* Issues directive for strict compliance with minimum public float

* Offers two year transitional provisions by requiring credible plan for public listed companies to meet criteria

* Permanent failure to comply could lead to suspension of trading or a mandatory delisting

* Over 70 main board firms below 20% thresholdThe Securities and Exchange Commission (SEC) is getting tough on listed companies, requiring them to be truly public from the New Year onwards, whilst offering transitional provisions to comply via credible plans.

As a continuous listing requirement, from 1 January 2014, all main board listed companies are mandated to have a minimum public float of 20% in the hands of a minimum of 750 public shareholders or a market capitalisation of Rs. 5 billion of firm’s public holding in the hands of minimum of 500 public shareholders whilst maintaining a public holding of 10%.

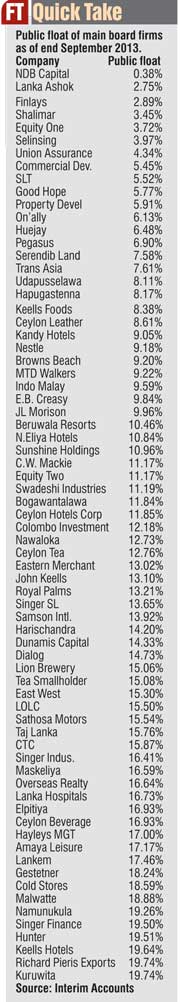

The Colombo Stock Exchange (CSE) has 288 companies representing 20 business sectors as at 01st December 2013, with a market capitalization of Rs. 2.4 trillion. Of the main board firms, over 70 don’t have a public float of above 20% as of end September 2013 shareholding.

For firms which don’t meet this requirement, a transitional arrangement has been proposed giving them a year in which to comply. These firms will have to ensure by 31 December 2015 a minimum public holding of 15% of its total listed ordinary voting shares in the hands of 500 public shareholders.

For the popular and less stringent Diri Savi Board listed firms, the minimum public float from 1 January 2014 is 10% in the hands of a minimum of 200 public shareholders. For Diri Savi Board firms not qualifying at present, within one year’s time they will have to ensure a minimum public holding of 7.5% in the hands of 100 public shareholders.

All listed firms will have to comply with minimum public float rules on or before 31 December 2016 though the SEC has made available the facility to seek extensions subject to more stringent requirements.

All firms not qualifying with minimum float as of 1 January 2014 will be required the correct the shortfall within 30 market days. If unable, they have to by 31 March 2014 make an immediate noncompliance announcement to the market giving the following information: that the entity’s public holding requirement has fallen below the specified requirement; the existing percentage of the public holding; and the number of shares in the hands of the public shareholders.

Upon the making of such ‘non-compliance announcement’ to the market, the listed entity shall be entitled to a period of 12 months from the date of the ‘non compliance announcement’ to correct the shortfall.

Immediately upon making the above mentioned ‘non-compliance announcement’ to the market, the listed entity will have to submit to the SEC the following additional information: the proposed rectification plan and the means to achieve the specified percentage and the time plan to achieve the same; and if the listed entity has chosen to adopt a method specified in Rule 5 the details and justification for the adopted method.

During the 12 months transition period, the PLC will have to make a ‘status announcement’ on the first working day of every quarter to the market which shall include the following: the existing percentage and the number of shares in the hands of the public; and as to whether steps have been taken to rectify the shortfall. Simultaneously the PLC needs to submit to the SEC a report on the progress of the rectification plan.

In the event, a PLC fails to increase public holding to the minimum requirement by at the end of the 12 months, it can seek a maximum number of two extensions but subject to conditions set by the SEC.

Conditions for first extension include proposed rectification plan and the means to achieve the specified percentage and the time plan to achieve the same; and details of the method to be adopted and justification for same. In wanting a second extension PLC needs to give reasons to the SEC as to why it could not reach the required threshold within the time period granted.

When considering such application, the SEC will take into consideration amongst other things, whether such a lower percentage is sufficient for a liquid market, including whether there are reasonable grounds to expect the public holding to reach the required threshold at the end of the second extension of time period if granted.

SEC said a sizeable public holding is a necessity for a transparent and liquid market. It is perceived that greater the public holding, less is the potential for market abuse.

“Therefore, a minimum public holding as a continuous listing requirement is introduced with the aim of promoting a liquid and transparent market with a better price discovery mechanism. Further, the maintenance of a minimum public holding is expected to provide a greater opportunity for the citizens of Sri Lanka to share the wealth produced by the public listed entities in Sri Lanka,” the SEC said.

Listed firms failing to comply with minimum float will have to as soon as practicable adopt methods to raise the public holding via issuance of new shares to the public through prospectus; or offer for sale of shares held by the non public shareholders to public through prospectus; or any other lawful modality determined by the public listed entity.

Any entity that fails to comply will be transferred to the Default Board of the CSE and in permanent failure it will be liable to any one or more of the following sanctions imposed by the SEC: publication of a notice of malfeasance; or suspension of trading; or a mandatory delisting.

http://www.ft.lk/2013/12/23/sec-gets-tough-on-plcs/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home