* Freezes Touchwood on-current assets in first-of-its-kind action on a listed company

* Issues two other directives including freeze of records or books of the company

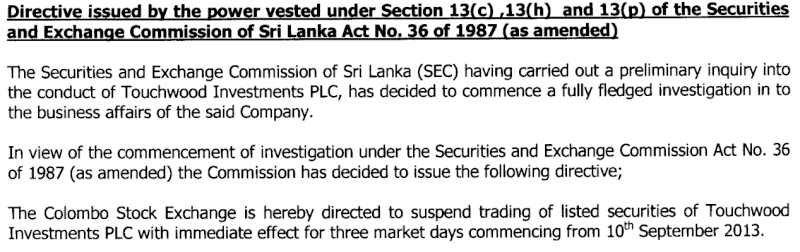

* Extends trading suspension by a further 3 days

* Full scale probe on

The Securities and Exchange Commission (SEC) yesterday took a tougher stance on Touchwood Investments Plc, (TWOD) imposing a freeze on its non-current assets, a first-of-its-kind move on a listed company.

The capital markets regulator also issued two other tough directives in addition to extending the suspension on the trading of TWOD shares by a further three days from 10 September, bringing the total to six.

On Wednesday last week during trading hours, SEC suspended TWOD shares following completion of preliminary investigations whilst emphasising a full-scale probe was ongoing. SEC action is because TWOD has a public holding of over 90% and to protect interests of investors.

The probe is independent of a defaulted customer filing winding up application in Western Province High Court.

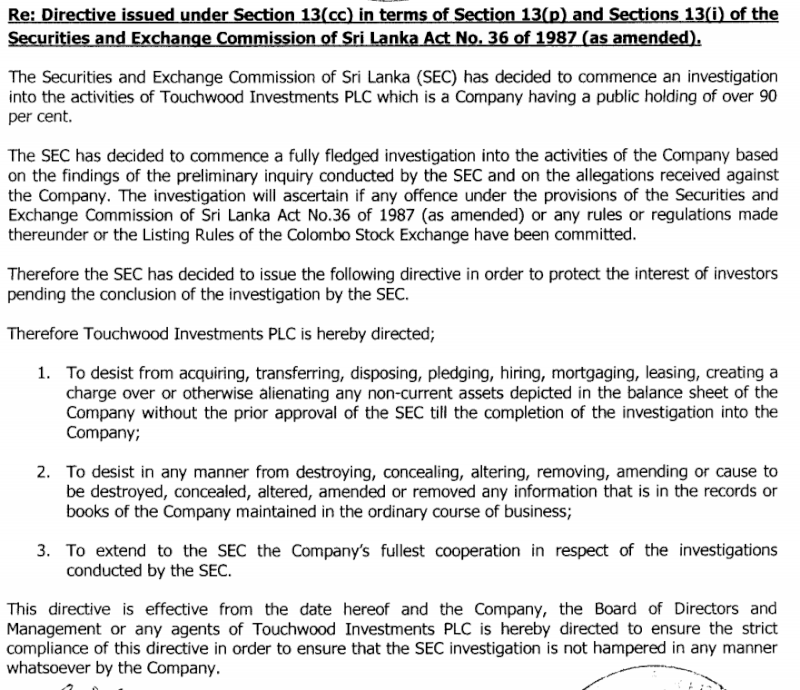

“The SEC has decided to commence a fully-fledged investigation into the activities of the company (TWOD) based on the findings of the preliminary inquiry conducted by the SEC and on the allegations received against the company,” the capital market’s regulator said in a letter to TWOD and its Board of Directors.

“The investigation will ascertain if any offence under the provisions of the SEC Act No. 36 of 1987 (as amended) or any rules or regulations made thereunder or the Listing Rules of the CSE have been committed,” said the SEC letter, which issued three directives.

They are

1) To desist from acquiring, transferring, disposing, pledging, hiring, mortgaging, leasing, creating a charge over or otherwise alienating any non-current assets depicted in the Balance Sheet of the company without the prior approval of the SEC till the completion of the investigations;

2) To desist in any manner from destroying, concealing, altering, removing, amending or cause to be destroyed, concealed, altered, amended or removed any information that is in the records or books of the company maintained in the ordinary course of business; and

3) To extend to the SC the company’s fullest cooperation in respect of the investigations conducted by the SEC.

Touchwood styles itself as the pioneer of the agro-forestry investment industry in Sri Lanka. It specialises in the cultivation of high value exotic tropical timbers as an alternative and sustainable source of forest products (mahogany, vanilla, sandalwood, teak and other cash crops).

