIC for the project. Considering the very high ROIC levels enjoyed by industry players (25%-40%) and on the back of considerable tax incentives, we believe that an ROIC of 30% is easily achievable.

* A 12.9% WACC on the project.

Major risks and concerns for the valuation are, change of Government policy regarding integrated resorts that may affect the project adversely, political and economic instability, weakening of the rupee and other factors that may result in unexpected cost increases.

A full report for JKH will follow once further details are available on the project.

http://www.ft.lk/2013/08/16/research-view-on-jkhs-plans-for-integrated-resort/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home