As per 2012/13 Annual Report, TWOD has planted over 400 trees of high-value timber in 2,854 acres spanning 42 plantations in six districts. This is in addition to timber plantations in Thailand in which customer deposits have been taken by the company.

SEC said the directives are effective with immediate effect and the company, the Board of Directors and management or any agents of TWOD are directed to ensure the strict compliance of this directives in order to ensure that the SC investigation is not hampered in any manner whatsoever by the company.

TWOD had 6,785 shareholders as at 31 March 2013, of which 2,305 were those holding between one and 1,000 shares with a 0.86% and 3, 332 holding between 1,001 and 10,000 shares accounting for 11% and a further 1,050 shareholders owning 10,001 and 100,000 shares accounting for 27%. Those owning over one million shares were eight with a collective stake of 36%.

Latest shareholding however has changed with TWOD Chairman Roscoe Maloney having divested a considerable part of his stake, which was 17% as at March 2013. He sold 3.35 million shares between Rs. 1.80 and Rs. 2 each on Monday last week. The disclosure came late as mid-week TWOD crashed to an all-time low of 90 cents before recovering to Rs. 1.30 at the time of suspension. Largely arising out of biological assets TWOD’s net asset per share is Rs. 30 though analysts have questioned their valuation.

The dip was on account of a petition filed to wind up TWOD by Kurukula Arachchige Don Leonard Priyanka Nanayakkara (petitioner) in respect of Rs. 3.8 million, which the petitioner alleges to be due from Touchwood Investments.

“The company has already filed an affidavit of opposition to the winding up application and will take further steps to defend and oppose this action,” said the filing signed by Touchwood Deputy Chairperson S. Maloney.

Prior to suspension of trading, around 45 million shares of TWOD or a 42% stake traded during the week ended Thursday.

At present SEC and Touchwood have an ongoing case as well (SEC vs Touchwood Investments Ltd., C.A. (Writ)323/2007 and S.C. App. 100/2011) where the company filed an application in the Court of Appeal against SEC and Sri Lanka Accounting and Auditing Standards Monitoring Board (SLAASMB) seeking writs of certiorari quashing the determination of SLAASMB and the Directive of the SEC issued to the company dated 9 March 2007 through which the company was directed to prepare financial statements for the years ended 31 March 2005 and 2006 on a cost basis in terms of IAS 41.

The Court of Appeal issued a writ of certiorari in favour of the petitioner company quashing the determination of the SLAASMB made against the company. The SLAASMB has appealed to the Supreme Court against the judgment of the Court of Appeal and the matter is pending before the Supreme Court.

Since the Supreme Court decision will have a bearing on the case against the SEC, the Court of Appeal laid by the case against the SEC pending the decision of the Supreme Court in respect of the appeal lodged by SLAASMB. The case involving SLAASMB has been postponed until 11 December 2013 for arguments.

As at end FY13, TWOD’s assets amounted to Rs. 8 billion, up from Rs. 6.8 billion in the previous year.

Despite styling itself as pioneer and in business for over a decade, TWOD remains saddled with over Rs. 500 million worth retained losses. Liabilities amounted to Rs. 4.7 billion as at end FY13, up from Rs. 3.7 billion a year earlier.

http://www.ft.lk/2013/09/10/sec-gets-tougher-on-touchwood/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

SEC Directive - TWOD Mon Sep 09, 2013 3:51 pm

SEC Directive - TWOD Mon Sep 09, 2013 3:51 pm

Re: SEC gets tougher on Touchwood Mon Sep 09, 2013 5:08 pm

Re: SEC gets tougher on Touchwood Mon Sep 09, 2013 5:08 pm

Re: SEC gets tougher on Touchwood Mon Sep 09, 2013 9:47 pm

Re: SEC gets tougher on Touchwood Mon Sep 09, 2013 9:47 pm Re: SEC gets tougher on Touchwood Mon Sep 09, 2013 10:08 pm

Re: SEC gets tougher on Touchwood Mon Sep 09, 2013 10:08 pm

SEC gets tougher on Touchwood Tue Sep 10, 2013 12:53 am

SEC gets tougher on Touchwood Tue Sep 10, 2013 12:53 am

Re: SEC gets tougher on Touchwood Tue Sep 10, 2013 8:47 am

Re: SEC gets tougher on Touchwood Tue Sep 10, 2013 8:47 am

ටච්වුඩ් ගැන පරීක්ෂණ විනිමය කොමිසම දැඩි කරයි Tue Sep 10, 2013 10:22 am

ටච්වුඩ් ගැන පරීක්ෂණ විනිමය කොමිසම දැඩි කරයි Tue Sep 10, 2013 10:22 am